- Allegations challenge James Wynn over 0xBC47 wallet ownership and asset movements.

- The wallet moved assets to KuCoin, denying Wynn’s ownership claim.

- Market debates transparency in trading, affecting derivatives platform trust.

James Wynn, the prominent crypto trader, became the center of attention after denying ownership of the wallet address 0xBC47, which reportedly sent all its assets to a KuCoin deposit address. This development follows recent allegations concerning the identity and activities linked to the wallet.

Wynn’s denial of any link to the controversial wallet emphasizes the broader industry debate over on-chain transparency’s risks. The situation brings attention to potential vulnerabilities in trading platforms with real-time data.

James Wynn’s Denial Fuels Community Debate

James Wynn, known for leveraging aggressively in derivatives markets, has publicly denied connections to the 0xBC47 wallet, which recently transferred all of its holdings to a KuCoin address. Wynn stated, “I deny being forced to liquidate my positions and dispute that the 0xBC47 wallet belongs to me.” Despite Wynn’s denial, on-chain data continues to link the 0xBC47 wallet to Wynn. The denial has not fully dispelled doubts within the community, highlighting the potential dangers of transparency, as assets can be strategically moved away from susceptible positions.

Key figures like CZ, Binance Founder, commented on decentralization’s risks, stating: “All orders on DEXs are publicly available in real-time.” This sparked calls for improved privacy measures, with some analysts advocating for trading solutions that offer more privacy, such as dark pools.

From the Coincu research team, there are anticipated developments in trading regulations that could arise from this event. The push for privacy enhancements follows ongoing scrutiny, with potential legislative responses to counteract transparency-induced vulnerabilities in trading platforms.

Anticipating Regulatory Responses to Wallet Controversy

Did you know? James Wynn’s recent financial scrutiny mirrors historical instances, like Michael Saylor’s Bitcoin strategies, where large players faced challenges due to total on-chain transparency.

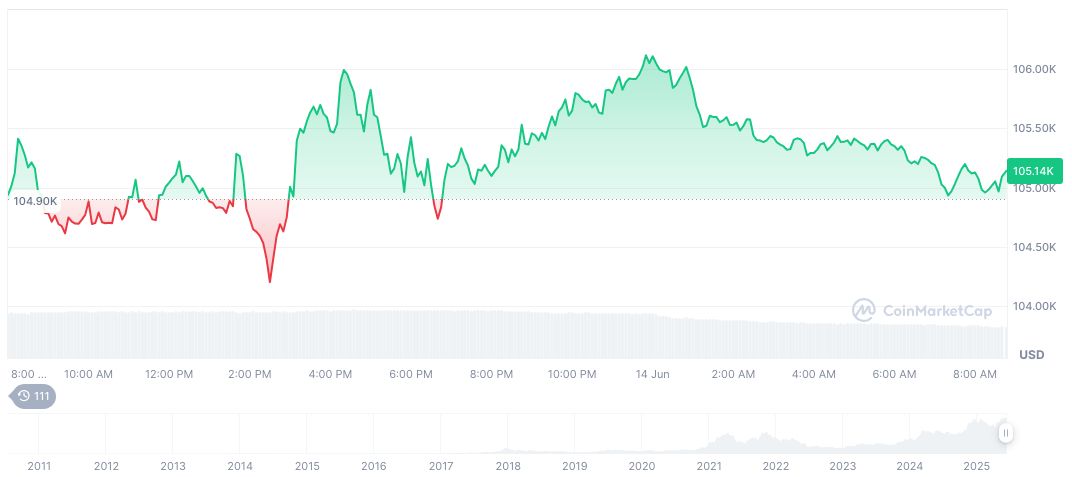

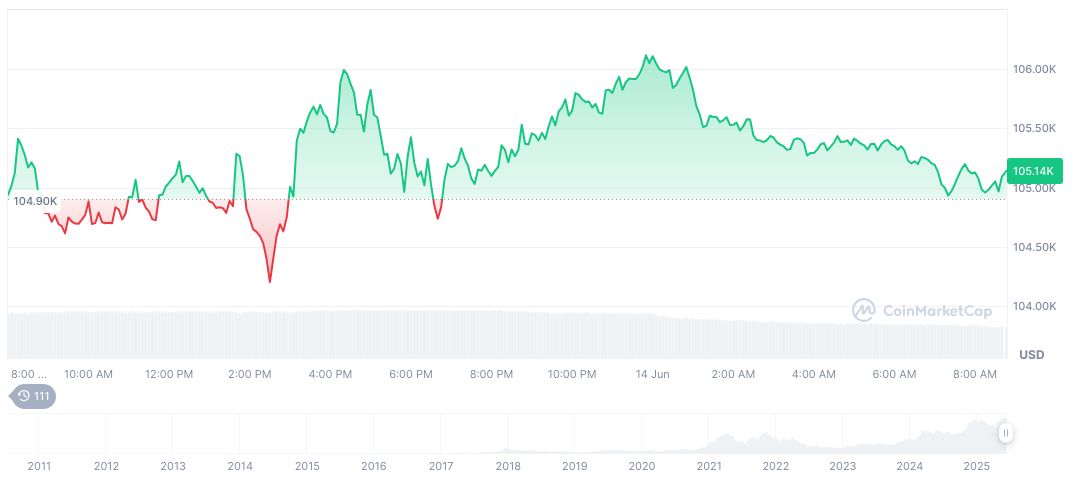

According to CoinMarketCap, Bitcoin (BTC) trades at $105,600.76 with a market cap of $2.10 trillion. Despite a 20.28% surge in the past 24 hours, it shows a minor weekly dip of 0.01%, while realizing significant gains over 60 and 90-day periods. The market dominance stands at 63.98%.

From the Coincu research team, there are anticipated developments in trading regulations that could arise from this event. The push for privacy enhancements follows ongoing scrutiny, with potential legislative responses to counteract transparency-induced vulnerabilities in trading platforms.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/343356-james-wynn-wallet-denial-controversy/