Key Takeaways

IMX’s on-chain activities remaind low, with users barely interacting in the market, while off-chain factors drove price growth. Analysis of chart patterns showed a further rally could be likely if resistance levels ahead are breached.

Immutable [IMX], the non-fungible token Layer 2 blockchain, has led the market in gains, topping with a 13% move.

The increasing number of IMX holders has played an immense role, after crossing a new high of 97,100 holders in the market, while derivative inflows have had an equal effect.

AMBCrypto analyzed whether these market factors are able to push IMX back above the $1.5 billion threshold.

On-chain plays minimal role

Activities on-chain have had no real reflection on the recent price surge witnessed in the past day.

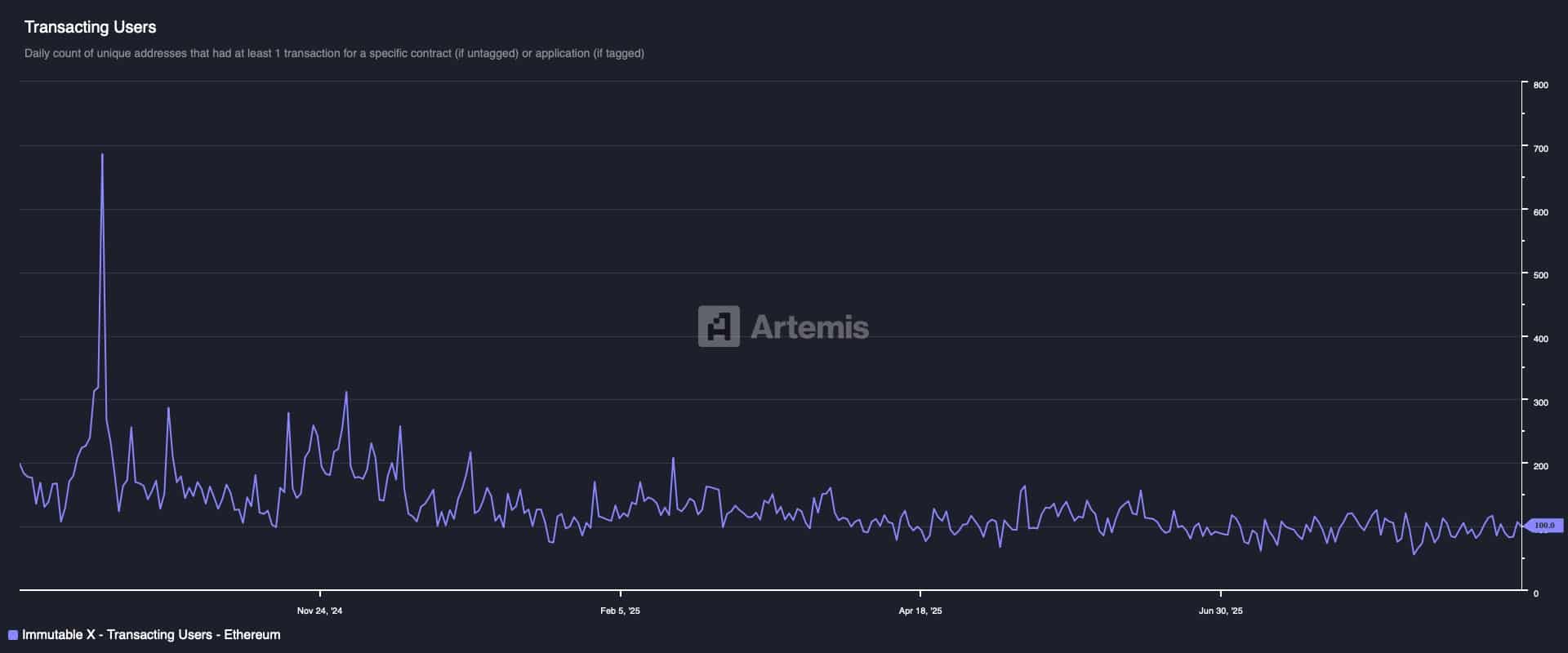

Analysis of transaction activity and users transacting in the market reflects that on-chain activity has remained nearly the same for months, oscillating between two thresholds.

Source: Artemis

In daily transactions, the number remained low at 128, at press time, a level that has been consistent.

Daily transacting users have also stayed at the same level, with just 100 active addresses interacting with the network.

This suggests a good level of retention by the blockchain but also reflects a lack of growth, typically making no real net additions to the market.

Funding from off-chain

The off-chain segments of the market have been the most active, despite weak on-chain activity.

According to CoinGlass, Spot Exchange Netflow has been on the negative side, indicating total inflows and outflows were dominated by buyers in the market.

So far, this group of investors has accumulated $781,000 worth of IMX, a major turnaround from the previous day’s sell-off in the market.

Source: CoinGlass

In the derivatives segment of the market, there has likewise been an inflow, with Open Interest (OI) seeing a major inflow of $16 million.

With the Funding Rate positive at 0.0035%, the majority of contracts in the market are from longs, placing bets on the possibility of a major upward surge.

For IMX to cross into the $1.5 billion market capitalization threshold, it requires more capital inflows than what is currently available.

$1.5 billion target faces resistance

AMBCrypto noted there are key barriers that could impact IMX price from trending higher and halt a possible surge in market capitalization.

Analysis of price charts using Fibonacci retracement tools shows that a key level IMX needs to overcome is the resistance at $0.713, confirming it can reclaim the $1.5 billion market capitalization.

Source: TradingView

Notably, however, the asset will need to trade to $0.75 on the chart before it could reach this milestone. For now, the tendency remains uncertain, as resistance around this target has recently triggered downward trends.

A continued building of momentum in the market and a surge in activity across segments would mean the asset could make a significantly new high.

Source: https://ambcrypto.com/immutable-surges-13-imx-can-reclaim-1-5b-market-cap-only-if/