- Hong Kong virtual asset ETFs saw a trading volume of HK$106.3 million on August 11.

- Increased trading signals growing interest in cryptocurrency ETFs.

- Bitcoin and Ethereum futures remain primary focus in Hong Kong.

The Hong Kong stock market recorded approximately HK$106.3 million in trading volumes for all virtual asset ETFs as of August 11, 2023, accounting for Bitcoin and Ethereum futures-based products.

This substantial trading volume underscores the growing interest in cryptocurrency ETFs, indicating potential shifts in investor behavior towards more established digital asset products.

Positive Market Reactions Signal Institutional Crypto Interest

The surge in trading activity signifies a growing interest in virtual asset ETFs within Hong Kong’s regulated market framework. Firms such as ChinaAMC and Harvest are at the forefront, offering futures-based ETFs tied to major cryptocurrencies.

Market reactions have been predominantly positive, as experts see this spike as indicative of institutional interest in virtual assets. “While there has been significant trading volume, it is essential to refer back to the HKEX pages for precise data characterizing daily trades,” said Tom Chen, Head of ETF Trading at Harvest Global Investments.

Market reactions have been predominantly positive, as experts see this spike as indicative of institutional interest in virtual assets. “While there has been significant trading volume, it is essential to refer back to the HKEX pages for precise data characterizing daily trades,” said Tom Chen, Head of ETF Trading at Harvest Global Investments.

Market Data and Future Insights

Did you know? Hong Kong’s adoption of virtual asset ETFs has been a significant step in bridging traditional and cryptocurrency markets, illustrating its potential as a global fintech leader.

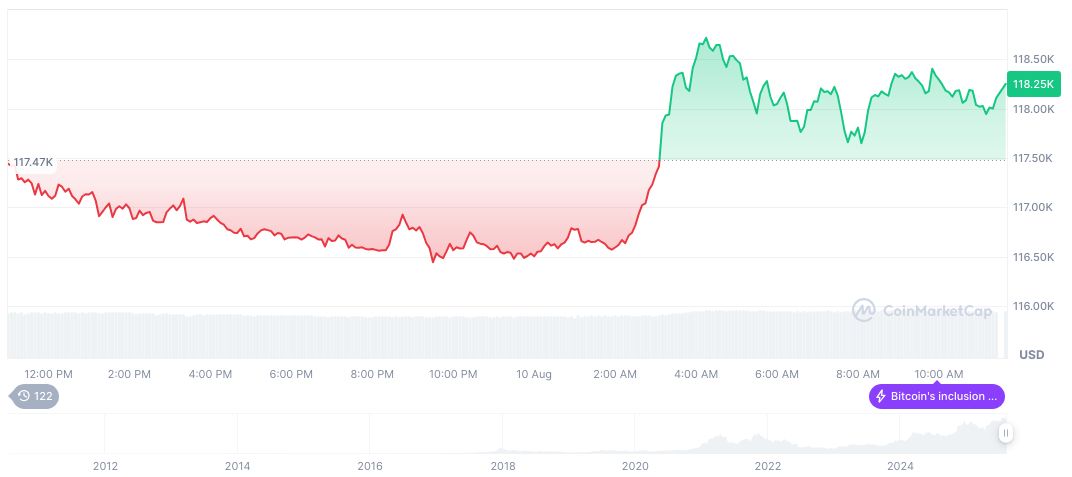

As of August 11, 2025, Bitcoin (BTC) is priced at $121,595.31, holding a market cap of $2.42 trillion and a market dominance of 59.87%. Trading volume in the past 24 hours reached $76.72 billion, marking a 24.91% increase. Recent movements show a 2.76% rise in the last 24 hours, according to CoinMarketCap.

The Coincu research team highlights the potential technological and financial outcomes as Hong Kong solidifies its platform for virtual asset ETFs. This market positioning could drive further adoption, particularly as derivatives become a significant link between digital and conventional financial systems.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/hong-kong-virtual-asset-etfs/