- Israeli military targets 720 Iranian facilities over three days amid conflict.

- No immediate cryptocurrency market impacts reported from the operations.

- Historical volatility noted in crypto markets during past Middle East conflicts.

The Israeli military reported the targeting of over 720 Iranian facilities in under three days. This escalation occurred amidst ongoing regional tensions, with the Israeli forces stating the operation’s swift execution.

The intensified military action is noteworthy; however, cryptocurrency markets have shown no immediate responses according to the latest available data. Historically, geopolitical events in the Middle East have sometimes influenced crypto asset volatility.

Over 720 Iranian Targets Hit Amid Escalating Tensions

According to reports, Israeli military spokespersons announced the targeting of over 720 Iranian facilities in less than three days. This military action highlights the escalating tensions in the region. The Israeli Defense Forces (IDF) Spokesperson stated, “No organized communications have been released from Israeli military spokespersons regarding their involvement in crypto-related matters.” The Israeli military’s operations were stated to have successfully impacted key Iranian military sites, aiming to neutralize threats. Despite the action’s scale, there are no direct comments from major crypto figures or exchanges about its potential impact on cryptocurrency markets.

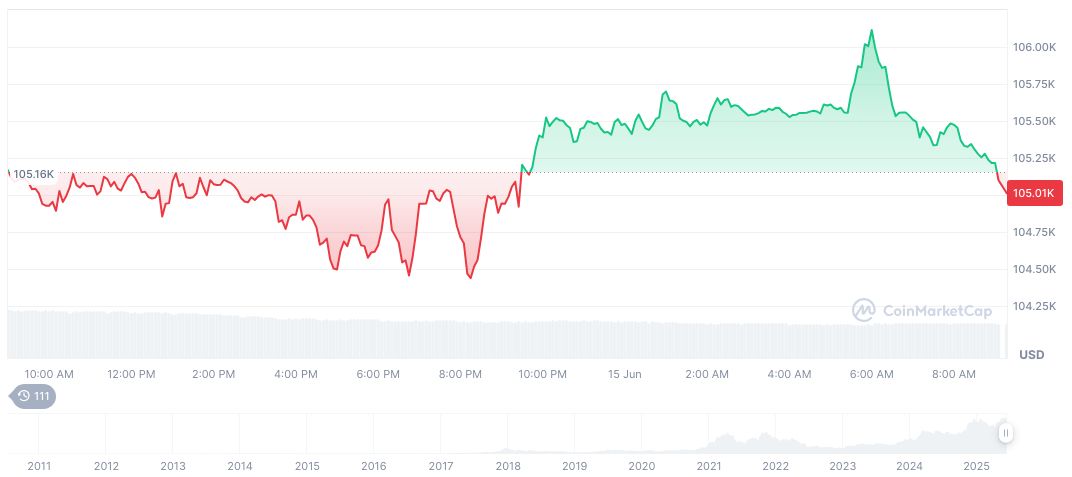

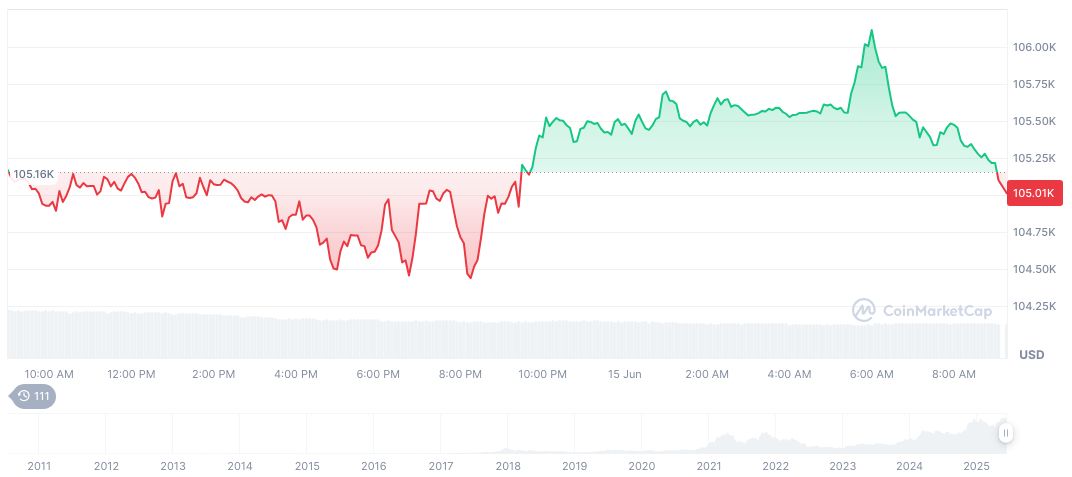

Bitcoin (BTC) currently trades at $105,505.33, with a market cap of $2.1 trillion, per CoinMarketCap data updated at 13:14 UTC on June 15, 2025. The asset shows a 0.40% rise in 24 hours, an increase in its dominance to 63.95%. Trading volume has decreased by 23.48% over the last 24 hours.

Coincu research team emphasizes the potential long-term impacts of geopolitical tensions on technology adoption and financial regulations. Volatility in asset prices could prompt regulatory reviews, affecting digital currency infrastructure and investor behavior. This analysis aligns with recent assessments, including discussions on how the White House Crypto Summit could shape regulatory approaches.

Middle East Conflict’s Limited Effect on Crypto Markets

Did you know? Historical military conflicts in the Middle East have often led to increased volatility in global financial markets, including cryptocurrencies.

Bitcoin (BTC) currently trades at $105,505.33, with a market cap of $2.1 trillion, per CoinMarketCap data updated at 13:14 UTC on June 15, 2025. The asset shows a 0.40% rise in 24 hours, an increase in its dominance to 63.95%. Trading volume has decreased by 23.48% over the last 24 hours.

Coincu research team emphasizes the potential long-term impacts of geopolitical tensions on technology adoption and financial regulations. Volatility in asset prices could prompt regulatory reviews, affecting digital currency infrastructure and investor behavior. This analysis aligns with recent assessments, including discussions on how the White House Crypto Summit could shape regulatory approaches.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/343427-israeli-forces-target-iranian-facilities/