- Insight Investment executive discusses Fed rate cut implications for US bonds.

- Market reactions mixed amid inflation concerns.

- Potential implications for diversified portfolios.

Insight Investment’s Harley Bradley comments that the Fed’s rate cut decision on September 17 might benefit US bond investors with globally diversified portfolios, amid ongoing inflation concerns.

The Fed’s willingness to tolerate inflation for labor market health could influence global fixed income dynamics, prompting investor focus on future rate cut forecasts.

Fed Rate Cuts Seen as Bond Market Catalyst

Harley Bradley, Co-Head of Global Rates at Insight Investment, highlighted the potential positive outcomes of the Federal Reserve’s anticipated rate cuts for globally diversified portfolios. He pointed out that while inflation persists, the Fed seems determined to prioritize employment stability over immediate inflation targets.

In the immediate aftermath of the Fed’s actions, investors are likely to see changes in bond market yields and returns. Safe-haven demand could shift, reflecting increased confidence in diversified asset holdings amid gradual rate adjustments.

News of potential rate cuts has generated mixed reactions. While some financial experts endorse the Fed’s focus on employment, concerns about inflationary impacts remain, creating skepticism within market circles.

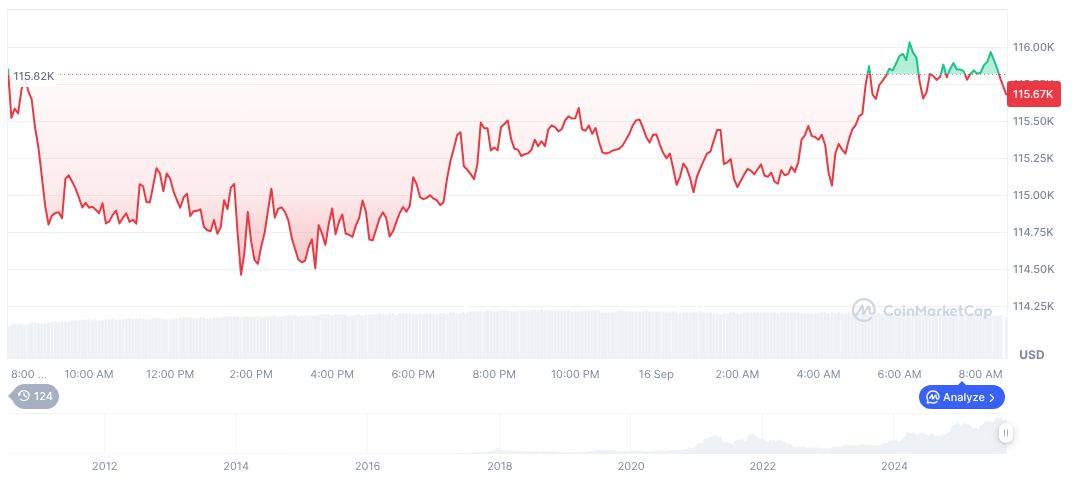

Bitcoin Price Decline Amid Fed Speculation

Did you know? The last significant Fed rate cut in early 2023 led to increased inflows in Bitcoin and Ethereum, sparking discussions about inflation hedge strategies.

Bitcoin’s current market landscape shows a price of $117,234.98 with a notable market cap of $2,335,562,231,379.00, commanding a 57.65% market dominance. Daily trading reached $46,482,456,552.00, indicating stable interest despite an 8.60% decrease. These insights come from CoinMarketCap as of September 17, 2025.

Insight’s analysis hints at possible shifts in regulatory landscapes as monetary policies adjust. These adaptations may stimulate innovations, promoting stability or change within financial systems.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/insight-investment-fed-rate-impact/