- Whale purchases and hedges ASTER through leveraged trades, influencing market flows.

- Strategic maneuvers impact ASTER’s short-term stability.

- Analysts note surge in ASTER volumes without official project comments.

On September 20, 2025, blockchain analyst Yu Jin reported a whale buying 7.5 million USDT of ASTER, engaging in hedging and funding fee arbitrage on the Hyperliquid exchange.

This highlights advanced funding fee strategies in crypto markets, with ASTER seeing significant activity and demonstrating complex trading mechanisms involving large market players.

Whale’s $7.5M ASTER Trade: Strategic Hedges and Market Effects

A whale purchased ASTER worth $7.5 million USDT from a single account and positioned through hedging on Hyperliquid. Analysts speculate the transaction aimed at arbitraging funding fees, exploiting Hyperliquid’s positive annualized rates of approximately 450%.

Significant trade activities have surrounded ASTER, with whales engaged in systematic hedging that could stabilize prices. The whale executed a leveraged shorting equivalent to their ASTER purchase, indicating strategic positioning rather than a straightforward investment.

This significant accumulation of ASTER by large wallets, particularly with systematic hedging through strategies like funding fee arbitrage, emphasizes the complexity of current whale behavior in the crypto market. – Yu Jin

ASTER’s Response to Whale Activity: Rising Price and Volume Analysis

Did you know? In similar token cases like AAVE, whales have historically performed complete hedges, leading to stable short-term pricing effects unlike those seen in immediate post-token launches.

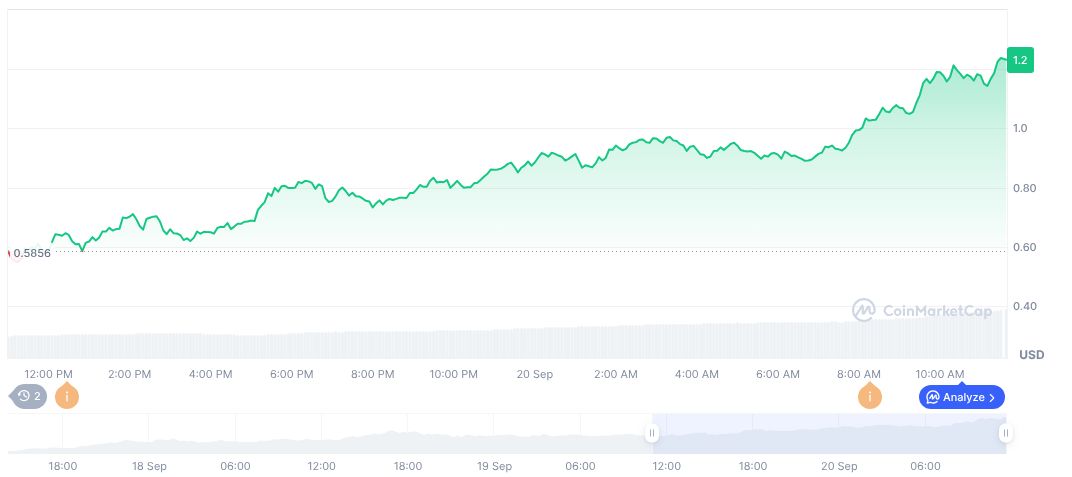

As reported by CoinMarketCap, ASTER currently trades at $1.18, witnessing a 24-hour trading volume surge of 116.06%. Recent trends note an 81.33% price increase over the past day. The market remains dynamic, with ASTER’s 7-day climb reaching 1292.57% as participants observe its volatile shifts.

Coincu analysis indicates broader implications for ASTER’s sudden market swings. Leveraged trades can lead to increased scrutiny and regulatory assessments as exchanges brace for potential compliance reviews and market adjustments in response to such strategic financial activities.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/whale-strategic-hedging-aster-trade/