- Lael Brainard advocates a rate cut at the next FOMC meeting, emphasizing private data reliance.

- She aims to reduce inflation to 2% in the coming years.

- Market impact suggests potential benefits for crypto with long-duration asset rally.

Former Federal Reserve Vice Chair Lael Brainard, now National Economic Council Director, indicates support for another rate cut at the December FOMC meeting to combat inflation challenges.

Her stance highlights the ongoing focus on maintaining a 2% inflation target amid economic uncertainties, potentially impacting crypto markets through macro-financial dynamics.

Rate Cut Strategy Amid Inflation Concerns

In a recent interview, Brainard discussed her inclination for a rate cut if attending the FOMC meeting, highlighting inflation control as a priority. Emphasizing the role of private data, she underscores the importance of making informed decisions amid incomplete government statistics.

With a rate cut on the horizon, financial markets may expect lower yields, boosting the value of long-term assets such as technology and cryptocurrencies. Historically, eased Fed policies have correlated with asset price rallies.

Market responses could pivot toward crypto assets, notably BTC and ETH, historically benefiting from Fed policy easing. While official reports lack direct mention of crypto, experts infer positive implications for digital currencies.

Predicted Market Effects on Crypto Assets

Did you know? Prior “hawkish rate cuts” like the Fed’s 2019 adjustment boosted equities and risk assets, creating favorable conditions for Bitcoin and major altcoins amidst global liquidity increases.

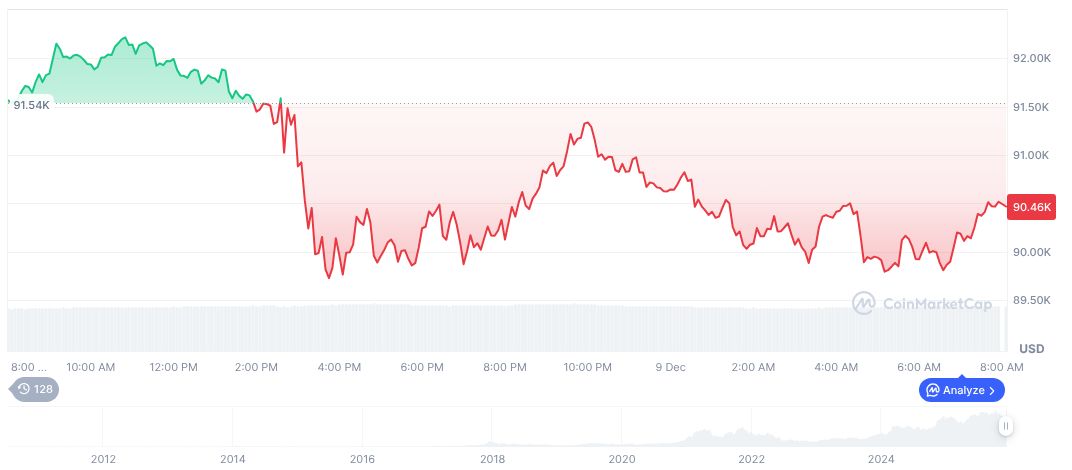

Bitcoin’s price is at $90,189.77, with a market cap of 1.8 trillion and a 24-hour trading volume of 56 billion. The asset shows a 3.83% increase over seven days despite a 11.27% decrease over a month, per CoinMarketCap.

The Coincu research team projects the proposed rate cut could stabilize inflation risks, facilitating liquidity favorable to risk assets such as Bitcoin and Ethereum, fostering a conducive crypto ecosystem.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/brainard-supports-rate-cut-inflation/