- Krisin Johnson resigns, leading to CFTC leadership gap.

- Regulatory uncertainty as Johnson exits September 3.

- U.S crypto market faces potential oversight challenges.

Kristin Johnson, the last remaining Democrat on the U.S. Commodity Futures Trading Commission, resigns effective September 3, 2025, intensifying leadership challenges during a critical phase for crypto regulation.

Johnson’s departure intensifies regulatory uncertainty, stalling digital asset oversight, affecting U.S. influence and potentially increasing risk in crypto derivatives markets like BTC and ETH.

CFTC Faces New Challenges with Single-Member Leadership

Kristin Johnson’s resignation follows her advocacy for stronger regulatory frameworks, especially post-FTX collapse. Appointed by President Biden in 2022, she emphasized the need for more resources and legislative clarity. Her departure, effective September 3rd, leaves Caroline Pham as the only remaining commissioner, impacting future regulatory actions.

The immediate effect of Johnson’s departure is a reduced capacity for the CFTC to enact new regulation or enforcement concerning digital assets. Her exit leaves the agency understaffed and raises questions about the U.S. influence on global crypto policies.

My last day at the Commission will be September 3, 2025. For nearly two decades, I have advocated for effective regulation of our markets. – Kristin Johnson, CFTC Commissioner

Market observers are wary of the leadership gap, with statements from Johnson highlighting the need for foundational resilience. As Chair Pham remains alone, the CFTC faces operational challenges in maintaining consistent oversight, leading to potential market hesitance.

Bitcoin’s Performance Amid CFTC’s Regulatory Shift

Did you know? The CFTC has never experienced a single-member commission during a significant rise in digital assets, making this leadership gap unprecedented in terms of potential impact on market regulation.

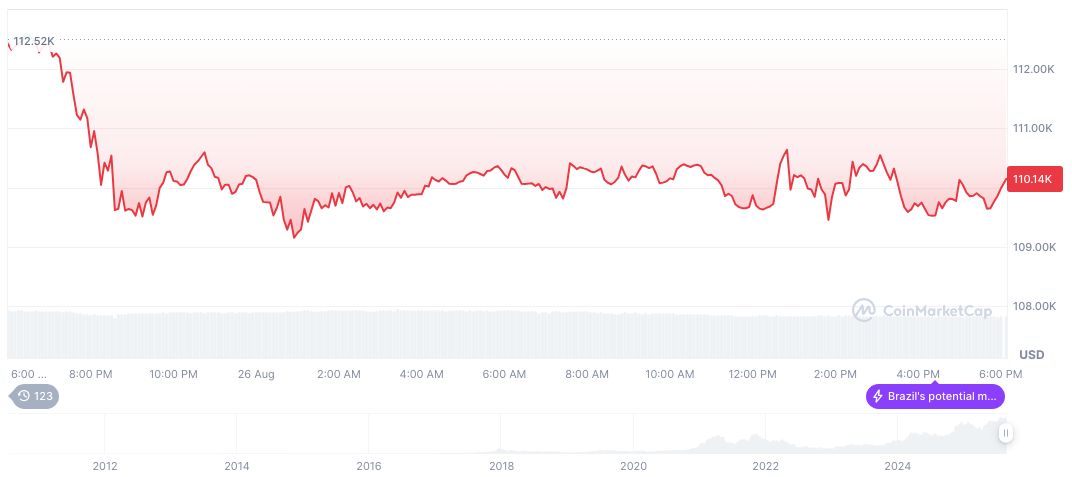

Bitcoin (BTC) recently traded at $111,672.82, holding a market cap of $2.22 trillion, with a dominance of 57.38%. Recent data from CoinMarketCap indicates a 24-hour trading volume of $68.92 billion, despite a decline of 19.53% in activity. Over three months, BTC experienced a 3.77% increase in price.

Coincu experts suggest the CFTC’s reduced enforcement capability might influence U.S. market activity. Regulatory uncertainty may deter institutional players, shifting influence to international regulatory bodies. The decision-making vacuum might lead to delayed responses to digital asset developments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/kristin-johnson-resigns-cftc-crypto-regulation/