- Bitcoin drops despite unverified inflation comments from Kevin Hassett.

- Potential for treasury management or liquidity shifts observed.

- Skepticism surrounds market reactions lacking source confirmation.

BlockBeats News reported on October 24 that Kevin Hassett claimed slowing inflation and easing Fed pressure, although no primary sources corroborate his statement.

The alleged remarks suggest potential impacts on market sentiment, yet Bitcoin (BTC) and Ethereum (ETH) volatility persisted, highlighting broader market turmoil without verified policy changes.

Bitcoin Drops amid Unverified Inflation Reports

Alleged statements from Kevin Hassett, indicating that inflation is slowing and Federal Reserve pressure is easing, have been causing stir in markets. Despite the lack of primary confirmation, these reports are circulating in financial communities.

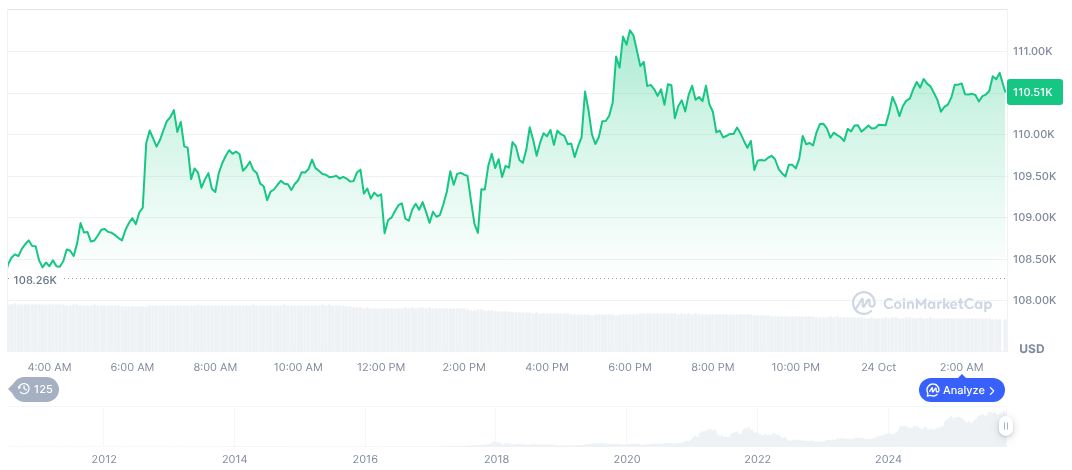

Bitcoin’s price decreased notably by 5.12% in October 2025 amid these reports, continuing its historically volatile performance in October. No direct actions or policy shifts were confirmed from U.S. officials or central banks, but the rumor reflects investor sentiment sensitivity.

Reacting to market volatility, cryptocurrency investors noted potential liquidity challenges. Despite reports tying market shifts to Hassett’s comments, experts express doubt due to the missing confirmation from authoritative sources. Federal Reserve and White House have no official remarks on this.

October 2025: Bitcoin Faces Third-Largest Monthly Drop

Did you know? In October 2025, Bitcoin experienced its third-largest price drop historically during the month, reflecting investor caution amid suspected macroeconomic shifts.

According to CoinMarketCap, Bitcoin (BTC) holds a market cap of $2.21 trillion with a price of $110,953.12, reflecting a 1.32% increase in 24 hours but a 1.72% decrease over the past 30 days. Trading volume stands at $52.40 billion, down by 23.49%.

The Coincu research team indicates that any monetary policy shifts could potentially amplify volatility in corresponding cryptocurrency assets. While historical data indicates a strong macro correlation, reliance on unofficial sources may lead to unsubstantiated market actions.

Conclusion: There are no direct or primary-source statements found from officials or major project leadership regarding the inflation-related comments or Fed’s actions dated October 24, 2025.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/market-inflation-fed-reaction/