- Involves First Digital Trust, banks in Dubai; $500 million fraud claim.

- Major financial implications across several institutions.

- Justin Sun urges Dubai to address fraud exposure.

In a significant financial disclosure, Justin Sun declared that the First Digital Trust and ARIA fraud case exceeds $500 million, involving UAE banks. The fraud case points to substantial implications for the financial systems within Dubai as Sun calls for decisive governmental intervention and vigilance from involved banks.

$500 Million Fraud Implicates Dubai and Global Banks

The latest disclosure by Justin Sun revealed an alleged fraud exceeding US$500 million, involving Dubai-based banks through Hong Kong’s First Digital Trust and Legacy Trust. The names tied to this scenario include prominent individuals such as Christian Alexander Boehnke De Lorraine Elbouef and Vincent Chok. Various affected funds flowed into Mashreq Bank, Abu Dhabi Islamic Bank, Emirates NBD, and Swiss EFG Bank, warranting significant concern.

Expert Insights as Market Watches Fraud Developments

Reactions from Justin Sun stress the urgency of regulatory oversight, with a robust denunciation of criminal alliances. He has explicitly insisted on intensified scrutiny and intervention from both local authorities and banking institutions to avert further harm.

Immediate actions entail potential internal reviews by the implicated banks to address unlawful financial movements. The investigation highlights the profundity of such maneuvers within financial networks. Sun emphasizes immediate counteractions to prevent similar events, demanding transparency and due diligence within the banking system to curtail illicit activities.

“Dubai must not become a haven for fraud and money laundering.” — Justin Sun, Founder, TRON

Market Data and Future Insights

Did you know? In a striking context, Dubai’s financial system has drawn parallels to historic fraud busts due to rigorous action calls from public figures like Justin Sun, exemplifying shifting demands for enhanced regulatory enforcement.

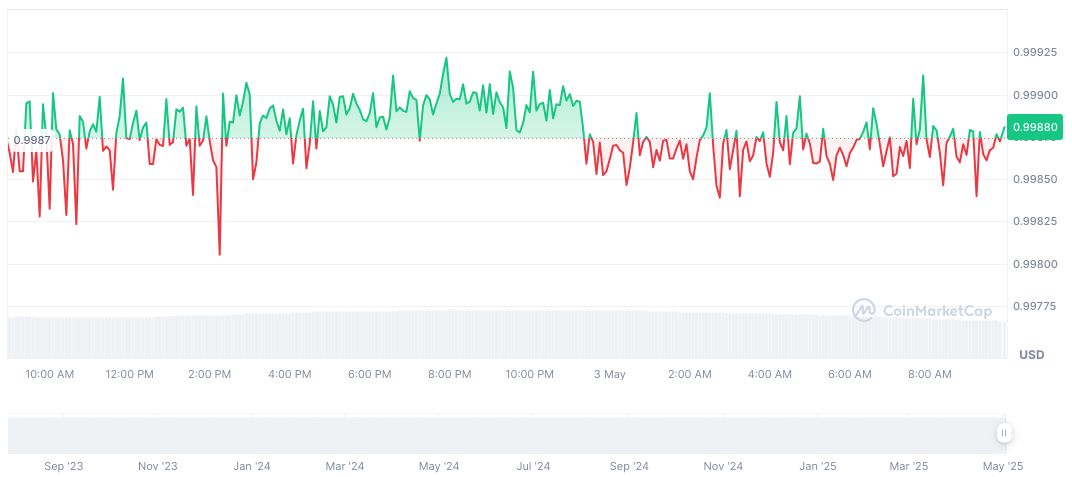

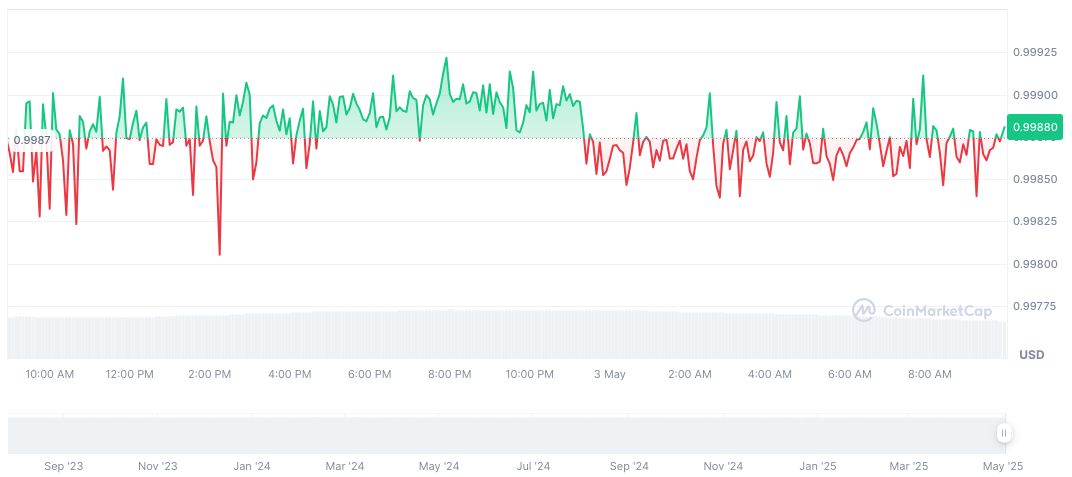

First Digital USD (FDUSD) currently trades at $0.99 with a 24-hour trading volume of 2687995457. Despite recent allegations, the stablecoin’s market cap stands at 1470232479. Although trading has faced slight setbacks, with a 0.01% dip in the last day, prices have shown moderate growth within 30 days, according to CoinMarketCap.

Experts suggest potential regulatory shifts as countries respond to such vast fraud announcements by implementing stricter compliance measures within financial infrastructure. The Coincu research team predicts potential financial restructuring to address future vulnerabilities, emphasizing enhanced monitoring and technological innovations in response to these revelations.

Source: https://coincu.com/335464-justin-sun-fdt-aria-fraud/