- Loom Network’s meteoric rise and abrupt fall have left investors questioning its future in a volatile market.

- Speculations about exchange manipulations and a massive supply sale cast a shadow over LOOM’s prospects.

- Technical indicators show high volatility and oversold conditions, suggesting potential for both recovery and further declines.

After years of dormancy, Loom Network made headlines with an over 7x surge. This rise brought it above its 2021 high, even amidst a tumultuous market. However, its unexpected ascent was short-lived.

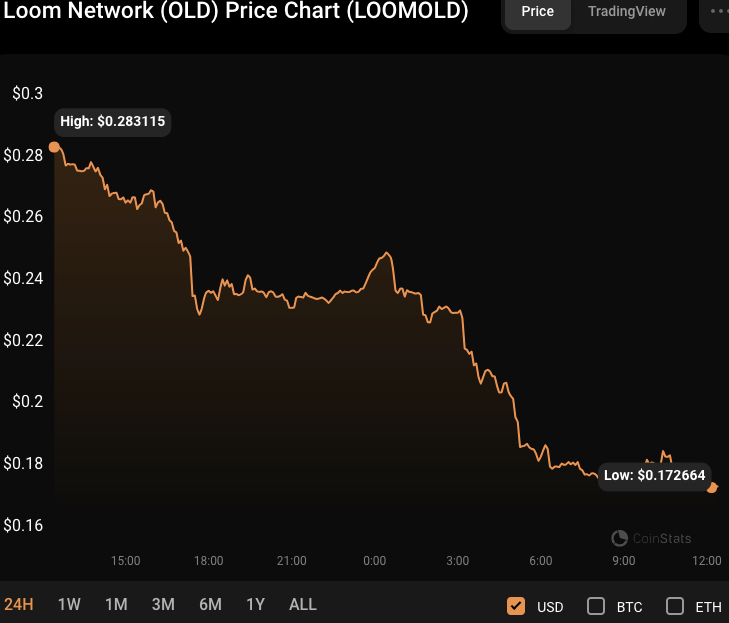

Just as the broader market began to show green shoots, Loom’s value plummeted. Since October 15, it has nosedived from $0.48 to $0.1686 at press time, recording a 39.43% decline within the last 24 hours.

If bearish momentum breaches the $0.1728 support, the next level to watch for is around $0.15. This sudden drop in value has left investors concerned about the prospects of Loom Network and whether it can regain its previous highs.

During the downturn, LOOM’s market capitalization decreased by 37.20% to $214,550,482, while its 24-hour trading volume decreased by 5.98% to $503,699,018, respectively. The significant decrease in market capitalization and trading volume further adds to the uncertainty surrounding Loom Network’s future performance.

Speculations Amid LOOM’s Nosedive

Several analysts have joined the conversation about Loom’s rapid descent. 0x_Lens, a popular voice on X (formerly Twitter), hints at “next-level manipulation by exchanges.” Significantly, he believes the project is “dead,” given its low market cap.

Similarly, another trader expresses bearish sentiments. He advises on shorting Loom. Besides this, he comments on a typical PCSN scenario with maximum negative funding. He also highlights that someone possessing 50% of Loom’s supply initiated a sale.

Hence, concerns over Loom’s distribution have intensified. A recent revelation by blockchain analytics firm Lookonchain states that a wallet holding 47.5% of LOOM’s supply has started selling. Consequently, speculations are rife that this wallet belongs to the crypto exchange Upbit. Interestingly, this aligns with 0x_Lens’s belief about exchange manipulations.

Additionally, Santiment points out a concerning trend. Developer activity around Loom Network has dwindled dramatically over the years. Such significant inactivity suggests that the pump may not have a strong foundation.

LOOM/USD Technical Analysis

Bulging Bollinger bands on the LOOMUSD 4-hour price chart, with the upper hand at $0.44751206 and the lower bar at $0.15265124, suggest that the price of LOOM/USD is experiencing high volatility. The wide range between the upper and lower bands indicates a significant potential for price movement in either direction.

The price action developing into red candlesticks at the lower band indicates that there is selling pressure in the market. A move below the lower band could signal a further decline in the price of LOOM/USD, with a $0.15 support level being tested.

The Relative Strength Index (RSI) rating of 30.79 also suggests that the LOOM/USD pair is currently oversold. This RIS level could lead to a short-term bounce in price as buyers may step in to take advantage of the lower prices. However, there is room for further downside potential if selling pressure continues to dominate the market.

In conclusion, Loom Network’s recent nosedive raises questions about its future amidst distribution concerns and declining developer activity. Volatility remains high, but the potential for a bounce exists.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/loom-network-plunges-over-39-amid-speculation-of-manipulations/