- IRS leaders Seth Wilks and Raj Mukherjee resign, joining DOGE plan.

- IRS resignations draw questions; no immediate market impact.

- Crypto tax policy may face uncertainty following resignations.

Seth Wilks and Raj Mukherjee, leaders in the IRS’s cryptocurrency project, resigned on Friday, May 3, 2025, joining the DOGE Deferred Resignation Plan.

The resignations may affect cryptocurrency tax strategies, sparking questions about future IRS policies on digital assets.

Resignations Spark Uncertainty in Crypto Tax Strategies

Seth Wilks and Raj Mukherjee, instrumental in IRS crypto tax initiatives, have formally resigned, marking the end of their tenure. These departures follow their integral roles in developing the 1099-DA tax form. Their resignation acceptance also involves the newly proposed DOGE Deferred Resignation Plan.

IRS crypto leadership changes as experts depart following Doge deals add another layer of uncertainty, as the IRS may face delays and shifts in their cryptocurrency-related directives. While the immediate effect on crypto markets remains muted, questions about the future of the 1099-DA form’s implementation persist.

Danny Werfel, IRS Commissioner, stated, “Pulling in expertise from the private sector to work with the IRS team is critical to successfully building the agency’s efforts involving digital assets and helping us do it in a way that works well for everyone” (CoinDesk).

Market analysts note the absence of public statements from Wilks, Mukherjee, or the IRS concerning the implications. Meanwhile, crypto community responses appear minimal, with little direct commentary from influential industry figures.

Minimal Market Response Amid Leadership Shakeup

Did you know? Historical data suggests previous regulatory departures occasionally lead to policy delays, but rarely immediate asset price shifts, highlighting the unique stability of decentralized crypto markets amid bureaucratic changes.

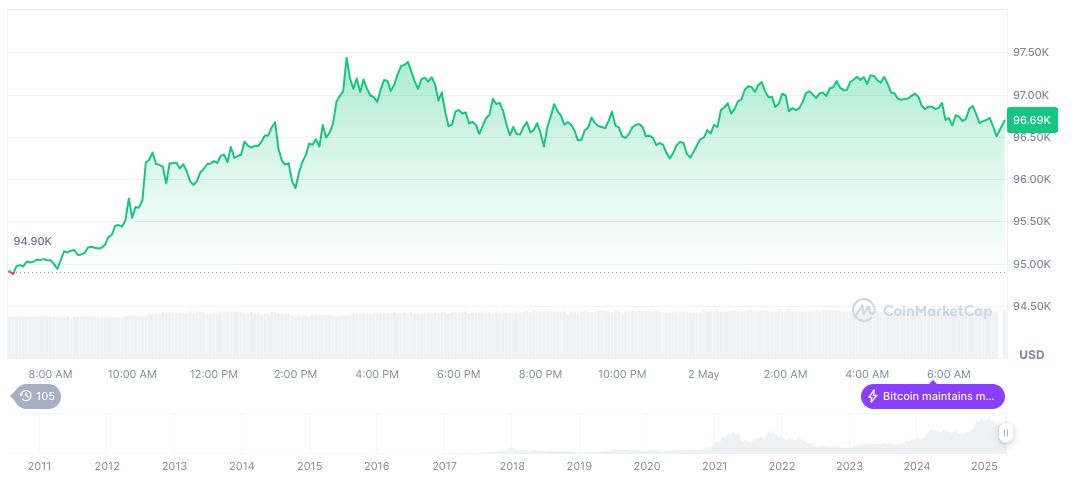

As of May 3, 2025, Bitcoin (BTC) trades at $96,711.80, reflecting a recent price uptick of 16.35% over the past month. Its market cap stands at formatNumber(1920624764131, 2) and holds a 63.78% dominance. Trading volume falls by 21.62% in the last 24 hours, while the circulating supply nears its 21 million max limit, according to CoinMarketCap.

According to Coincu, these resignations might lead to changes in U.S. cryptocurrency tax policy interpretations. Historically, regulatory gaps often arise when key officials exit, potentially complicating compliance standards until successors are established.

Source: https://coincu.com/335424-irs-crypto-leaders-resign-impact/