- Markets expect the Federal Reserve to cut rates by 25 basis points.

- XS.com cites weak labor data influencing potential bolder actions.

- Fed maintains 4.25%-4.50% rate amid cautious stance.

The Federal Reserve’s upcoming meeting on September 17, 2025, anticipates a modest 25 basis points interest rate cut amidst cautious policy stances and ongoing inflation concerns.

Market anticipations hinge on Federal Reserve’s cautious stance, potentially impacting major cryptocurrencies like BTC and ETH, reflecting broader economic and financial sector reactions.

Fed’s Rate Cut Considerations and Market Projections

Financial experts are paying attention to the upcoming Federal Reserve meeting, where an expected rate cut of 25 basis points could signal a shift in policy. As market participants weigh the Fed’s next steps, scrutiny remains high on labor market data, which shows signs of weakening. Data from BlockBeats News highlights a 92% probability of this modest cut.

Immediate financial impacts include potential shifts in asset prices, especially if more aggressive cuts become likely. Jerome Powell has noted, “Rising risks to the labor market even as inflation pressures linger.” Jerome Powell and the Fed remain cautious, balancing inflation risks and employment concerns. This context underscores the expectation of smaller adjustments, preserving flexibility for future monetary adjustments.

Financial and market reactions indicate a strong preference for a cautious approach. Quotes from future FOMC meetings characterize a desire for stability, suggesting that any move will carefully consider the dual mandate of inflation control and employment support. XS.com analyst Rania Gule notes the room to maneuver as labor conditions may require bold action later.

Cryptocurrency Movements Amid Economic Shifts

Did you know? In past scenarios like March 2020, unexpected rate cuts by the Federal Reserve spurred notable rallies in Bitcoin, Ethereum, and major DeFi tokens, reflecting a strong correlation with liquidity shifts.

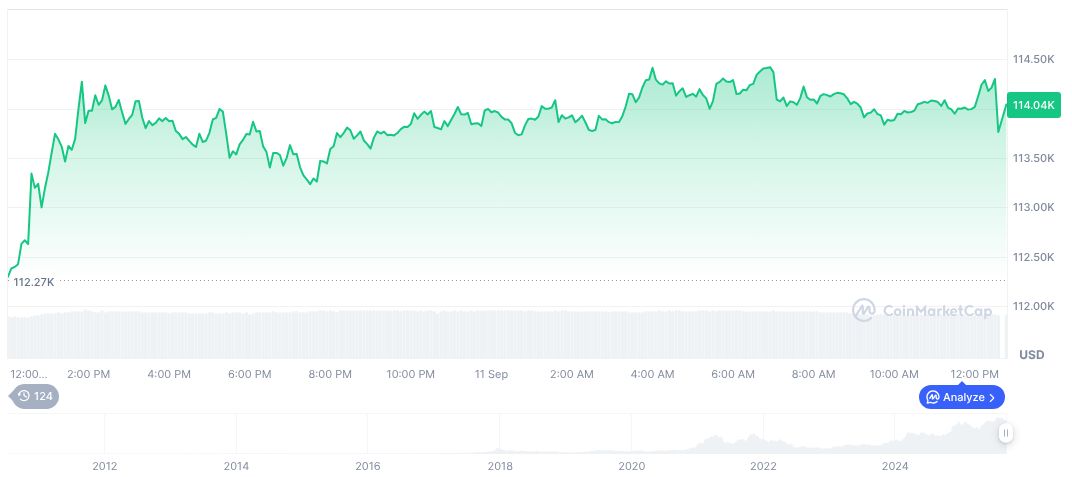

As of September 12, 2025, Bitcoin (BTC) is priced at $115,331.06 with a market cap of $2.30 trillion. Price movements over 90 days show an overall increase of 9.58%, according to CoinMarketCap. Despite recent gains, Bitcoin’s 30 and 60-day trails reflect minor declines. Trading volumes have dropped by 7.00% in the past 24 hours. The maximum supply remains capped at 21 million, with nearly 19.92 million in circulation.

Coincu’s research team reports upcoming Federal Reserve policy impacts may stimulate cryptocurrency volatility. While the labor market weakens, this can generate a favorable environment for crypto, attracting investments as traditional assets experience uncertainty. Technological advancements and regulatory developments might further shape the decentralized finance landscape.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/federal-reserve-rate-cut-september-2025/