- LBank, reportedly pursuing a US IPO, offers stock to some staff.

- No verified confirmation from LBank on IPO or shares.

- Employees with mainland Chinese passports reportedly excluded.

A crypto influencer has hinted at a US IPO by a second- or third-tier exchange, reportedly LBank, excluding employees with mainland Chinese passports from share allocations.

This rumor, if true, highlights ongoing regulatory complexities in crypto-financed IPOs, affecting employee participation and potentially influencing the broader market trends for exchanges.

LBank’s Reported IPO Strategy Faces Scrutiny

The reported US IPO involving LBank hints at organizational growth strategies, though no direct announcements from the exchange corroborate these claims. A potential share incentive allegedly involves the allocation of 250 shares exclusively to invited staff, with nationality restrictions applying due to regulatory standards. Exclusion of employees with mainland Chinese passports reflects ongoing compliance concerns within the industry.

LBank officials and related parties have not provided confirming details, leading industry analysts to seek further verification. According to a LBank Official Announcement, “At this time, we have not disclosed any plans for a US IPO or stock offerings to employees.” Market reactions appear muted, with significant market movements or official comments remaining absent in the immediate aftermath.

Speculation Rises Amid Absence of Official Confirmation

Did you know? Some cryptocurrency exchanges have faced similar compliance challenges when seeking IPOs, requiring adaptation to diverse regulatory landscapes.

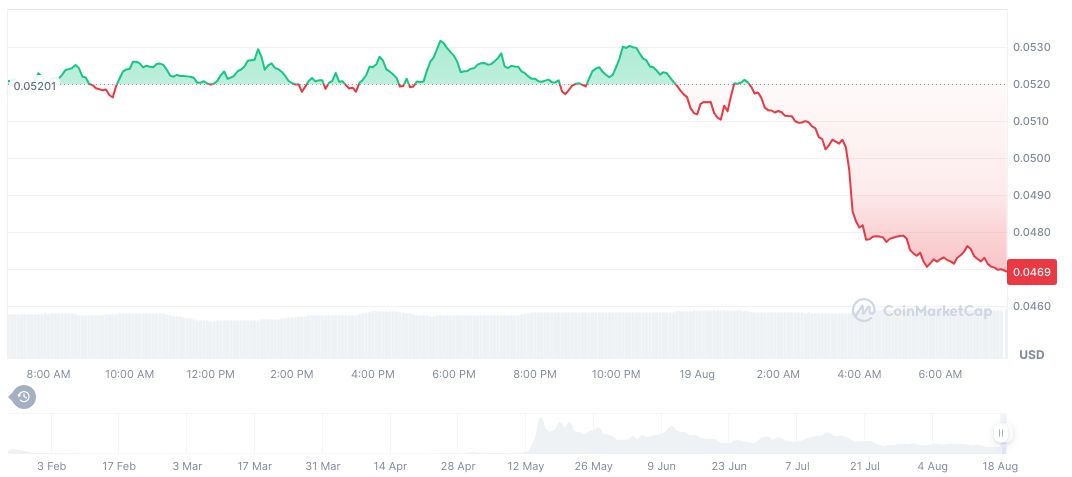

CoinMarketCap data indicates Launch Coin (LAUNCHCOIN) currently trades at $0.05, experiencing notable downturns: -9.41% in the past 24 hours and -30.60% over the past week. The market cap stands at 47,016,568.89, with trading volume reaching 21,351,015.93. Price changes over 60 days show a significant -61.13% shift, reflecting broader market volatility.

Coincu researchers suggest that the myriad unverified claims about LBank’s activities potentially affect investor sentiment, leading to increased scrutiny from market participants. The lack of concrete details creates an atmosphere of speculation, impacting trading behaviors and investment forecasts within the crypto ecosystem.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/lbank-us-ipo-share-offering/