Hyperliquid Strategies has filed with the U.S. SEC to raise up to $1 billion through a new equity offering. The funds will be used to bolster the firm’s balance sheet, including a strategic accumulation of HYPE tokens.

Hyperliquid Strategies Prepares Major Capital Injection

According to an S-1 filing, Hyperliquid Strategies intends to offer up to 160 million shares of common stock via a committed equity facility with Chardan Capital Markets. The company plans to allocate proceeds toward general operations and potential HYPE token purchases.

The entity was formed through an ongoing merger between Nasdaq-listed biotech company Sonnet BioTherapeutics and special-purpose acquisition firm Rorschach I LLC. Once finalized later this year, the merged company will trade on Nasdaq under a new ticker yet to be disclosed.

Leadership will include former Barclays CEO Bob Diamond as Chairman and David Schamis as Chief Executive Officer.

The filing revealed that the company currently holds 12.6 million tokens and $305 million in cash. The firm noted it plans to deploy its digital assets primarily through staking, which it expects will generate consistent yields over time.

“The company aims to deploy its HYPE token holdings selectively, primarily through staking substantially all of its HYPE holdings,” the filing stated.

The filing follows institutional activity surrounding the HYPE token. Last month, Nasdaq-listed Lion Group announced plans to convert its Solana and Sui holdings into HYPE.

HYPE Token Gains Momentum Despite Market Downturn

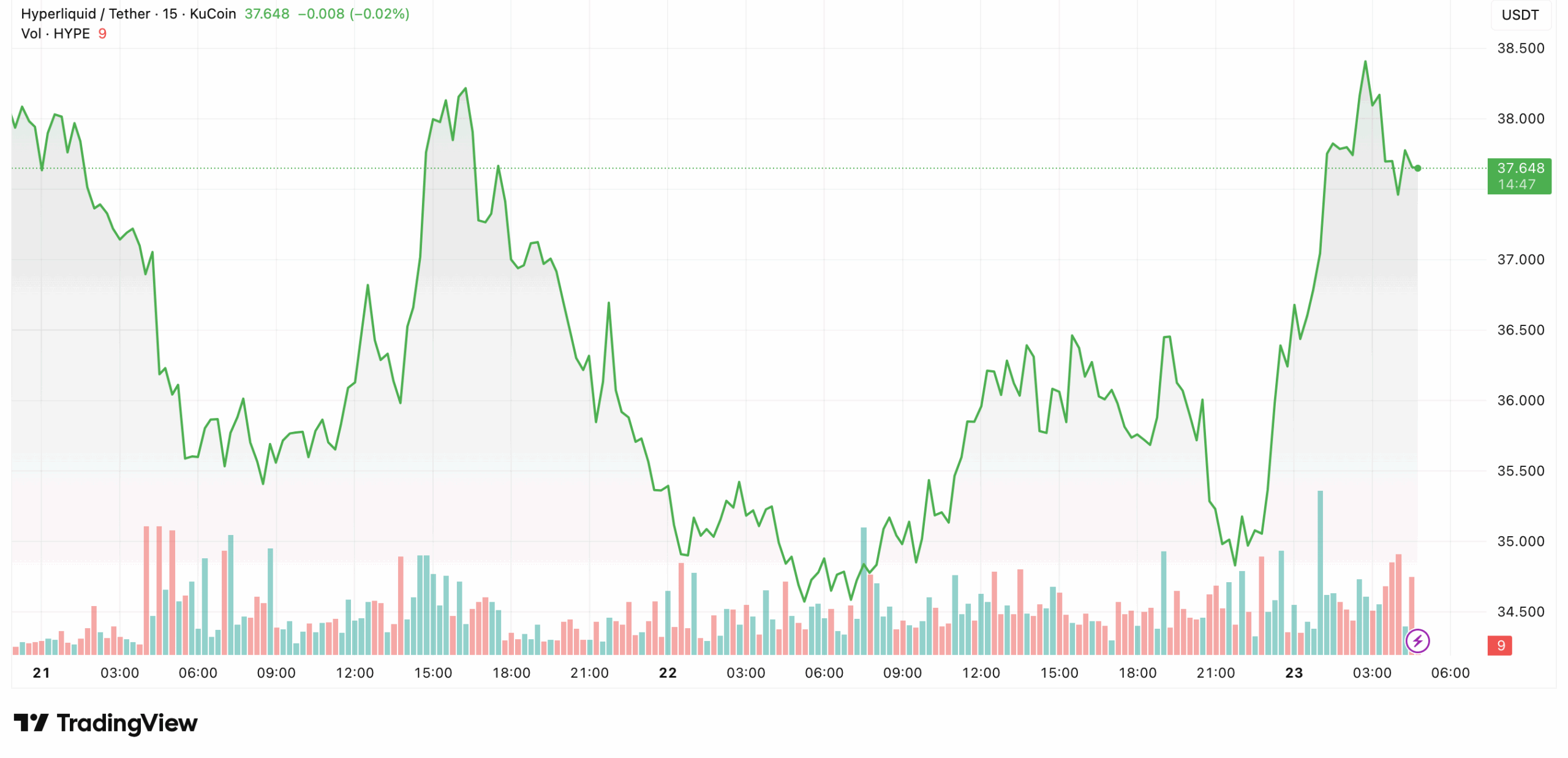

The announcement came as the HYPE token continued to outperform the broader crypto market. According to TradingView, the token has recorded gains of nearly 7% over the past 24 hours, defying a minor overall market dip of –0.42%.

By contrast, BNB Chain’s Aster token fell 7.6%. This shows the token’s strength despite Bitcoin’s volatile trading at about $108,000.

Analysts attribute this strength to ongoing network upgrades and new institutional access products. This has boosted sentiment in the token’s ecosystem in recent weeks.

For instance, Bitwise Asset Management submitted a Form S-1 filing for the Bitwise Hyperliquid ETF. The proposed structure includes new ways for investors to create and exchange tokens. This setup aims to lower costs and improve efficiency for traditional investors who want to invest in the token.

In parallel, the team launched its HIP-3 network upgrade. The update allows builders to create new futures markets on HyperCore without needing approval from a central authority. These developments suggest growing confidence in the platform’s fundamentals.