- HKMA limits stablecoin licenses to a few firms.

- Firms must demonstrate prudent and sustainable business models.

- Regulatory caution mirrors global trends for investor protection.

Hong Kong Monetary Authority (HKMA) Chief Executive Eddie Yue announced plans to limit initial stablecoin licenses amid market speculation. The regulatory approach, focusing on risk management, highlights Hong Kong’s strategic alignment with global standards.

Hong Kong’s decision, led by Eddie Yue of the HKMA, restricts stablecoin licenses to a select few firms. Market excitement is on the rise with many companies eager to enter the market for digital payments. The HKMA undertakes a conservative approach, limiting licenses to firms demonstrating prudent and sustainable business models. This strategy may dampen speculative trading trends, as the immediate financial benefits for companies could remain uncertain. Industry participants, while speculative, now face cautious optimism and potential regulatory complications.

Historical Parallels and Current Market Stability

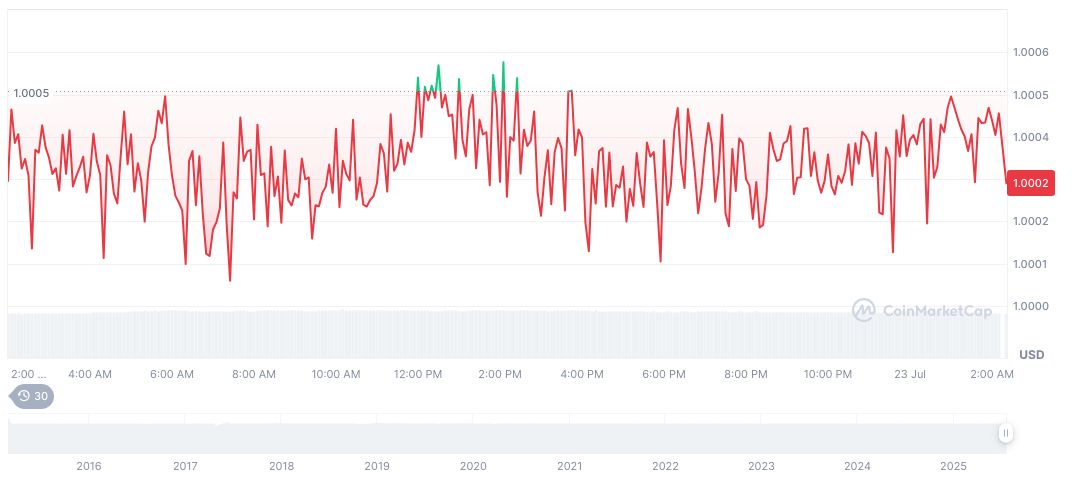

In stablecoin markets, Tether USDt (USDT) remains crucial with a market cap of $162.01 billion and stable price of $1.00. Recent trades totaled $146.70 billion, unaffected by Hong Kong’s regulatory measures. CoinMarketCap reveals negligible short-term price shifts, maintaining market builder status.

Coincu’s research sheds light on Hong Kong’s strategic actions. Regulatory caution offers stability, aligning local policies with global financial standards. Industry stakeholders may witness long-term growth given the adaptation period for new entrants.

“A stablecoin is not an investment vehicle, but rather a blockchain-based means of payment. By nature, it has no room for appreciation. Only a handful of licences will be granted initially. Applicants must demonstrate viable use cases and the ability to operate in a prudent and sustainable manner, as well as command the trust of market participants.” — Eddie Yue, Chief Executive, Hong Kong Monetary Authority (HKMA)

Market Data and Future Outlook

Did you know? The cautious regulatory stance in Hong Kong mirrors global trends where jurisdictions are ramping up digital asset controls to prevent market excesses and ensure investor protection.

Recent trades totaled $146.70 billion, unaffected by Hong Kong’s regulatory measures.

Industry stakeholders may witness long-term growth given the adaptation period for new entrants.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/350237-hong-kong-stablecoin-regulation-approach/