Key Takeaways

Hyperliquid soared to a new all-time high of $57.38. Whales scooped up $9.46 million worth of HYPE, amid increased capital inflow.

Hyperliquid’s [HYPE] soared 7.55% to a new all-time high of $57.38 before slightly retracing to $56.68 at press time.

Over the same period, its market cap reached a new all-time high of $19.13 billion, while volume jumped 39% to $617 million.

Can HYPE continue with its remarkable uptrend?

Whales continue accumulating HYPE

In the middle of a strong uptick, investors especially jumped into the market to chase the rally.

According to Lookonchain, a whale deposited $8 million into Hyperliquid and purchased 86,322 HYPE tokens worth $4.88 million.

Source: Lookonchain

A whale wallet recently deposited 4.58 million USDC into Hyperliquid to purchase HYPE.

Altogether, large holders have spent $9.46 million acquiring the token—signaling strong market conviction from institutional players.

Exchange data further supports this accumulation trend. According to Coinglass, HYPE’s Spot Netflow has remained negative for two consecutive weeks, reflecting consistent outflows from exchanges.

At press time, Netflow stood at -$12.76 million, indicating that more HYPE is being withdrawn than deposited, a classic sign of aggressive accumulation.

Hyperliquid’s on-chain activity heats up

Significantly, as the uptrend continued, HYPE’s on-chain network activity surged considerably as well.

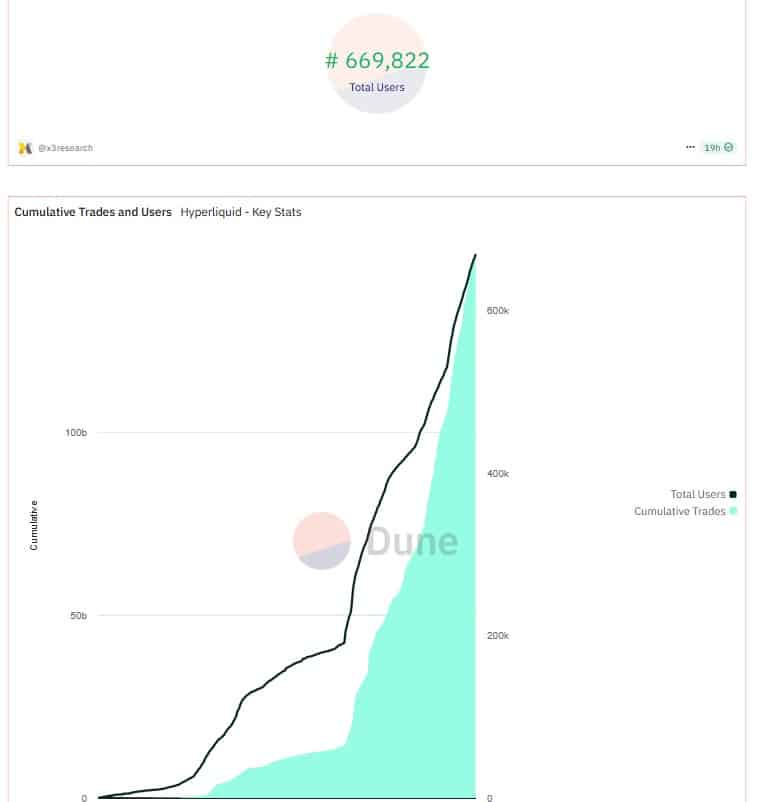

According to Dune, Hyperliquid’s Cumulative Trades surged to 147 billion, while Total Users jumped to 669.8k, as of writing.

Source: Dune

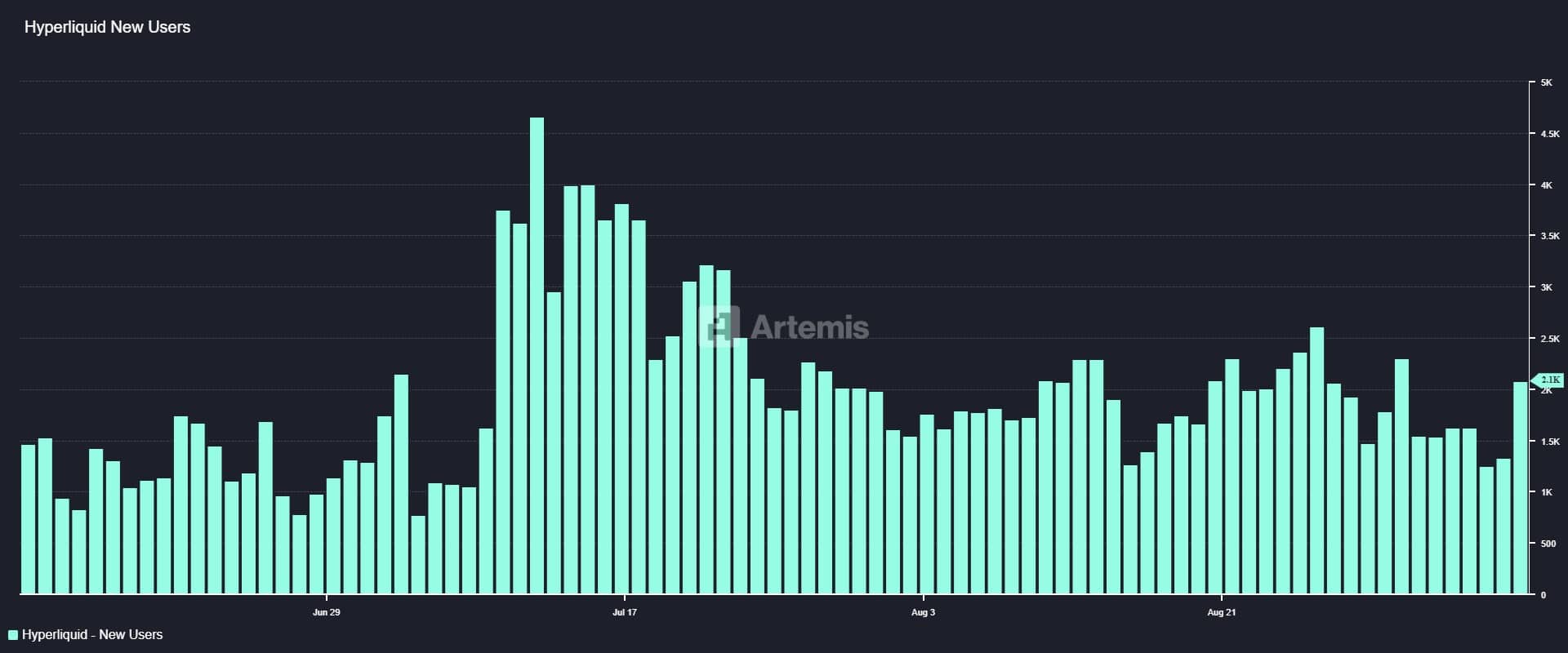

At the same time, the number of New Users surged 42% to 2.1k, indicating a strong adoption rate. Typically, when the number of users and their activity spike, it signals strong market participation.

Source: Artemis

On top of that, Hyperliquid’s Transactions Per User surged to a new all-time high of 20.5, reflecting strong network engagement with users becoming more active.

Thus, the current price rally is strongly backed by organic demand, network usage, and a market condition that has historically supported higher prices.

Source: Artemis

Derivatives capital inflow soars

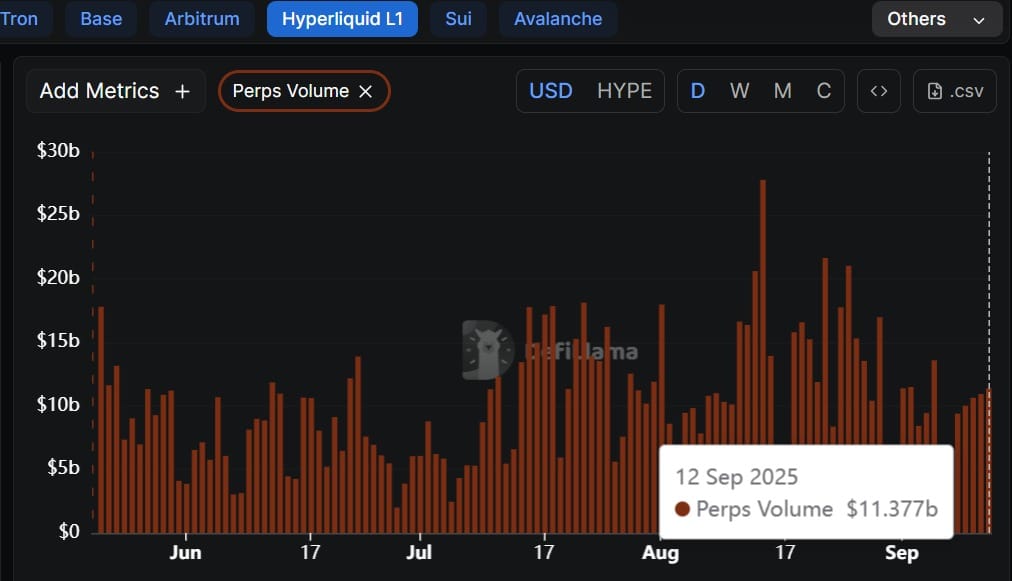

Notably, when we examine the derivatives market, we determine that significant capital flowed there, indicating sustained demand for futures positions.

According to Defillama, HYPE’s Perpetuals Volume surged from $3.3 billion to $12.3 billion within five days, indicating massive capital inflow.

Source: Defillama

Often, when Perps Volume hikes amid strong spot demand, it suggests that leverage activity is backed by real buying, making the uptrend more sustainable.

Such a setup implies that participants are bullish and anticipate a further uptrend.

Can the uptrend continue?

According to AMBCrypto’s analysis, HYPE rallied as buyers, both whales and retail, dominated the market. At the same time, its on-chain activity surged significantly, indicating organic demand.

Therefore, the prevailing market conditions position HYPE for more gains. As such, if these positive sentiments persist, Hyperliquid’s uptrend will continue and hit another high.

However, if the ATH incentivizes holders to realize profit, any intense downward pressure will see HYPE retrace to $51.

Source: https://ambcrypto.com/hyperliquid-hits-new-ath-evaluating-if-hype-can-hold-the-rally/