- Fed emphasizes long-term inflation expectations amid market scrutiny.

- Examines inflation impact on price and wages.

- Increased volatility in crypto and risk assets.

Federal Reserve released its June meeting minutes on July 10, highlighting stable long-term inflation expectations. Participants expressed concern over rising short-term expectations, which could influence prices and wages. The discussion underscores the Fed’s focus on inflation.

The emphasis on inflation stability reflects economic policy nuances, with potential market volatility implications. The crypto market might experience shifts as investors react to perceived monetary policy changes.

Fed Highlights Inflation Concerns Amid Market Fluctuations

The Federal Reserve’s June meeting minutes reveal a focus on long-term inflation expectations, as discussed on July 10. Fed Chair Jerome Powell and the FOMC highlighted the importance of maintaining stability amid recent short-term expectation spikes. Participants cautioned about these short-term expectations influencing long-term views and affecting price and wage setting in the near term.

Market participants are closely monitoring these updates, which hint at potential macro-economic adjustments. Although no immediate rate cuts are anticipated for July, discussions about potential adjustments in September suggest ongoing policy evaluation. Lloyds Bank commented, “The minutes of the US Federal Reserve’s June meeting… are not expected to change the market’s expectation that rates will remain unchanged at the July meeting, with any rate adjustment more likely to occur in September.”

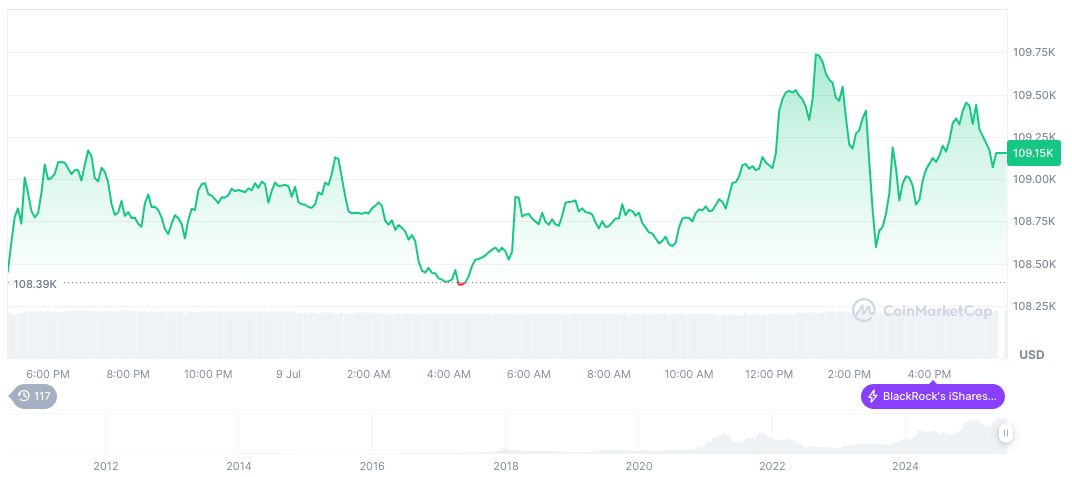

Crypto markets have exhibited increased volatility following the Fed’s release. Bitcoin and Ethereum saw correlated price movements, aligning with historical precedents where such monetary signals influence digital asset valuations. Lloyds Bank noted that rate stability expectations remain unchanged, emphasizing September as a more probable period for adjustments.

Crypto Market Volatility Following Fed’s Inflation Focus

Did you know? The last time the Federal Reserve held rates steady while considering future cuts, crypto prices fluctuated sharply, reflecting the market’s uncertainty amid economic policy transition.

CoinMarketCap reports Bitcoin trading at $109,492.76 as of July 9, 2025. The market cap is $2.18 trillion with a 24-hour trading volume of $45.04 billion, marking a 0.42% price change. Bitcoin’s circulating supply nears 19.89 million, underscoring its market dominance at 63.89%.

Insights from Coincu’s research suggest that ongoing inflation discussions could evoke broader financial and technological impacts. Such trends may affect innovation, regulatory frameworks, and crypto adoption, aligning with historical shifts seen across several economic cycles.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/347749-federal-reserve-june-minutes-inflation-focus/