- Hut 8 announced a $1 billion stock issuance plan for infrastructure expansion.

- Investment aims to enhance AI and HPC capabilities at Hut 8.

- Market anticipates impacts on the Bitcoin sector and related industries.

Hut 8, a Bitcoin mining company, announces a new $1 billion At-the-Market stock issuance plan, replacing its previous $500 million plan, to expand AI and computing infrastructure.

This move signifies a strategic capital shift enhancing Hut 8’s digital infrastructure capabilities, impacting the Bitcoin market and related sectors with potential increased demand for mining equipment.

Hut 8’s $1 Billion Strategic Shift in Infrastructure

Hut 8, a prominent Bitcoin mining firm, has launched a $1 billion stock issuance program to bolster its computing infrastructure. The initiative, led by CEO Asher Genoot and CFO Sean Glennan, replaces a previous $500 million plan—$300 million of which had already been issued.

Hut 8’s strategic focus is on enhancing AI and high-performance computing (HPC) capabilities. The funds are intended for acquiring energy assets, upgrading infrastructure, and expanding AI services. As Hut 8 CEO Asher Genoot stated, “Our new brand enables us to more clearly express what has always set Hut 8 apart: a power-first, innovation-driven approach to developing, commercializing, and operating next-generation digital infrastructure.”

Market reactions highlight increased interest in Bitcoin’s mining sector. Asher Genoot emphasized the strategic reserve’s role, asserting it would strengthen the firm’s financial position. Community and industry feedback reflect both optimism and anticipation of forthcoming developments.

Bitcoin Market Faces Changes Amid Hut 8 Expansion

Did you know? Hut 8’s strategic expansion aligns with historical trends where major mining companies, like Marathon Digital, similarly utilized ATM offerings to bolster infrastructure and reserves.

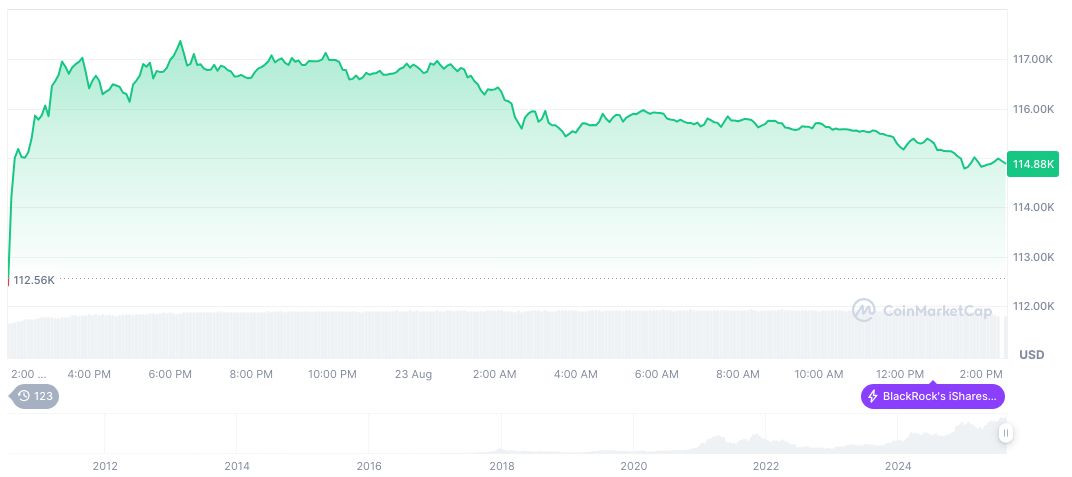

Bitcoin (BTC) currently trades at $114,762.95 with a market cap of $2.29 trillion. BTC holds a market dominance of 57.43%. Over the past 90 days, BTC has increased by 4.47%. CoinMarketCap data reveals a 38.19% decline in 24-hour trading volume as of August 24, 2025.

Insights from Coincu research suggest that Hut 8’s expansion can potentially impact Bitcoin’s market liquidity and network hash rate. These developments might also prompt regulatory discussions, particularly around the implications of scaling mining operations and infrastructure growth. The latest SEC filing from Gryphon Digital Mining provides further context on similar strategic financial maneuvers in the sector.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/hut-8-1-billion-stock-issuance/