- U.S. Federal Reserve Chair Jerome Powell suggests rate cuts after weak jobs data.

- Fed rate cuts perceived positively for BTC and ETH.

- Crypto markets may experience increased liquidity following potential rate cuts.

U.S. Treasury Secretary Benson, on September 7th, emphasized that economic policy will not pivot on a single dataset amid predictions of a potential 800,000 job decrease by 2024.

The anticipated job loss highlights concerns over U.S. economic health, prompting expectations of Federal Reserve interest rate cuts, potentially affecting cryptocurrency markets including BTC and ETH.

Jerome Powell’s Rate Reduction Hint Amid Labor Market Weakness

Federal Reserve Chair Jerome Powell has suggested potential rate cuts, citing weak labor data. His comments indicate a shift from an inflation-focused approach to addressing employment concerns. “We will proceed carefully,” Powell stated, indicating that potential interest rate cuts are in response to weak labor data. President Donald Trump criticized the Fed’s slow response, backing his claims with adjusted employment forecasts showing potential job losses.

Possible impending rate cuts, if implemented, could lead to increased liquidity in financial markets. Historically, this move has favored risk assets, such as Bitcoin and Ethereum, due to their increased attractiveness relative to fiat returns. The belief in fed rate reduction also surged among market participants to 99%, according to CME FedWatch. Market responses have been notable. While cryptocurrencies like BTC and ETH have historically risen on Fed rate cut expectations, experts caution the eventual Fed decision remains key. Official commentary from Powell reassured careful policy terms: “We will proceed carefully,” emphasizing decisions will be data-driven and employment-sensitive.

Did you know? The U.S. Federal Reserve’s monetary policy shift in 2020, post a labor market decline, led to substantial crypto market growth, showcasing the significant impact of macroeconomic decisions on digital assets.

Crypto Market Reaction to Fed’s Possible Rate Cuts

Did you know? The U.S. Federal Reserve’s monetary policy shift in 2020, post a labor market decline, led to substantial crypto market growth, showcasing the significant impact of macroeconomic decisions on digital assets.

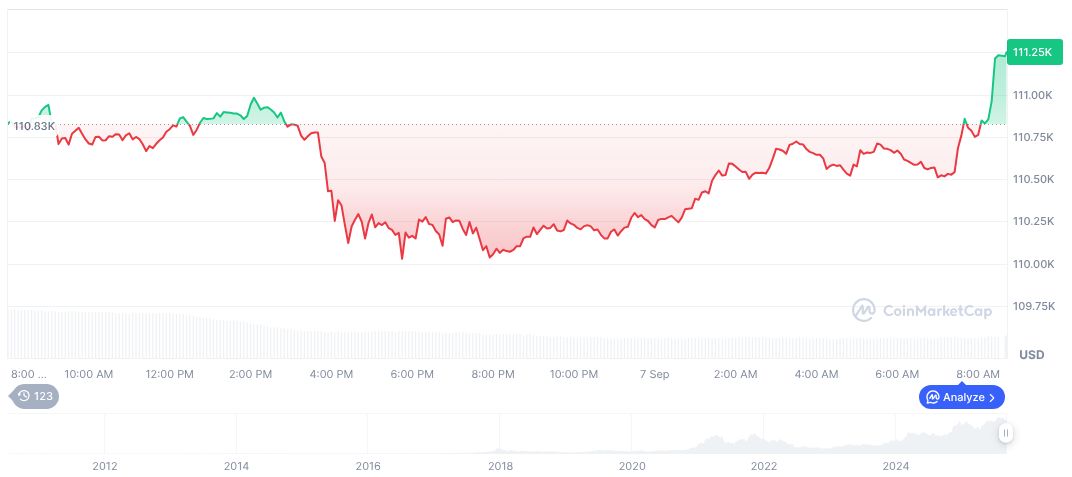

Bitcoin (BTC) currently sits at $111,156.87, possessing a market cap of formatNumber(2213956850827.84, 2) and market dominance of 57.86%. Over 24 hours, BTC price fluctuated by 0.33%. Recent movements showed a 2.51% increase over the last 7 days, following a 4.70% decrease in 30 days. Data sourced from CoinMarketCap by September 7, 2025.

Analysts from the Coincu research team suggest potential regulatory impacts could arise from changing policy landscapes. Fed rate adjustments may enhance crypto adoption as alternative investment vehicles. These shifts often ripple through the entire financial ecosystem, affecting broader technological sectors as well.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/jerome-powell-fed-rate-cuts-signal/