- Key Point 1

- Key Point 2

- Key Point 3

Hong Kong’s Secretary for Financial Services and the Treasury, Christopher Hui, stated limited stablecoin licenses will be issued in initial phases. This cautious strategy focuses on cross-border payment scenarios, aiding developing nations with currency volatility.

The strategy reflects Hong Kong’s prudent approach towards stablecoin issuance, emphasizing support for emerging markets via cross-border payments. The plan also includes promoting financial asset tokenization, transitioning from green bonds to exchange-traded funds (ETFs) and potentially metals.

Hong Kong Prioritizes Stablecoin Licenses for Cross-Border Payments

Hong Kong plans to issue stablecoin licenses selectively to prioritize cross-border payments for developing nations. Christopher Hui emphasized government leadership in promoting stablecoin applications and future financial assets tokenization.

License allocations will remain limited as the regulatory landscape evolves. This measured approach aims to stabilize and optimize currency transactions across borders, particularly in regions experiencing financial volatility.

“We hope that [stablecoins] will focus on addressing the difficulties and pain points in the real economy, such as cross-border payments, especially when involving local currencies with higher risks, or when the local financial system is not so well-developed, creating certain challenges for cross-border payments.” — Christopher Hui, Secretary for Financial Services and the Treasury, Hong Kong.

Industry responses feature Standard Chartered and Animoca Brands as key participants, while Chinese firms JD.com and Ant Group propose offshore yuan-pegged stablecoins, pending approval from China’s central bank. Hong Kong’s cautious steps may attract more global players.

Innovation and Stability: Hong Kong’s Financial Strategy

Did you know? Hong Kong’s stablecoin push aligns with its historical focus on financial innovation, transitioning from a purely HKD-pegged sandbox to broader currency inclusivity.

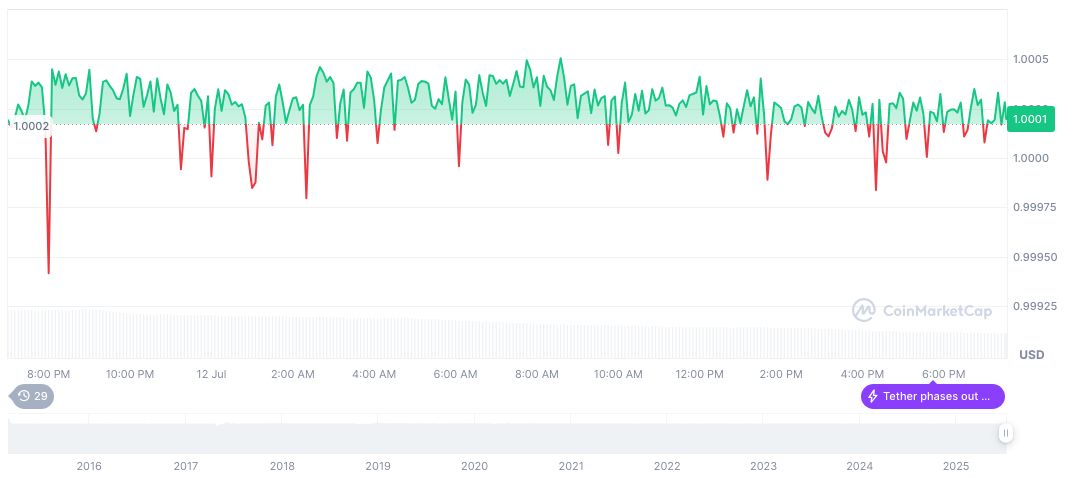

As of July 13, 2025, Tether USDt remains stable at $1.00 with a market cap nearing 160 billion USD. The circulating supply is 159.49 billion, and its 24-hour trading volume has decreased by 23.53%. Data by CoinMarketCap shows fluctuations over recent months with notable growth in 90 days.

The Coincu research team foresees boosted financial resilience in emerging markets utilizing stablecoin technology, with Hong Kong’s regulatory approach serving as a model. Technological developments might lead to expanded digital financial services, encouraging moves in commodity trading.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/348449-hong-kong-limits-stablecoin-licenses/