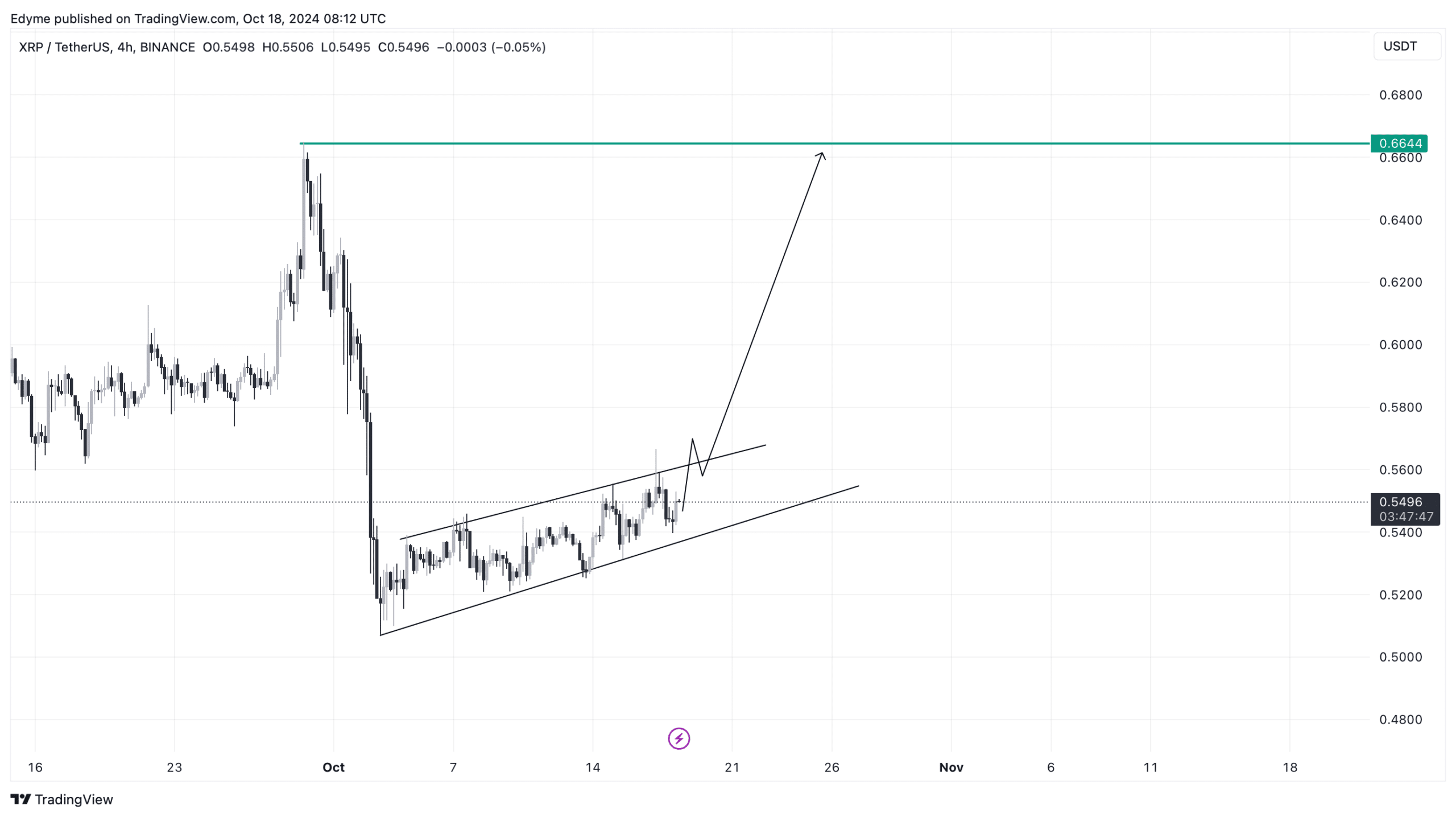

- XRP is trading in an ascending channel pattern, which could lead to a rally toward $0.66.

- XRP’s RSI currently sits at 60, suggesting the asset may be poised for a potential price surge.

XRP has been on a gradual increase in recent weeks, while the asset hasn’t seen a major decline in price, it has also not risen significantly over the past weeks.

So far, XRP has increased by 5.2% in the past two weeks and 2.3% in the past week—although the past day performance has been slightly different with XRP seeing a slight decrease in price.

Regardless of this, technical analysis on XRP’s chart reveals that the asset could soon surge to as high as $0.66 as long as key support levels hold strong.

The bullish technical picture

A technical analysis on XRP’s chart reveals that the asset is showing a bullish signal. Specifically, XRP is facing the odds of surging to as high as $0.66 in price. This could be possible as long as XRP holds the support level of $0.52.

To put this into context so as to understand: on the 4-hour chart, XRP has so far trended sideways for a while now therefore forming an ascending channel pattern. This ascending channel pattern is a bullish signal especially if an asset breaks above it.

Source: TradingView

Now, with XRP forming this ascending channel pattern on its 4-hour chart, the asset is now facing the odds of rising to as high as 0.66 as long as it breaks above and have a candle close above the upper boundary of the ascending channel pattern which is $0.56 area and as long as XRP also maintain its price and hold above the lower boundary of the ascending channel pattern which $0.52.

Notably, the ascending channel pattern is a common formation in technical analysis, where price trends higher in a rising channel. When an asset remains within this pattern, it indicates a bullish outlook.

If XRP manages to break above the upper boundary and close with a solid candle, it confirms the bullish scenario, increasing the chances of further gains. Maintaining support around $0.52 is essential for this momentum to continue.

Fundamental outlook on XRP

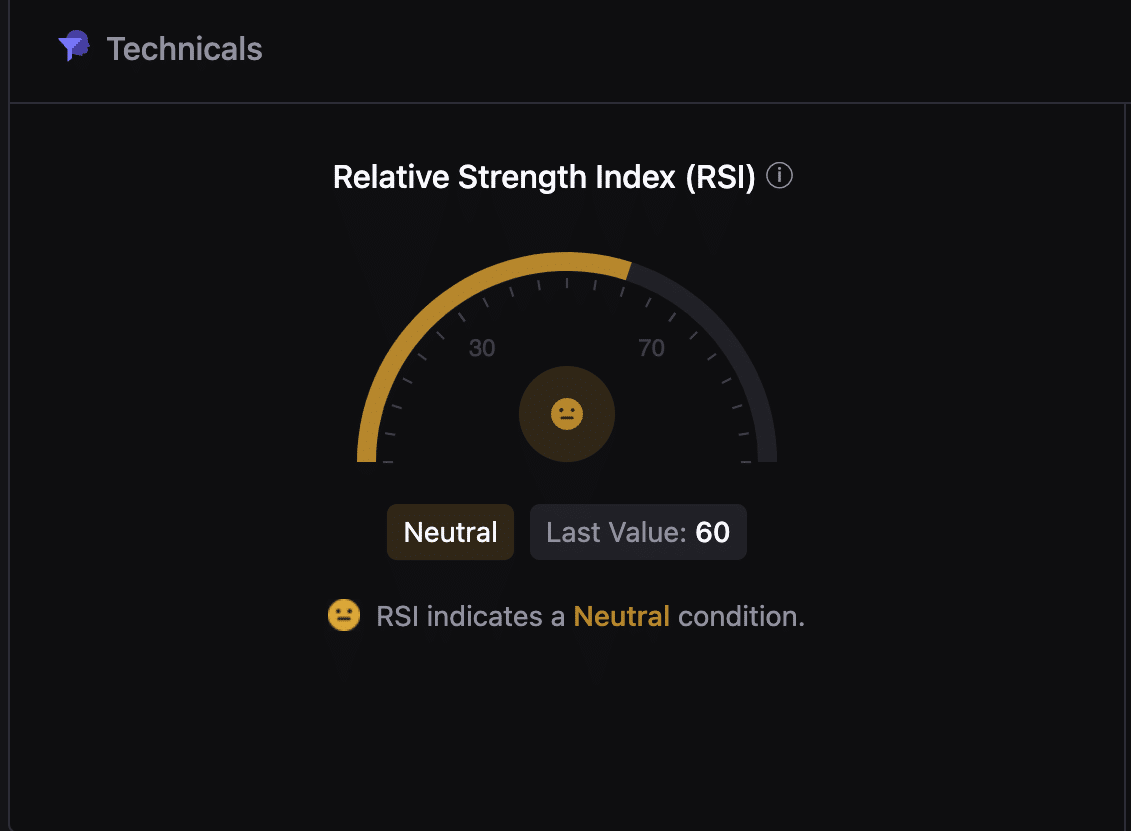

From a fundamental perspective, XRP’s market metrics are also reflecting promising signs. One key metric is the Relative Strength Index (RSI), which is currently at 60. RSI is a momentum indicator that helps assess whether an asset is overbought or oversold.

Source: CryptoQuant

A reading of 60 suggests that the Ripple token is neither overbought nor oversold, placing it in a neutral condition. This balance indicates that there is still room for the price to rise further without entering an overbought territory, which could cause a pullback.

Read XRP’s Price Prediction 2024–2025

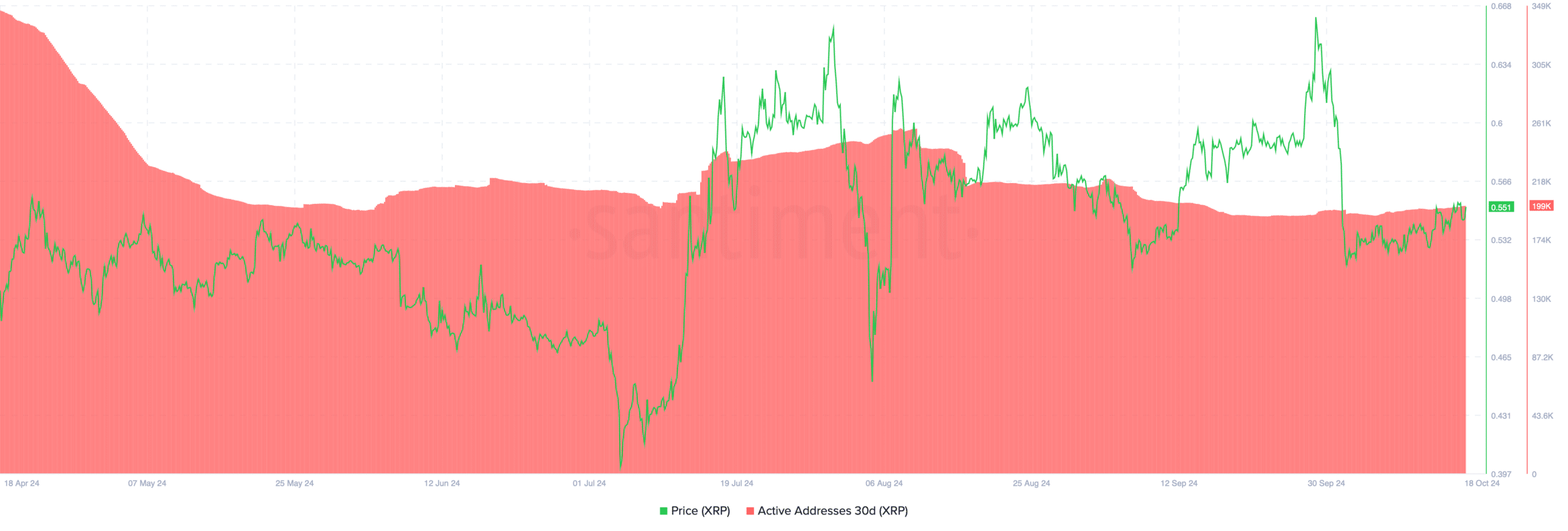

Another essential metric for XRP’s market sentiment is its active addresses, a reflection of retail interest in the asset. Data from Santiment shows that active addresses surged to over 250,000 in early August.

Source: Santiment

However, this figure has since decreased, stabilizing between 190,000 and 199,000 in the past few weeks. While this represents a slight drop in retail participation, the figure remains relatively strong, suggesting consistent market interest.

Source: https://ambcrypto.com/xrp-shows-bullish-signs-key-levels-to-watch-for-a-breakout-to-0-66/