- Japan plans to cut crypto taxes to 20%, effective 2026.

- Lower tax aims to attract both retail and institutional investors.

- Binance’s Zhao sees this as a pro-growth move for Japan.

Japan plans to reduce its cryptocurrency tax rate from a maximum of 55% to 20%, effective from early 2026, pending legislative approval, potentially transforming its crypto market dynamics.

This tax reform aligns digital asset taxation with stock market rates, attracting more investors and potentially driving significant growth in Japan’s crypto sector.

Japan’s 2026 Crypto Tax Overhaul: A Strategic Shift

Japan’s initiative to trim cryptocurrency taxes marks a concerted effort to reposition itself as an attractive hub for digital asset investment. Spearheaded by the Japanese Financial Services Agency (FSA), the proposal suggests classifying 105 “green-listed” digital currencies as financial products subject to the new tax rate.

By aligning crypto tax rates with those of traditional assets, Japan aims to eliminate barriers deterring both retail and institutional participants. This shift, scheduled for early 2026, is seen as a move to boost market liquidity and participation.

Market responses to the announcement have been generally positive. Binance founder Zhao Changpeng commented that reducing fees represents a “promoting economic growth” move. His comments underscore optimism about Japan becoming a competitive player in the digital currency space.

Regulators are almost done finalizing the policy. — Katsunobu Kato, Finance Minister, Japan

Crypto Taxation Impact: 15% Market Activity Rise Anticipated

Did you know? Japan’s move to reclassify crypto aligns with its approach to stock market taxes, aiming to boost domestic crypto trading much like past reforms enhanced equities.

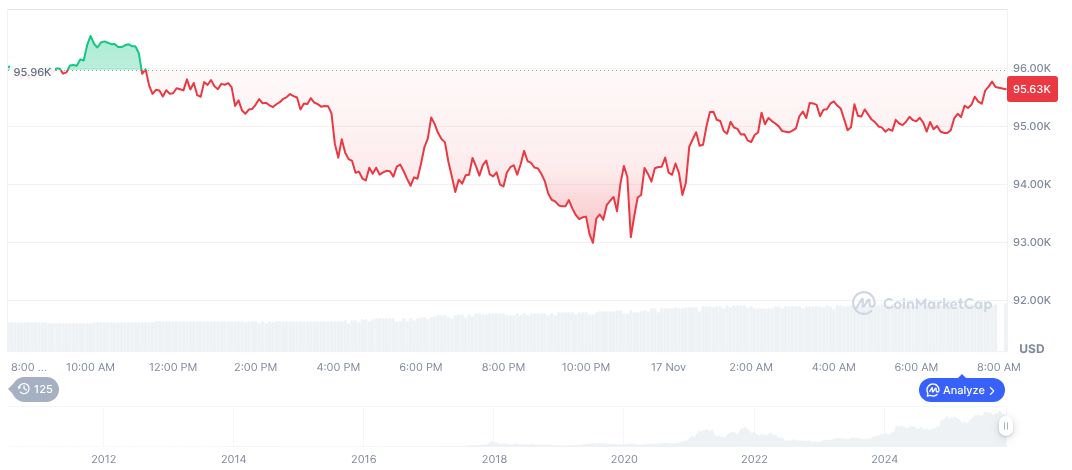

Bitcoin (BTC) currently trades at $95,720.82, with a market cap of $1.91 trillion, maintaining a dominance of 58.84%. Over the last 24 hours, the trading volume reached $77.38 billion, despite a 0.71% decline. These figures, provided by CoinMarketCap, highlight Bitcoin’s enduring influence amid regulatory shifts.

Coincu research suggests that this regulatory change could lead to a 15% increase in market activity, fostering a more vibrant trading environment. By prioritizing well-vetted assets, Japan aims to balance market safety with growth.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/japan-reduces-crypto-tax-rate/