- LD Capital founder Yi Lihua forecasts ETH trends amid market fluctuations.

- Interest rate cuts in September may drive the bull market.

- Galaxy Digital’s performance highlighted; patience is advised for investors.

Yi Lihua, founder of LD Capital, recently commented on Ethereum’s fluctuations, driven by US stock market dynamics, indicating potential market adjustments aligned with expected interest rate cuts.

This insight suggests future opportunities for investors, underscoring the importance of patience in navigating Ethereum’s current market conditions and related asset trends.

Interest Rate Cuts and Their Potential on Crypto Markets

Yi Lihua’s statement, shared on his Twitter account, references how recent macro influences such as the US stock market and tariffs have affected Ethereum’s price fluctuations. He projects that after mid-August, market expectations will lean towards a likely interest rate reduction in September. Accordingly, he characterizes all recent pullbacks in ETH as buying opportunities.

A clear bull market trend is anticipated as interest rate expectations align with macroeconomic developments. This potential for a positive shift in crypto markets suggests a heightened investor interest in accumulating Ethereum during its current volatile state.

Responses from industry experts emphasize that patience will be crucial during market fluctuations. Yi Lihua also highlighted Galaxy Digital’s success in the crypto investment sphere as an example of market resilience. The crypto sector is awaiting further comments or policy statements from influential financial bodies about recent market dynamics.

Ethereum Price Movements Suggest Strategic Buying Opportunities

Did you know? The expectation of a significant market trend shift linked to interest rate cuts in September directly contrasts with previous crypto market patterns, underlining a potential break from the dreaded four-year cycle of cryptos.

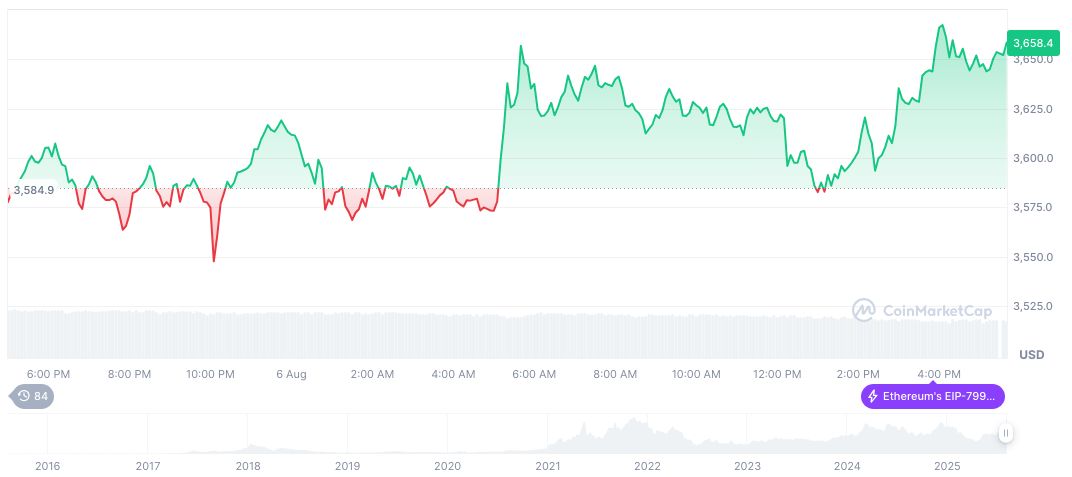

As per CoinMarketCap, Ethereum (ETH) is priced at $3,684.79 with a market capital of $444.79 billion. Currently, ETH holds a market dominance of 11.79%, with a daily trading volume of $27.74 billion, down by 16.54% within 24 hours. A 2.62% increase over the past 24 hours suggests rising investor interest, particularly with a notable 78.51% increase over 90 days.

Yi Lihua stated, “Under the macro influences such as the US stock market and tariffs, ETH has been fluctuating for a while. It is expected that after mid-August, we will start to see the market trend towards expectations of interest rate cuts in September. The bull market trend is undoubtedly clear, and all recent pullbacks are buying opportunities. Patience is indeed very important.” (ChainCatcher)

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/ld-capital-bullish-eth-projections/