- TON’s technical indicators suggest mixed signals, with RSI hinting at a potential rebound.

- Open interest and a near-balanced long/short ratio indicate rising speculation and possible volatility.

Toncoin [TON] has taken the crypto world by storm, growing its holder base from 4.3 million at the beginning of 2024 to a staggering 100 million currently. This rapid increase in holders has been accompanied by a corresponding spike in trading volume, signaling strong market interest.

At press time, TON was trading at $5.18, down slightly by 0.25% over the past day. Therefore, the critical question is whether TON can sustain this momentum and push forward into higher price ranges.

TON technical analysis: Is a rally coming?

Examining TON’s technical indicators, the Relative Strength Index (RSI) was at 45.18, showing the market is just below neutral. This indicates a slightly oversold condition, suggesting that a rebound could be on the horizon.

However, the MACD (Moving Average Convergence Divergence) shows a slight bearish signal, as the histogram hovers just below zero, reflecting minimal momentum in either direction.

Consequently, traders are closely watching for a breakout signal to determine TON’s next move.

Source: TradingView

TON network activity: A short-term dip or long-term growth?

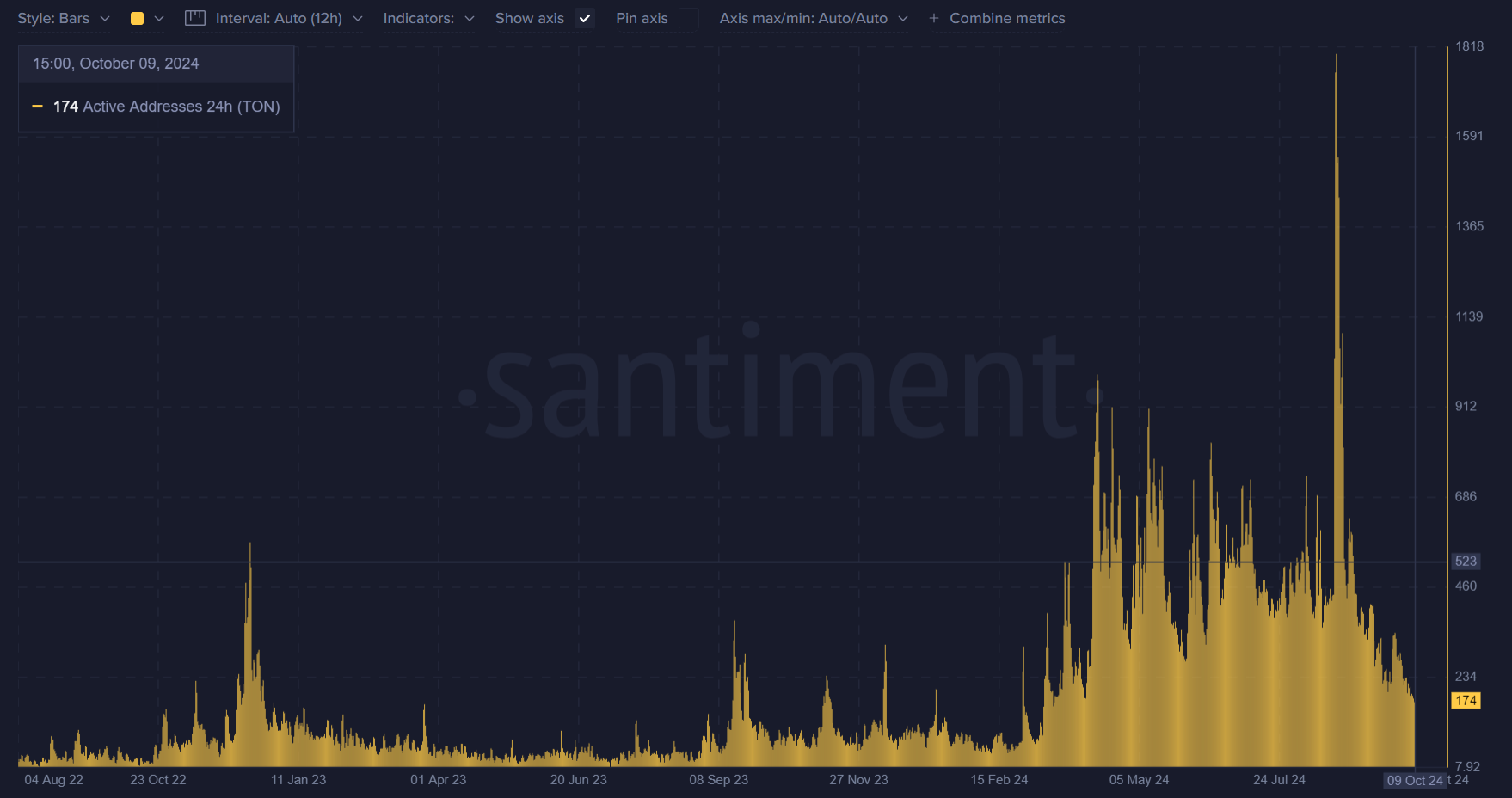

Daily active addresses provide another crucial insight into TON’s network health. At press time, 174 active addresses were recorded, down from 188 the previous day. This slight dip might suggest a temporary cooling-off period.

However, considering the massive increase in long-term holders, the broader network growth remains strong. Additionally, the influx of new users signals robust adoption, even if short-term activity fluctuates.

Source: Santiment

Long/short ratio: Bearish sentiment could trigger a rebound

Interestingly, the updated long/short ratio reveals a more balanced sentiment. Currently, 53.45% of traders hold short positions, while 46.55% are long. Therefore, the long/short ratio stands at 0.8709, suggesting that bears still have a slight edge.

However, the margin is much narrower than in previous sessions.

As a result, this balance indicates that the market could see volatility in either direction. Thus, traders should be prepared for sudden shifts in price, as the equilibrium between bulls and bears tightens.

Source: Coinglass

Open interest: Rising speculation could fuel volatility

Open interest has risen by 1.02%, with $232.72 million now invested in TON futures. This increase suggests growing speculation, as traders take leveraged positions expecting further price movements.

As volatility rises, the market could experience sudden and dramatic shifts.

Source: Coinglass

Read Toncoin’s [TON] Price Prediction 2024–2025

TON is on the cusp of another breakout. Although some technical indicators show short-term bearish signals, the long-term growth in holders and increasing speculation point toward sustained upward momentum.

If TON breaks through its resistance levels, a significant rally could follow.

Source: https://ambcrypto.com/is-ton-set-for-another-surge-after-reaching-100-million-holders/