The Hong Kong Monetary Authority has issued guidelines for stablecoin issuers to mitigate VPN usage risks, effective August 1, 2025.

This regulation emphasizes anti-money laundering measures, impacting stablecoin issuers’ operations and potentially reshaping Hong Kong’s financial landscape.

Global Regulatory Impact of Hong Kong’s $3.2M Capital Requirement

HKMA has finalized guidelines targeting VPN use in stablecoin issuer operations. The Hong Kong Legislative Council passed the Stablecoins Ordinance in May 2025, setting the stage for these measures. Licensed issuers must implement robust protections, such as reviewing network protocols and device settings, to detect VPN use.

Issuers must maintain HK$25 million (~$3.2 million USD) in capital for licensing compliance. This requirement is expected to foster collaborations between traditional banks and fintech startups, though it raises entry barriers for less established firms.

Reactions from industry and government have been muted as no primary statements or responses from private stablecoin projects or exchanges have emerged. Experts predict the regime’s stringent compliance requirements will attract established entities, solidifying Hong Kong’s position as a stablecoin hub. Eddie Yue, Chief Executive of the Hong Kong Monetary Authority (HKMA), noted, “Following the passage of the Stablecoins Bill, we immediately consulted the market regarding the two implementation guidelines on supervision and anti-money laundering. We are currently refining the requirements based on the feedback, with a view to publishing the guidelines by the end of July.”

Market Data and Global Implications

Did you know? Financial hubs like Hong Kong are increasingly imposing direct stablecoin supervision, echoing international trends inspired by the Bank for International Settlements.

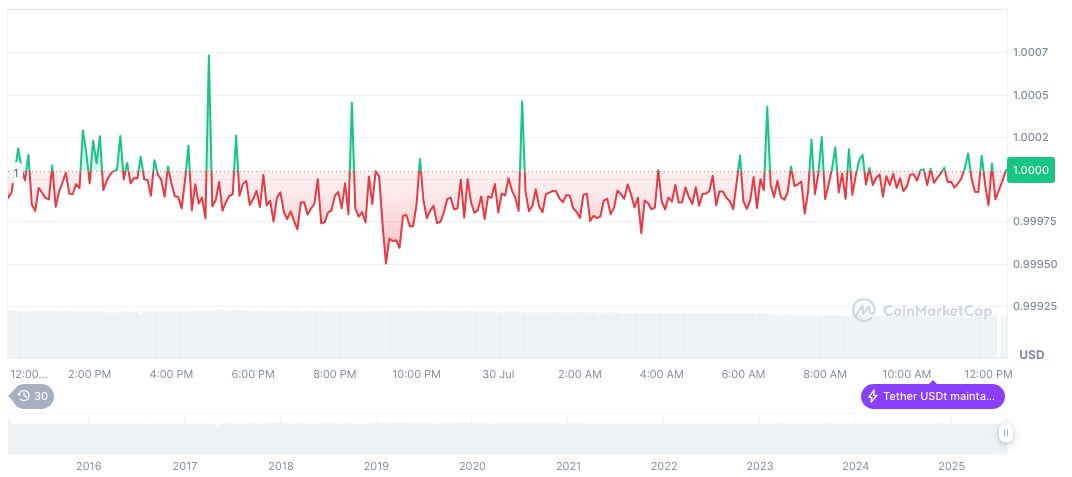

Tether USDt (USDT) remains stable at $1.00, with a slight 0.01% increase over 24 hours. The market cap stands at formatNumber(163753335571, 2), representing a 4.20% market dominance. CoinMarketCap reports a 24-hour trading volume of formatNumber(121048839896, 2), maintaining consistent stability over the past quarter.

Coincu research suggests that Hong Kong’s guidelines may impact global regulatory approaches, leading to increased scrutiny on VPN usage across other jurisdictions. The new measures align with global anti-money laundering efforts, ensuring technological compliance while fostering Hong Kong’s reputation as a regulatory-compliant hub.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/hong-kong-stablecoin-guidelines-vpn/