- Hong Kong sets August 2025 for Stablecoin Ordinance implementation.

- Regulation requires compliance on asset management and user redemption.

- Potential for increased stablecoin usage in international projects.

On June 6, 2025, Hong Kong announced the Stablecoin Ordinance will go into effect on August 1, 2025. The initiative outlines a legal framework for stablecoin issuers.

This move is significant as it aligns Hong Kong with global digital finance regulations, potentially boosting stablecoin utilization.

Hong Kong’s Landmark Stablecoin Regulation Slated for 2025

On June 6, Hong Kong SAR Government published the Stablecoin Ordinance Notice, setting an effective date of August 1, 2025. The ordinance clarifies stablecoins’ legal use and regulation principles. Key government officials highlighted the legal framework’s role in ensuring appropriate regulation and consumer protection. Stablecoin issuers will need to comply with standards on asset management, customer fund segregation, and quick redemption.

The move positions Hong Kong as a regulatory pioneer, potentially encouraging more international projects to use stablecoins in regions with unstable local currencies. Notably, Xu Zhengyu, Financial Services and Treasury Bureau Director, emphasized the importance of prompt redemption compliance to meet user expectations. The ordinance has received a positive outlook for improving financial transparency and advancing the regulatory environment. Legislative Council has already passed the bill, marking a decisive shift in financial services regulation.

“The underlying stablecoin is legal tender, and in the future it can be used as an electronic asset through blockchain and other technologies for payment. Stablecoin issuers are supervised by the HKMA. Redemption requests from stablecoin holders must be completed within one working day to meet user requirements.” — Xu Zhengyu, Director, Financial Services and Treasury Bureau

Resemblance to EU’s MiCA: Market Implications

Did you know? Hong Kong’s stablecoin regulatory approach is similar to the EU’s MiCA initiative, which historically improved market liquidity and attracted institutional interest in digital finance.

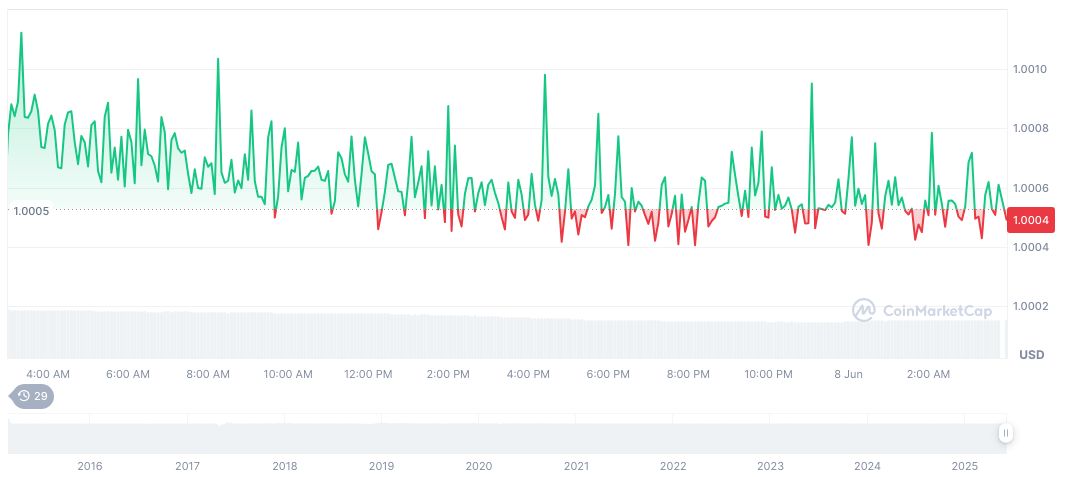

According to CoinMarketCap, Tether (USDT) maintains a stable price of $1.00, with a market cap of $154.83 billion. Despite a 19.75% decrease in 24-hour trading volume to $53.61 billion, its 90-day price change is at 0.04%. Circulating supply stands at 154.76 billion USDT, showcasing its market prominence.

Insights from Coincu’s research team suggest that Hong Kong’s regulatory advancements are likely to foster innovation and draw international stablecoin projects, enhancing its fintech ecosystem. This strategic framework sets the stage for increased adoption and integration of blockchain technologies in financial services.

Source: https://coincu.com/342171-hong-kong-stablecoin-ordinance-2025/