- Chainlink holds above key EMAs, fueling short-term bullish continuation hopes.

- Rising open interest signals strong trader engagement in LINK derivatives market.

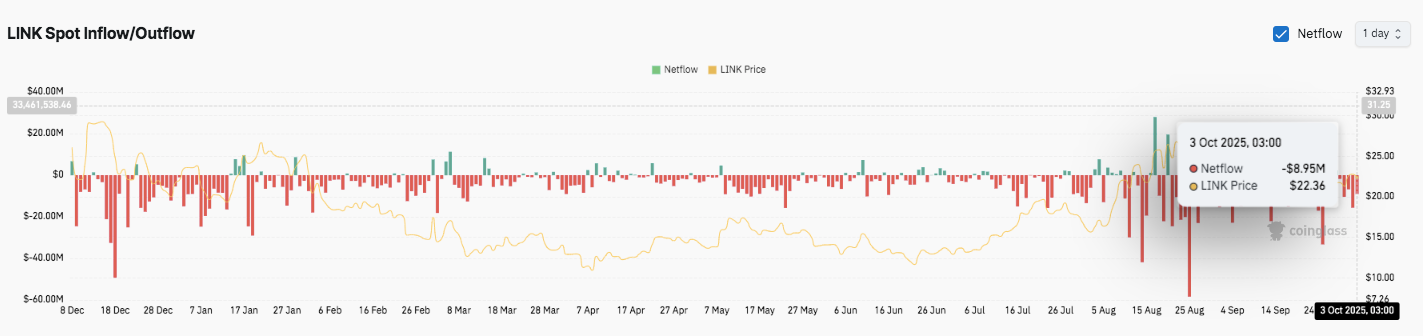

- Persistent exchange outflows show cautious sentiment despite price uptrend.

Chainlink (LINK) has recently attracted heightened attention as its price demonstrates a short-term uptrend following a low near $20.37. The cryptocurrency bounced above key moving averages, including the 50 EMA around $22.12 and the 100 EMA near $22.36, signaling renewed bullish momentum.

Additionally, the 200 EMA at $21.90 now acts as a strong support zone, providing a foundation for potential price gains. Traders are closely watching Fibonacci retracement levels from the recent swing high at $25.63 to the low at $20.37, as these points may dictate near-term resistance and support.

Fibonacci Levels and Key Price Targets

Immediate resistance appears around $23.28, the 1.618 Fibonacci extension, where LINK has already faced slight rejection. If bulls maintain strength, the next resistance range lies between $24.49 and $25.29, corresponding to the 0.786 and 0.236 retracement levels. These zones could challenge upward momentum but also offer potential breakout opportunities.

Conversely, on the downside, LINK may retest support near $22.12, reinforced by the 50 EMA, or further decline toward $21.83, aligning with the 2.618 Fibonacci extension. A sustained break below these levels could lead to deeper consolidation near the recent swing low of $20.37.

Related: Chainlink Whales Scoop 800K LINK as Stablecoin Supply Hits Record $283B

Derivatives Activity Reflects Strong Trader Interest

Besides price action, Chainlink futures have seen a sharp rise in open interest throughout 2025. From July onwards, open interest climbed from previous ranges of $300 million–$600 million to surpass $1.3 billion by early October.

This surge indicates a higher level of trader participation, suggesting both speculative bets and hedging strategies are driving market engagement. The parallel increase in LINK price and open interest reflects growing confidence among derivatives traders, strengthening the outlook for short-term bullish momentum.

Persistent Exchange Outflows Signal Caution

However, despite upward price movement, LINK has experienced sustained net outflows from exchanges throughout 2025. Several spikes exceeded $40 million, particularly in mid-August and late September, while inflows remained limited.

The October 3 net outflow of $8.95 million demonstrates ongoing selling pressure, highlighting cautious sentiment despite price recovery attempts. These outflows indicate long-term holding behavior but suggest investors remain vigilant, weighing market conditions against potential risks.

Technical Outlook for Chainlink (LINK) Price

Key levels remain well-defined heading into October:

- Upside levels: $23.28, $24.49, and $25.29 as immediate hurdles. A breakout could extend toward $26.00 and $27.35.

- Downside levels: $22.12 (50 EMA support), followed by $21.83 and $20.37 recent swing low.

- Resistance ceiling: $25.29, aligned with the 0.236 Fibonacci retracement, is the key level to flip for medium-term bullish continuation.

The technical picture suggests LINK is compressing around major EMAs and Fibonacci clusters, where a decisive breakout could spark volatility expansion in either direction.

Related: Chainlink Is Now the Official Pipeline for US Government Economic Data On-Chain

Will Chainlink Go Up October?

Chainlink’s October price prediction hinges on whether bulls can defend the $22.12–$21.83 zone long enough to mount a challenge on the $24.49–$25.29 cluster. Technical compression and growing open interest both point toward heightened volatility ahead.

If bullish momentum strengthens, LINK could retest $26.00 and even $27.35. Failure to hold $21.83, however, risks breaking into deeper consolidation near $20.37. For now, LINK remains in a pivotal zone. October’s narrative favors optimism, but conviction inflows and EMA flips will decide the next leg.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/chainlink-price-prediction-link-eyes-25-after-strong-recovery/