- Hong Kong to regulate unlicensed stablecoins from August 2025.

- Providers must secure licenses or face fines and imprisonment.

- Regulations aim to enhance investor protection and market stability.

Hong Kong will enforce a Stablecoin Ordinance starting August 1, 2025, making it illegal for unlicensed fiat-backed stablecoins to be promoted or sold to retail investors, according to the Hong Kong Monetary Authority.

This regulatory shift aims to fortify investor protection and establish stringent controls, positioning Hong Kong as a global leader in stablecoin regulation.

New Licensing Requirements for Stablecoins Begin in 2025

The Stablecoin Ordinance, set to take effect on August 1, 2025, establishes strict licensing requirements for fiat-backed stablecoins in Hong Kong. Enforced by the HKMA, this move prohibits the distribution or promotion of unlicensed stablecoins, with penalties of up to HK$50,000 and six months’ imprisonment for violators.

Hong Kong aims to enhance market stability and investor protection, underscoring the significance of regulatory oversight in the cryptocurrency market. This regulatory approach distinguishes Hong Kong as a pioneering jurisdiction in retail stablecoin regulation, limiting access to only a select few licensed providers.

“From the date of the Ordinance’s implementation, any promotion of unlicensed stablecoins to the public in Hong Kong will be illegal.” — Eddie Yue Wai-man, Chief Executive, Hong Kong Monetary Authority (HKMA)

Hong Kong’s Regulation Parallels EU’s MiCA

Did you know? Hong Kong’s Stablecoin Ordinance mirrors the EU’s MiCA regulation, positioning the region as a leader in stablecoin oversight, similar to global trends enhancing retail protection.

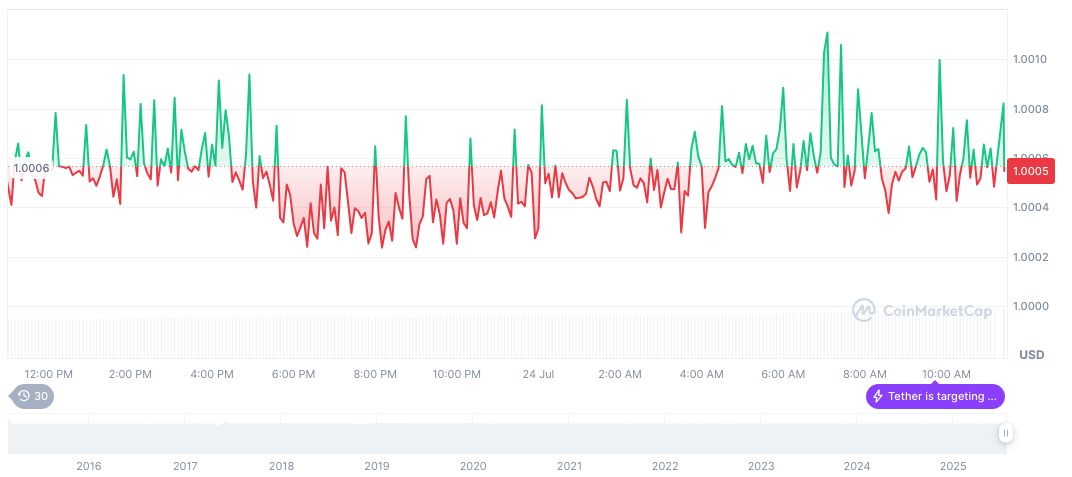

Tether USDt, commonly known as USDT, stands at $1.00, with a market cap of $162.59 billion and a 4.21% market dominance, according to CoinMarketCap. Over the past 24 hours, trading volume reached $158.65 billion, despite a minor price dip of 0.03%.

CoinCu analysis predicts that Hong Kong’s rigorous stablecoin regulation could pave the way for other jurisdictions, potentially establishing a new global framework. Hong Kong’s dual-track regulation for stablecoins considerations. Market dynamics likely will evolve, focusing on legal compliance and robust anti-money laundering measures to align with the augmented standards.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/hong-kong-stablecoin-licensing-3/