- Jeff Schmid argues against further rate cuts to prevent inflation.

- Schmid’s stance may affect speculative asset flows.

- Interest rate policy decisions impact crypto markets.

Kansas City Fed President Jeff Schmid emphasized on October 6, 2025, his opposition to further interest rate cuts, citing inflation concerns at a public address.

Schmid’s stance suggests potential stability in U.S. interest rates, influencing macroeconomic conditions and impacting crypto market dynamics, particularly cryptocurrencies like Bitcoin and Ethereum sensitive to monetary policies.

Schmid’s Stance Challenges Speculative Market Momentum

Jeff Schmid of the Kansas City Fed emphasized a cautious monetary stance to mitigate inflation risks. Schmid stated that inflation remains excessively high, and the central bank should avoid further interest rate reductions. According to him, recent inflation data, with 80% of categories showing price increases, supports this perspective.

Market reactions were swift, with financial analysts suggesting that Schmid’s comments may lead to a stronger U.S. dollar, influencing speculative investments. A higher interest rate environment could reduce capital flows into risk assets, including Bitcoin and Ethereum, as these assets are sensitive to changes in dollar liquidity.

“Muted impact of tariffs on inflation should not be taken as a reason to cut interest rates.” — Jeff Schmid, President, Federal Reserve Bank of Kansas City

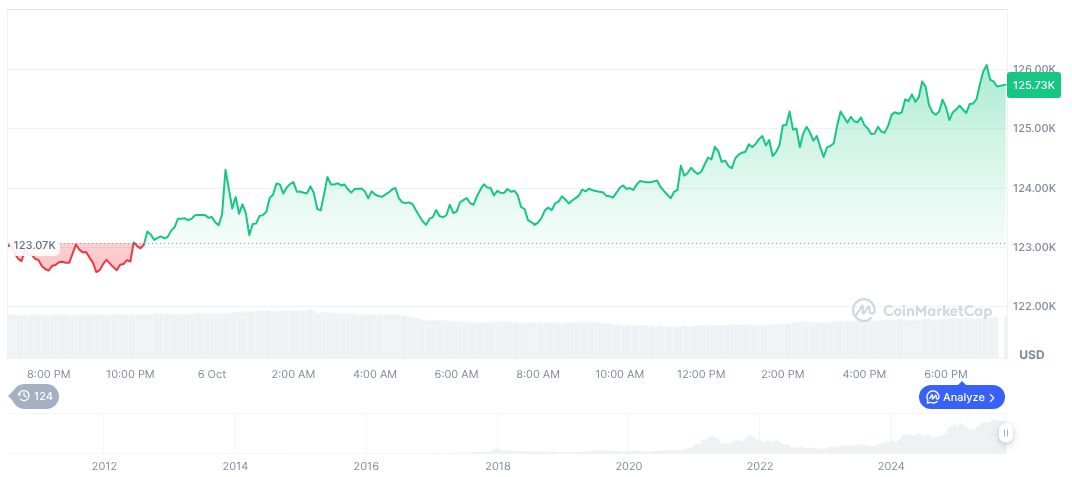

Bitcoin’s 14.59% Rise Despite Rate Concerns

Did you know? In late 2022, when the Fed maintained higher interest rates, liquidity in decentralized finance platforms decreased, reflecting the historical impact of rate signals on speculative capital flows.

Bitcoin’s current price of $124,724.47 reflects a 0.58% increase over the past 24 hours, with a market cap of $2.49 trillion. Over the past 90 days, Bitcoin’s price has grown by 14.59%, according to CoinMarketCap. Despite a recent dip in trading volume by 3.82%, the market dominance remains strong at 58.11%.

The Coincu research team notes that Schmid’s comments may foreshadow continued regulatory caution affecting the crypto sector. While higher rates can tighten liquidity, historical trends suggest that strong fundamentals of major tokens like BTC and ETH may counter some of these pressures.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/schmid-opposes-further-rate-cuts/