- Main event, leadership changes, market impact, financial shifts, or expert insights.

- Hong Kong enforces stablecoin licensing by 2025.

- Strict reserve requirements for fiat-backed coins.

The Hong Kong Monetary Authority announced a new regulatory framework for fiat-referenced stablecoin issuers, effective August 1, 2025, to streamline licensing and ensure compliance.

This legislation aligns Hong Kong with global standards and impacts entities issuing fiat-backed stablecoins, requiring robust reserves and licensing for retail market engagement.

Regulations Demand Strict 1:1 Reserve Ratio for Issuers

Hong Kong’s Monetary Authority (HKMA) has implemented a new regulatory framework for stablecoin issuers effective August 1, 2025. The framework requires any institution intending to issue fiat-referenced stablecoins to undergo a comprehensive licensing process. These changes were formalized by the Legislative Council through the concurrence of the Financial Commissioner, setting foundational policies for digital asset markets.

Stability requirements mandate issuers to maintain a 1:1 reserve ratio of high-quality liquid assets. This rule aims to enhance transparency and mitigate market risks associated with fiat-backed digital currencies. Only licensed entities can market stablecoins to retail investors, underscoring the framework’s focus on compliance and safety for consumers.

The introduction of these regulations has sparked varied reactions across the global crypto industry. While no official statements have come from key figures, the regulation is seen as part of Hong Kong’s strategic positioning in digital finance. Initial responses emphasize the potential exclusion of unregulated issuers.

“Hong Kong Monetary Authority (HKMA), Regulatory Authority, HKMA, ‘Any institution intending to apply for a license…should express its intention to the licensing team. This move facilitates preliminary, informal discussions, allowing the licensing team to gain a deeper understanding of the institution’s background and business model, as well as ensuring that they fully understand the licensing process and the minimum criteria required by the Financial Commissioner.’” Elliptic Blog

Global Crypto Industry Reacts to Hong Kong’s Framework

Did you know? Hong Kong’s move mirrors global efforts, similar to the EU’s MiCA regulation, indicating a worldwide push for clearer guidelines on stablecoins.

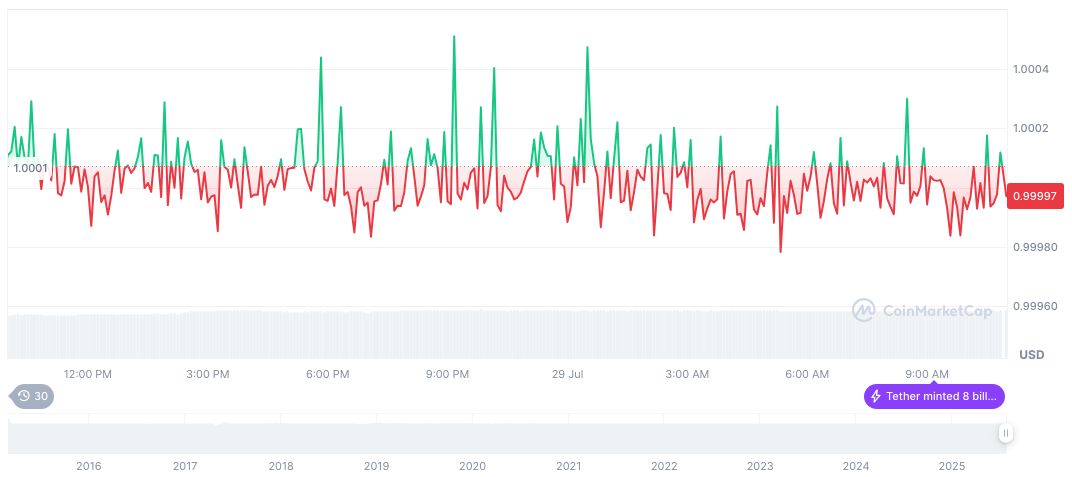

According to CoinMarketCap, Tether USDt (USDT) maintains its $1 price with a market cap at $163,607,973,605. Despite a $123,867,507,744 trading volume in the past 24 hours and minor price fluctuations over recent months, its market dominance is at 4.24%. Updated July 29, 2025.

Coincu research indicates the new regulations might lead some issuers to withdraw from Hong Kong, potentially consolidating the market among compliant entities. Future regulatory clarity is expected to instill confidence, possibly prompting increased institutional participation in the region’s stablecoin ventures.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/hong-kong-stablecoin-regulations-2025/