Litecoin retraced 6.54% on the 19th of January 2026, after facing a hack earlier in the month, leading investors to question whether this wound has fully healed.

Source: CoinMarketCap

Despite this, institutional interest and whale activity continued to increase. However, the sharp decline begs the question: What led to this drop despite growing institutional confidence?

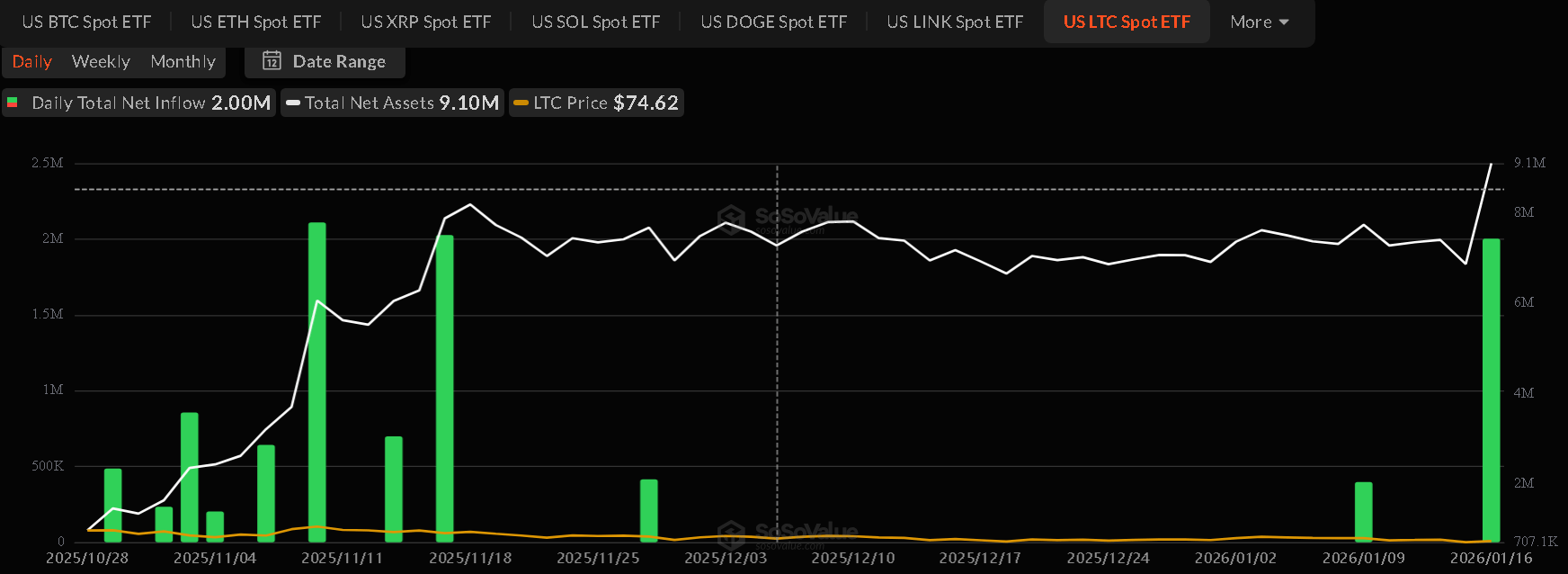

Litecoin’s decline and ETF inflows: A contrasting story

Despite a retracement in price, Litecoin saw $2M in ETF inflows last week. However, this drop was largely influenced by Bitcoin losing $94K and settling around $92K.

Despite this price decline, institutional interest in Litecoin remained strong.

Source: SosoValue

This influx of ETF investments showed that, while the price action was bearish, institutional support for LTC remained robust, which could have led to a market reversal in the long term.

Institutions took advantage of the market conditions, positioning themselves for future growth as the market stabilized.

Rising volume and Open Interest: Will momentum shift?

As of press time, Litecoin’s Open Interest hit $635M, the highest level since July 2025, when LTC surged past $100. Litecoin’s volume also reached a high of $1.1B, last seen in mid-November.

Source: CoinGlass

Rising volume and Open Interest point to increased market activity, with large players positioning for potential upside.

However, investors should remain cautious, as rising OI and volume must be followed by positive repricing. Continued price declines would suggest that bears are still in control.

Aggressive moves amid decline

During this period, Litecoin whale activity intensified, a sign that large traders were positioning for a rebound.

This behavior is often seen before price reversals, and spot average order sizes on CryptoQuant showed increasing interest from whales. Retail investors were nowhere to be seen.

Historically, aggressive whale positioning has led to temporary price recoveries, although these reversals have not always been sustained. Upcoming headlines will confirm this.

Source: CryptoQuant

The question now is: Were these whales catching the falling knife? With rising whale activity, investors will be watching closely to see whether this pattern leads to a sustained rebound or if the bears continue to dominate.

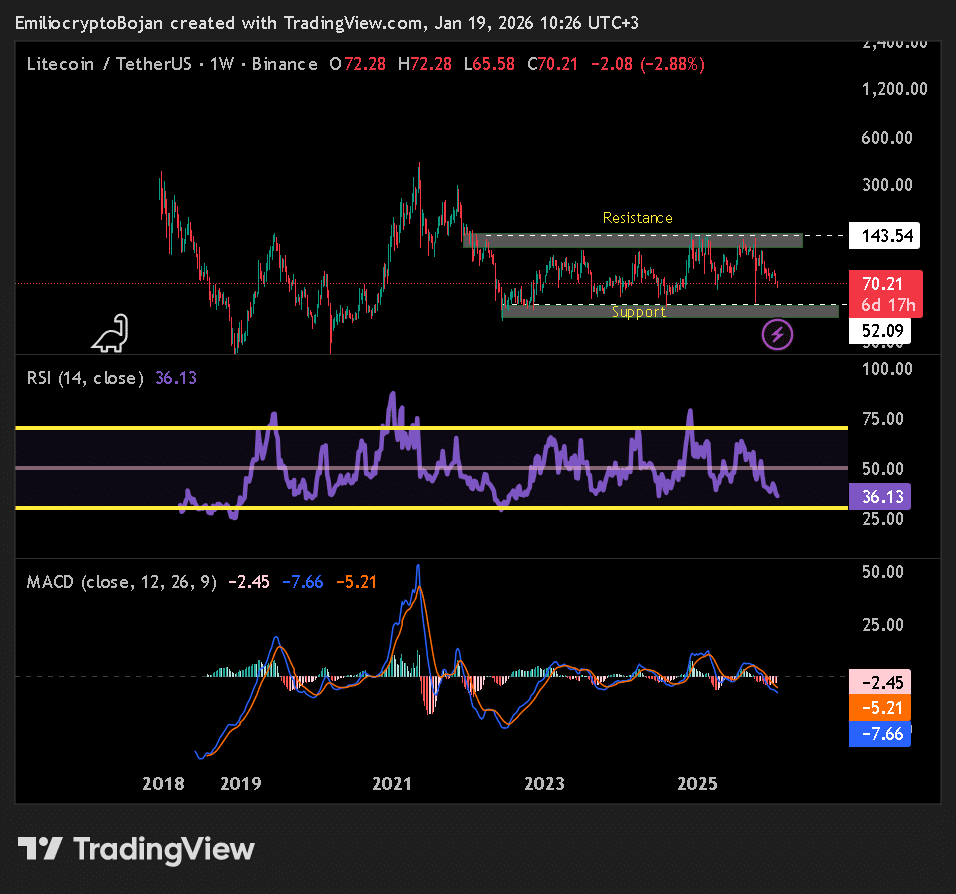

LTC at a key support zone

As of the time of writing, Litecoin traded at $70.21. On the weekly timeframe, it was nearing key support at $52, within the range between $52 and $143 that started in 2021.

The RSI and MACD indicators suggested that Litecoin was oversold, indicating a potential reversal point.

Source: TradingView

The market is now closely watching to see if Litecoin’s price will stabilize at this level or continue to fall.

Final Thoughts

- Despite recent declines, ETF inflows and whale activity suggested a potential price reversal for Litecoin.

- Litecoin’s price neared critical support levels, with the next few days proving crucial in determining its momentum.

Source: https://ambcrypto.com/litecoin-retraces-6-5-can-whales-and-etf-inflows-lead-to-a-reversal/