- Introduction of stringent requirements for stablecoin issuers.

- Mandate for 100% reserve backing in cash or government bonds.

- Potential to influence global regulatory standards.

The Hong Kong Financial Services and the Treasury Bureau introduced new stablecoin licensing regulations aimed at enhancing market stability.

Hong Kong’s Financial Secretary, Paul Chan, announced the introduction of a stablecoin licensing system at the Digital Finance Awards 2025. This system mandates stablecoin issuers to meet strict requirements and involves oversight by the Hong Kong Monetary Authority. Institutions such as Standard Chartered are set to participate actively, emphasizing the need for stability and asset backing.

Hong Kong Mandates 100% Reserve Backing for Stablecoins

Issuers must maintain reserves in cash or government bonds, ensuring redemption at any time. This regulation aligns with global trends and provides a model for similar frameworks. The licensing aims to prevent speculative activities and foster genuine financial innovation.

Paul Chan highlighted that stablecoins should be tools for innovation, not speculation as outlined by Hong Kong Government. The government seeks input from market participants on integrating these licensed stablecoins into public systems. Industry reactions suggest anticipation of greater institutional adoption.

“Stablecoins should be used as tools for financial development and innovation, rather than speculative opportunities. Introducing clear and robust regulations for issuers ensures market integrity and provides the foundation for responsible growth in the digital asset sector.” — Paul Chan Mo-po, Financial Secretary, Hong Kong

Potential Global Impact: Stablecoins and Institutional Growth

Did you know? Hong Kong’s previous initiatives, like the 2022 digital asset platform licensing, quickly institutionalized markets, licensing ten exchanges by mid-2025.

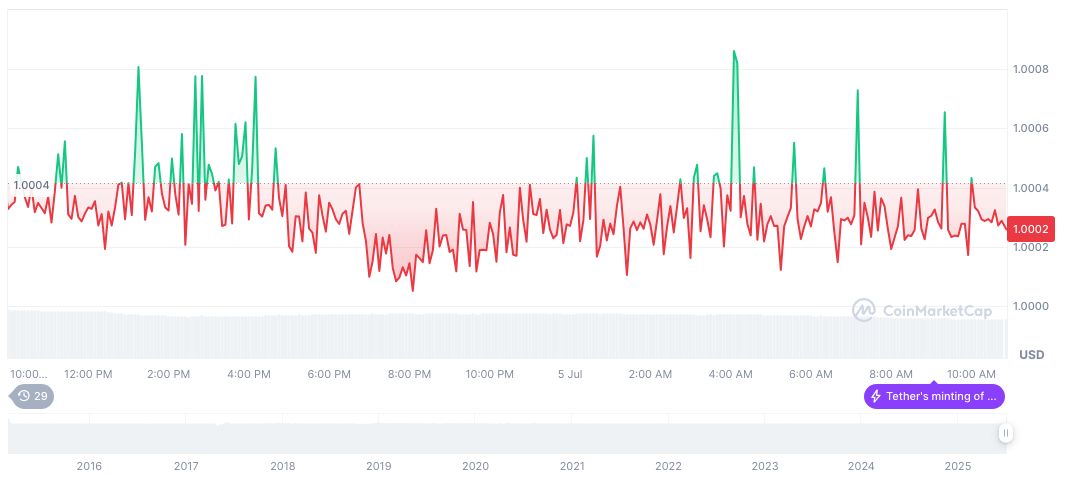

According to CoinMarketCap, Tether USDt (USDT) remains a dominant stablecoin. As of July 5, 2025, its market cap stands at formatNumber(158646522334, 2), and it holds a market dominance of 4.77%. Over 24 hours, trading volume reached formatNumber(55153588856, 2), despite a minor decrease of -17.15%.

Analysts from Coincu predict that Hong Kong’s robust licensing framework could boost interest from global banks as seen in China’s Economic Strategies, increasing stablecoin utilization in financial markets. This could set precedents for regulatory standards worldwide, particularly in Asian markets looking to secure digital currency flows.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/346954-hong-kong-stablecoin-licensing-2/