- Iran considers blocking the Strait of Hormuz after Israeli actions.

- Potential disruption to oil markets observed.

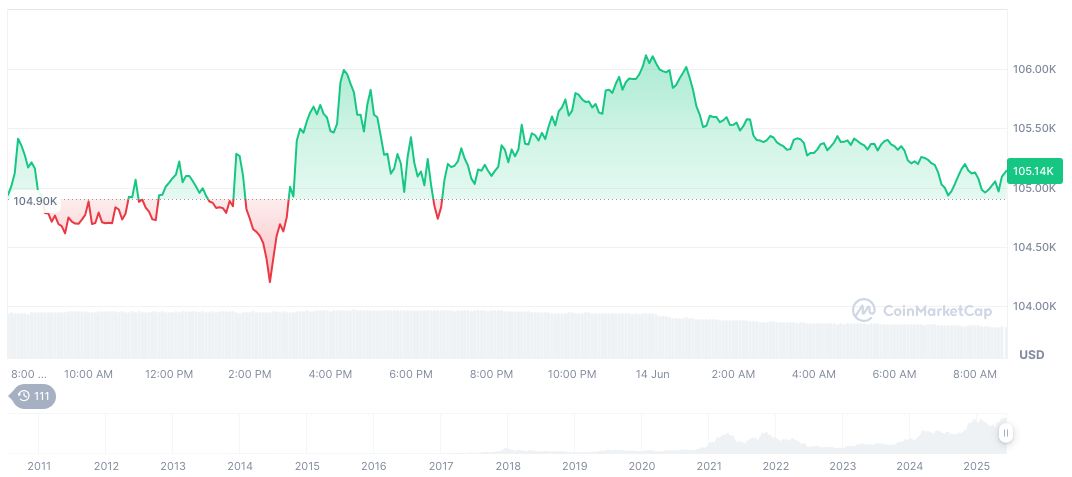

- Uncertainty impacts cryptocurrency prices, with noted volatility.

Iran is considering closing the Strait of Hormuz to oil shipments following Israeli military actions, as reported by Iranian media on June 14. The waterway is crucial for global energy supplies. Threats to block the Strait of Hormuz have escalated geopolitical tensions, impacting oil and crypto markets.

The escalating tension surrounding the Strait of Hormuz follows declarations by Iranian officials that could see a significant disruption in oil transit, affecting global energy markets profoundly. Additionally, amidst the geopolitical upheaval, the crypto market is experiencing volatility, underscoring the sector’s sensitivity to international political situations.

Iran’s Potential Blockage and Global Oil Ramifications

Esmail Kosari, a senior member of Iran’s Parliamentary Security Committee, indicated Iran is weighing the option of closing the Strait of Hormuz. As he stated, “Iran is considering closing the Strait of Hormuz in response to Israeli attacks.” This decision comes in response to recent actions in the region, highlighting underlying geopolitical strains. State-affiliated outlets serve as the primary communication channel for this.

Should Iran proceed with blocking the strait, there could be an immediate impact on global oil supplies, as the waterway accounts for 20% of global oil transits. Market observers are preparing for disruptions, mirroring past tensions in the region.

Oil markets have reacted with heightened volatility ever since speculation arose about potential closures. The absence of confirmed physical blockages maintains market caution. Meanwhile, cryptocurrencies like Bitcoin have experienced notable volatility, reflective of the asset’s use as a geopolitical hedge.

Crypto Market Volatility Amid Geopolitical Tensions

Did you know? Iran threatened to block the Strait of Hormuz multiple times in the last decade, primarily using it as leverage in geopolitical disputes without following through, due to potential economic repercussions.

As of CoinMarketCap’s June 14 data, Bitcoin is trading at $104,945.52, with a market cap of $2.09 trillion. Over the past 90 days, Bitcoin experienced a 26.98% increase. The circulating supply is near its 21 million limit with no significant changes in recent trading volumes.

The Coincu research team suggests that the situation could incite regulatory reviews globally, especially in securities and commodities markets. Historical trends show regional conflicts typically prompt short-term price shifts in crypto assets, driven by their perceived safety in volatile times.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/343263-iran-blocks-strait-hormuz/