- Solana cools after run to $245–$250, key resistance blocking new highs.

- ETF delays weigh on bullish momentum as traders eye $272 ATH zone.

- Whale treasuries active with $98M FalconX withdrawal, $24M OKX deposit.

Solana price cooled after last weekend’s run toward a critical resistance near $245–$250. By Tuesday’s London session on Sept. 17, SOL slipped nearly 5% to trade around $236, giving it a fully diluted valuation near $143 billion. The pullback saw Solana fall behind Binance Coin (BNB) in market cap rankings.

SOL has also underperformed against Bitcoin this week, with the SOL/BTC pair trending lower as traders rotate into BTC strength.

Is Solana Facing Major Technical Resistance?

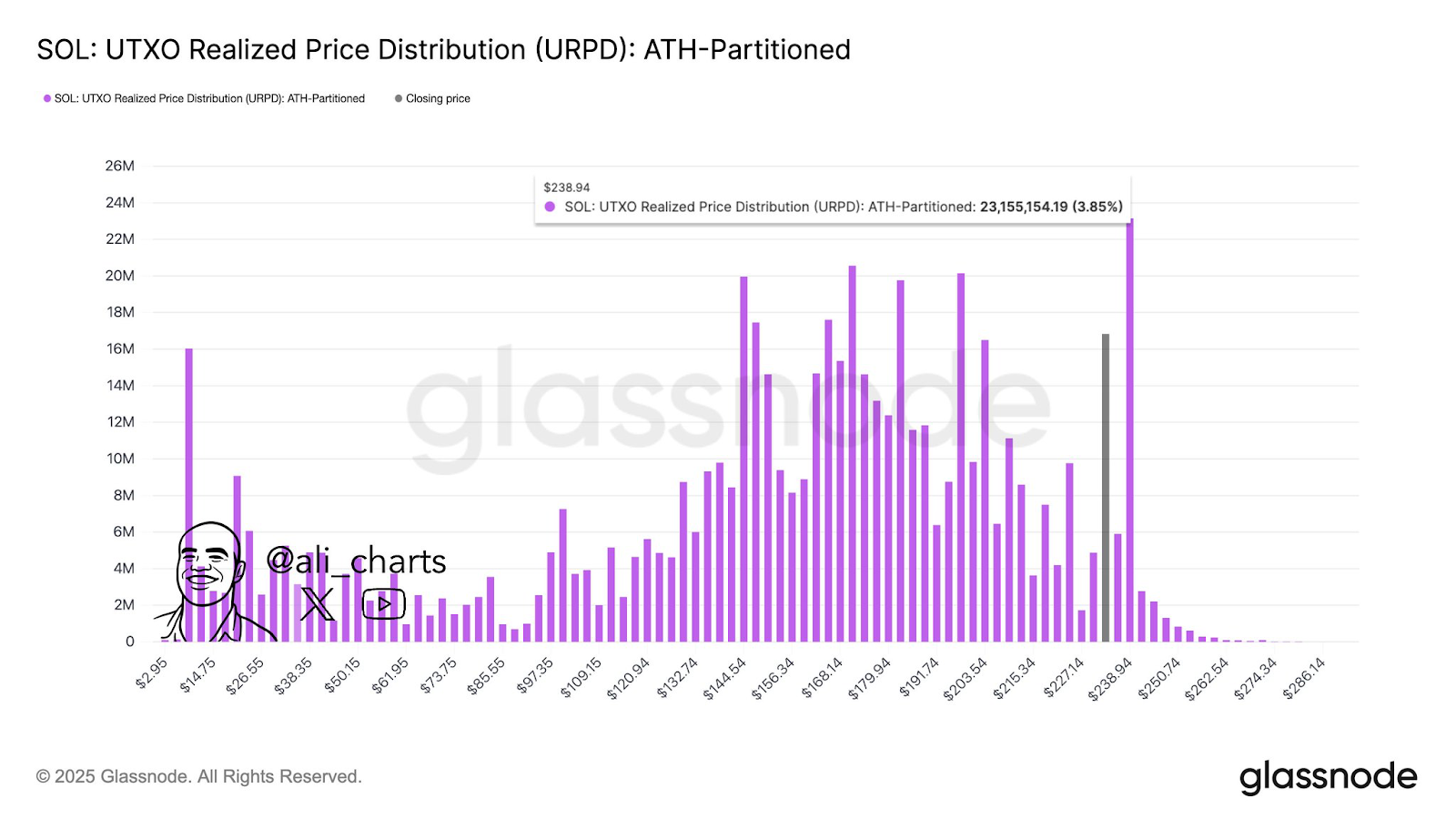

Yes. Solana’s first big supply wall sits just below $250. On-chain data flagged by Glassnode’s URPD indicator shows dense realized-price clustering at this level, suggesting heavy overhead supply.

Technical signals confirm the stall:

- A reversal near $245 has produced a potential head-and-shoulders formation on the 4H chart.

- The RSI shows bearish divergence, hinting at cooling momentum.

- A retest of the 100 SMA (4H) is possible if support at $225–$230 fails.

These align with trader consensus that $250 is Solana’s most immediate resistance, with the all-time high zone at $272–$275 representing the larger structural lid.

Related: Solana Treasuries Surpass $3 Billion, Pantera Leads With $1.1B Stake

Bigger Picture

Despite near-term cooling, the weekly and monthly outlook remains constructive. Analysts including CryptoGoos point to a possible cup-and-handle setup, projecting Solana could aim for the $500 region if resistance levels are cleared with volume.

For now, $250 and $275 are the gates. Bulls need to reclaim them before long-term projections gain credibility.

Are Traders Losing Patience on Solana ETFs Approval Delay?

The U.S. SEC has delayed decisions on multiple spot Solana ETF applications, weighing on sentiment. Traders now expect batch decisions later in 2025, with speculation around potential approvals before year-end.

ETF optimism remains a tailwind on dips, but until deadlines are resolved, the uncertainty adds to resistance overhead.

What Are Whale Investors Doing With SOL?

On-chain trackers show large holders remain active:

- Forward Industries and five other entities each hold more than 1M SOL for treasury management.

- Earlier today, FalconX withdrew 414,075 SOL (worth ~$98M) from Binance, Coinbase, OKX, and Bybit.

- Conversely, another whale deposited 100,000 SOL (~$24M) into OKX after receiving funds from Coinbase Prime.

These treasury moves highlight continued institutional interest, even as short-term traders rotate profits into BTC and other altcoins.

Related: Solana (SOL) Price Prediction For September 18

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/solana-price-resistance-250-analysis/