- Key Point 1

- Key Point 2

- Key Point 3

OKX CEO Star announced compliance investigations on Huione Group-related crypto transactions after coordinated international sanctions, including asset freezes, due to money laundering allegations.

This action could disrupt market activities, potentially affecting Bitcoin and Ethereum, as exchanges globally halt Huione-associated transactions, marking a significant shift in global AML enforcement.

OKX Enhances Security Amid Huione Sanctions

OKX Exchange’s CEO Star Xu has announced enhanced transaction controls involving Huione Group, following the U.S. decision to place the group under financial sanctions. This response aligns with announcements from global regulatory bodies describing extensive money laundering activities. The changes include comprehensive compliance review of transactions related to Huione Group, which could result in fund freezes or account terminations. These measures aim to curb alleged illicit financial flows. Market reactions include a notable focus on enhancing anti-money laundering protocols across cryptocurrency platforms. Regulatory bodies underscore the broader significance of this crackdown, with enforcement measures gaining traction.

In light of Huione Group’s inclusion on international sanctions lists and its associated risks, OKX will conduct thorough compliance investigations on all Huione-related transactions. We may freeze assets and terminate accounts where risk is confirmed.

“In light of Huione Group’s inclusion on international sanctions lists and its associated risks, OKX will conduct thorough compliance investigations on all Huione-related transactions. We may freeze assets and terminate accounts where risk is confirmed.” — Star Xu, CEO, OKX

Huione Case: Ripple Effect on Market Dynamics

Did you know? The Huione Group’s linkage to large-scale fraud echoes past cases like BTC-e, where sanctioned actions resulted in major exchanges freezing assets tied to money laundering networks.

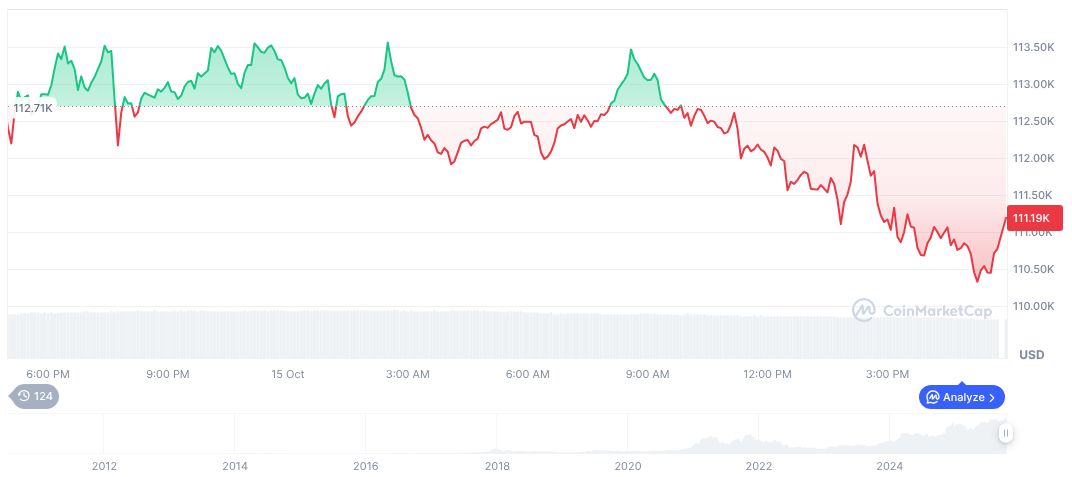

Bitcoin (BTC), currently priced at $111,162.44 with a market cap of $2.22 trillion, reflects market volatility, with a 24-hour trading volume of $75.74 billion, down 15.30% according to CoinMarketCap. Recent declines include a 7-day drop of 10.38%.

Coincu research highlights potential long-term impacts of rigorous compliance measures on the cryptocurrency landscape. The enforcement of anti-money laundering protocols in cases like Huione’s is expected to refine operational standards and bolster regulatory frameworks.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/huione-group-okx-controls-sanctions/