- The U.S. Department of Labor reviews BLS data challenges.

- Examines CPI, PPI, and job reporting reductions.

- Market pressure mounts due to job data revision.

The U.S. Department of Labor’s Inspector General announced a review of challenges in the Bureau of Labor Statistics’ data collection and reporting processes on September 11, 2023.

This review, driven by significant data revisions, impacts economic strategies and could influence monetary policy decisions, although no immediate effect on cryptocurrencies like Bitcoin and Ethereum is reported.

BLS Faces Data Integrity Scrutiny Over Revisions

The BLS has faced scrutiny following downward revisions in job creation estimates by 911,000 over the past year. The U.S. Department of Labor Inspector General is reviewing the collection and reporting processes for Consumer Price Index (CPI), Producer Price Index (PPI), and monthly employment data. This review was spurred by a statement from the Office of the Inspector General emphasizing the need for data integrity and accuracy.

Reports indicate that these data reductions pose significant questions about the accuracy of indicators vital for decision making in financial markets and Federal Reserve policies. With a history of such revisions, stakeholders question the potential impact on headline inflation and employment statistics.

Karoline Leavitt, White House Press Secretary, stated: “This is exactly why we need new leadership to restore trust and confidence in the BLS’s data on behalf of the financial markets, businesses, policymakers, and families that rely on this data to make major decisions.” [2]

Employment Data Revisions and Crypto Market Dynamics

Did you know? Historical downward revisions in U.S. employment data exceeding 900,000 jobs, such as the current revision, significantly alter market expectations and can shift Federal Reserve interest rate deliberations.

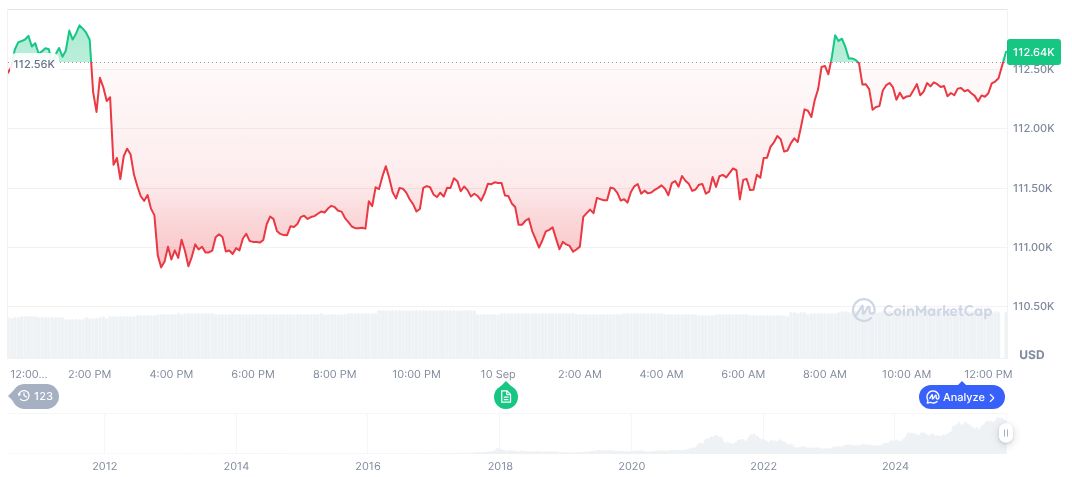

As of September 11, 2025, Bitcoin (BTC) is trading at $113,900.92 with a market cap of approximately $2.27 trillion. Its dominance stands at 57.49% with a notable 2.16% price increase over the past 24 hours. These data points, as reported by CoinMarketCap, reflect BTC’s ongoing market influence and 10.40% gain over the past 90 days.

Insights from the Coincu research team indicate that while statistical revisions influence economic sentiment, their direct impact on crypto markets is mediated through macroeconomic policy shifts. Historical trends show that such revisions can guide Federal Reserve actions, indirectly influencing cryptocurrency valuations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/inspector-general-reviews-bls-challenges/