- Unverified reports influence Bitcoin and gold price dynamics.

- Market reactions lack primary-source confirmation.

- No official statements on alleged financial shifts.

The U.S. federal government has reportedly partially shut down amid ongoing tensions, with potential market shifts speculated, despite a lack of official confirmation or direct market effects.

The apparent shutdown may signal significant economic implications, though verified data lacks support for alleged surges in gold and cryptocurrencies, reflecting the need for cautious market interpretation.

Unverified Shutdown Claims Impact Bitcoin and Gold Prices

Unverified reports of a U.S. government shutdown are influencing financial market dynamics. These claims suggest heightened asset movement, including a surge in Bitcoin (BTC) and gold prices. Despite the conjecture, no official source has confirmed the shutdown’s occurrence or its alleged market impact. “Due to the lack of primary-source confirmation from any official or direct institutional channels regarding the specific claims about the U.S. federal government shutdown impacting gold and cryptocurrency prices, no verifiable quotes from key players, industry figures, or government officials can be provided as of now.”

The market is reacting with significant yet speculative shifts in trading volumes. Cryptocurrencies, notably Bitcoin and Ethereum, demonstrate increased trading activity. However, these movements lack clear attribution to a specific event, raising questions about their sustainability and drivers.

Industry leaders and financial analysts have not officially commented on these fluctuations. Major market figures, including high-profile cryptocurrency brokers and U.S. financial agencies such as the SEC or Treasury, remain silent, offering no verification or analysis of the unfolding situation.

Bitcoin and Market Data Amid Speculative Trading Shifts

Did you know? Previous U.S. government shutdowns have occurred 14 times since 1981, mostly lasting one to two days, with no prior event directly correlating with massive crypto market reactions.

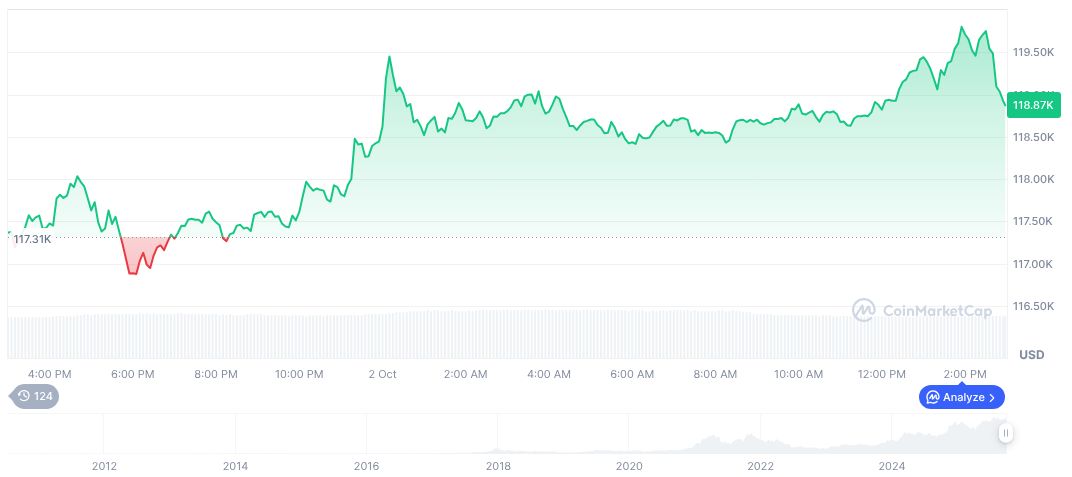

Bitcoin’s current value stands at $120,318.40 with a market cap of $2.40 trillion, according to CoinMarketCap. It commands 57.88% market dominance, showing a 1.34% increase over the last day and a notable 11.25% rise over 90 days. Recent trading volume reached $66.74 billion, marking a 13.14% decrease.

Coincu research suggests that speculative trading and investor sentiment may drive current market fluctuations. Without validated external pressures, current trends may reflect short-term volatility rather than substantive economic shifts. Historical trends indicate that while market agitation correlates with geopolitical uncertainties, definitive financial outcomes lack consistent alignment with such events.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/market-volatility-unverified-shutdown-reports/