- Kraken buys Small Exchange to bolster U.S. derivatives market position.

- $100 million acquisition strengthens infrastructure.

- Potential increased institutional participation in U.S. crypto markets.

Kraken announced on October 2023 the acquisition of Small Exchange from IG Group for $100 million, establishing a regulated derivatives exchange in the U.S., enhancing crypto trading infrastructure.

This acquisition solidifies Kraken’s position in the U.S. market, aiming for comprehensive derivatives offerings, impacting BTC and ETH and challenging DeFi projects through increased institutional participation.

Kraken’s $100 Million Move in U.S. Derivatives

Kraken announced the acquisition of the CFTC-regulated Small Exchange from IG Group for $100 million, establishing a foundation for a regulated domestic derivatives exchange. The deal, primarily overseen by co-CEO Arjun Sethi, unifies U.S. spot, margin, and derivatives trading under one CFTC license, strengthening infrastructure and reducing fragmentation.

The acquisition price included $32.5 million in cash and $67.5 million in Kraken stock. This aims to create a transparent and efficient U.S. trading venue. The strategic move is part of Kraken’s ongoing investment in regulated infrastructure, targeting reduced latency and better access and performance for U.S. traders — Arjun Sethi, Co-CEO, Kraken.

Market Data

Did you know? Kraken’s acquisition echoes its 2019 purchase of Crypto Facilities, which led to Europe’s first regulated crypto futures market.

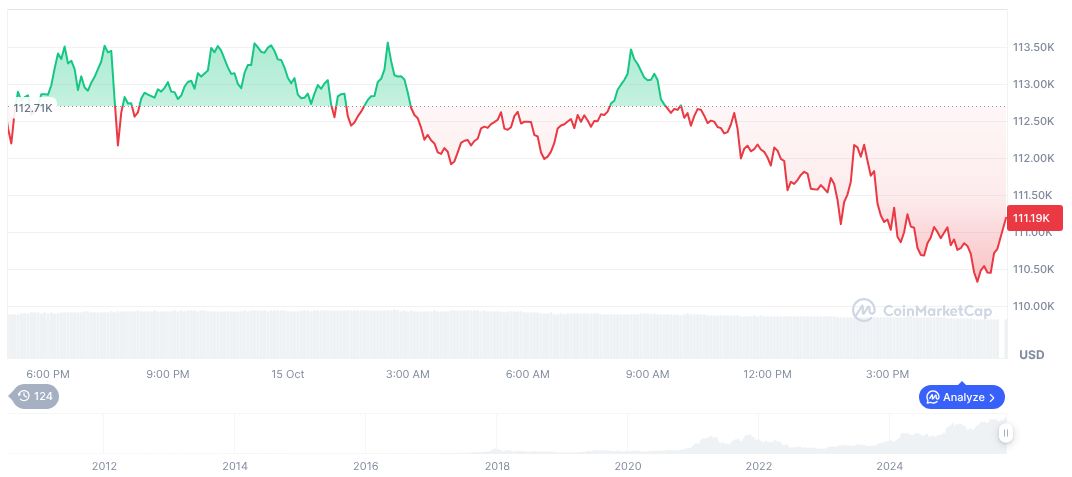

Bitcoin, trading at $111,718.04, holds a market cap of $2.23 trillion and a dominance of 58.87%, according to CoinMarketCap. Its 24-hour volume decreased 18.76% to $68.93 billion. The circulating supply nears 20 million, with losses of 0.66% over 24 hours tracked until October 16, 2025.

Coincu research indicates the acquisition could accelerate market evolution, enhancing financial efficiency by reducing U.S. market fragmentation, and potentially advancing technological platforms, which may pressure decentralized finance initiatives.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/kraken-small-exchange-acquisition/