- Hong Kong’s HKMA issues tokenized bonds exploring CBDC integration.

- Tokenized bonds could revolutionize government securities issuing.

- CBDCs may streamline bond subscriptions, boosting market efficiency.

The Hong Kong Monetary Authority has announced the issuance of tokenized bonds totaling HK$386 billion since 2019, with plans to integrate CBDC subscriptions in the upcoming batch.

This action underscores Hong Kong’s growing adaptation of digital finance, potentially evolving CBDC use in broader financial transactions and reinforcing its role in modern financial markets.

Hong Kong’s Pioneering Role in Bond Tokenization

Christopher Hui, Secretary for Financial Services and the Treasury, emphasizes Hong Kong’s intention to normalize tokenized bonds. The government aims for broader adoption by considering tax incentives such as stamp duty exemptions. Paul Chan, Hong Kong’s Financial Secretary, highlights the bond program’s capacity to enhance efficiency, transparency, and security in financial protocols. As he noted, “The Government has once again issued digital green bonds this year, incorporating various technological innovations. This demonstrates Hong Kong’s strengths and leadership position in combining the bond market, green and sustainable finance, as well as fintech.”

Market participants, including major banks and asset managers, express optimism over these ongoing technological innovations.

Market participants, including major banks and asset managers, express optimism over these ongoing technological innovations.

Broader Impact of CBDCs on Financial Efficiency

Did you know? The first government tokenized green bond was issued by Hong Kong in 2023, marking a pioneering use of blockchain for full on-chain bond lifecycle management.

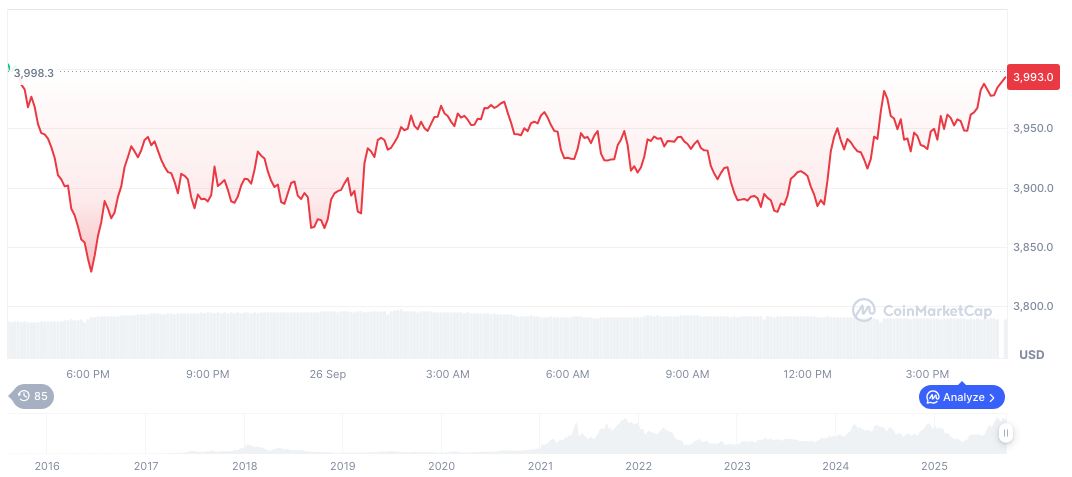

As of September 27, 2025, Ethereum (ETH) trades at $3,979.36 with a market cap of $480.32 billion and market dominance at 12.77%. Over 24 hours, the price increased by 1.22%, although 7-day metrics reflect a 10.95% drop. Source: CoinMarketCap.

Coincu Insights from the research team suggest that integrating CBDCs with tokenized bonds could streamline and modernize the subscription process across capital markets. Regulatory developments in CBDC infrastructure show a promising trajectory for further financial digitization.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/blockchain/hong-kong-explores-cbdc-tokenized-bonds/