- SOL has been trading sideways lately after being one of the year’s most volatile cryptos

- Worth looking at if and how the Solana network’s slowdown contributed to SOL’s current situation

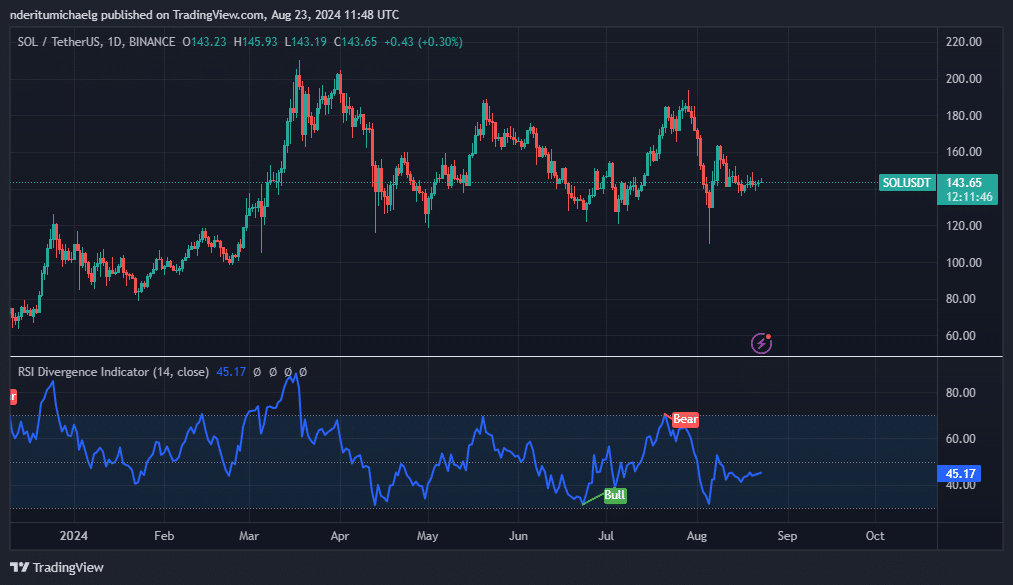

Solana’s native cryptocurrency SOL has been one of the most active coins in terms of volatility and demand this year. However, volatility has all but disappeared over the last five days.

SOL’s price action has been hovering around the $143-level for the last 7 days. This makes it officially SOL’s least volatile week this year.

The low volatility price performance is a surprising turn of events, especially considering that SOL registered a strong recovery from its 4-week lows recently. Its RSI had initially bounced back strong, but it reverted below its 50% level. This confirmed that the bulls had lost their momentum, with the altcoin trading at $143.65 at press time.

Source: TradingView

Will SOL recover and regain volatility? That is the question that SOL investors and traders would want to know. The reality is that SOL’s slowdown is not an isolated observation. In fact, Bitcoin has also slowed down over the last few days.

Meanwhile, we saw significant demand in some altcoins this week, resulting in a bullish performance. This means liquidity has been flowing from major cryptocurrencies like Solana and Bitcoin, into other altcoins. Simply put, the volatility should eventually make a comeback.

Assessing the state of Solana’s ecosystem

SOL’s performance, especially its ability to bounce back after a dip, has been a good yardstick for measuring demand over the last few months. Therefore, sideways price action signals a decline in demand for SOL in the Solana ecosystem.

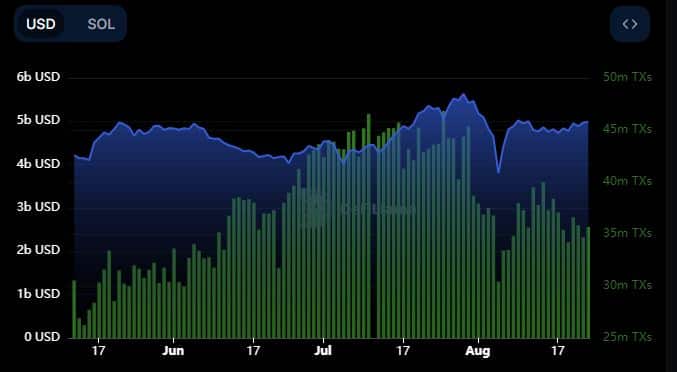

Unsurprisingly, on-chain data confirmed that Solana transactions recorded a considerable decline over the last 4 weeks. For perspective, the network registered 46.83 million transactions as of 25 July. Figures for the same dipped to as low as 30.41 million transactions on 5 August.

Source: DeFiLlama

While transactions registered some recovery over the last 2 weeks, the numbers remained well below 40 million transactions. In fact, these figures have been declining somewhat since mid-August. This confirmed that Solana’s network has been going through a phase of slowing network demand.

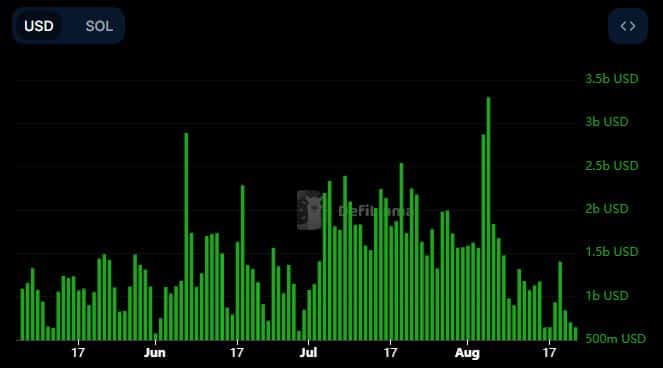

Despite the declining transaction count, Solana’s TVL remained relatively stable though – A sign of network confidence. However, the same cannot be said for on-chain volume. Solana’s highest volume peaked at $3.3 billion, at the height of the crash on 5 August.

Source: DeFiLlama

The network’s volumes have since retreated to their lowest levels in the last 3 months. Additionally, Solana’s daily on-chain volume averaged $646.78 million in the last 24 hours.

This is a sign of the slowdown in Solana’s on-chain activity and consequently, the impact on SOL.

Source: https://ambcrypto.com/is-sol-losing-its-spark-solanas-network-may-have-the-answer-because/