- Hong Kong accelerates stablecoin licensing to capitalize on digital asset growth.

- Paul Chan Mo-po expects increased stablecoin demand, boosting the local economy.

- HKSAR’s stablecoin regulation opens doors for both local and global issuers.

Hong Kong SAR Government Financial Secretary Paul Chan Mo-po announced the acceleration of stablecoin licensing amid rising market demand. The new framework takes effect August 1, 2025, with the Hong Kong Monetary Authority processing applications swiftly.

Hong Kong’s Stablecoin Licensing to Drive Economic Growth

Anticipating heightened market interest, Paul Chan Mo-po emphasized stablecoins’ potential to enhance financial services with programmable characteristics. The Hong Kong Monetary Authority will expedite the licensing process to foster innovation.

Global Recognition as Hong Kong Sets Stablecoin Precedent

The Hong Kong Monetary Authority will soon process stablecoin licenses to meet increased demand in the digital asset sector. Paul Chan Mo-po, Financial Secretary, acknowledged market interest in stablecoins’ exchange efficiency and creative potential. “With the booming digital asset market, the market demand for stablecoins is expected to increase further. We have noticed that many market players are very interested in this.” The statement reinforces the notion that with quicker license processing expected, local and international issuers stand to gain from this regulatory environment.

The new measure is designed to better accommodate stablecoin issuers, enhancing financial flexibility in Hong Kong. By officially integrating stablecoins into its financial landscape, Hong Kong aims to attract more digital asset participants.

Industry reactions have largely been receptive, recognizing this move as a significant step toward broadening digital finance. Paul Chan’s statement about new opportunities for Hong Kong’s economy highlighted the regional economic benefits, amplifying optimism within the financial community.

Market Data and Future Insights

Did you know? Hong Kong is set to become one of the first global financial centers to establish a robust legal framework for stablecoin issuance, akin to the European Union’s MiCA framework but with greater openness to multiple fiat currencies.

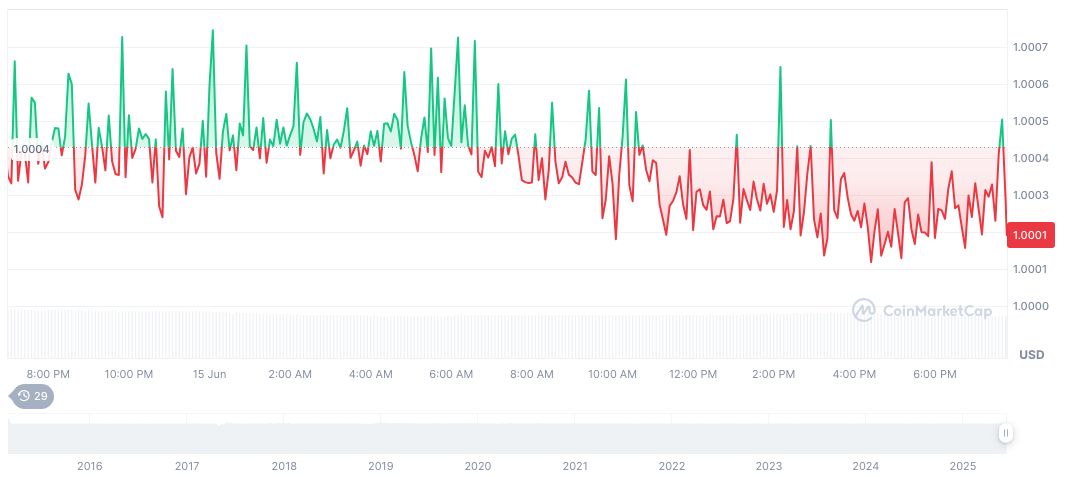

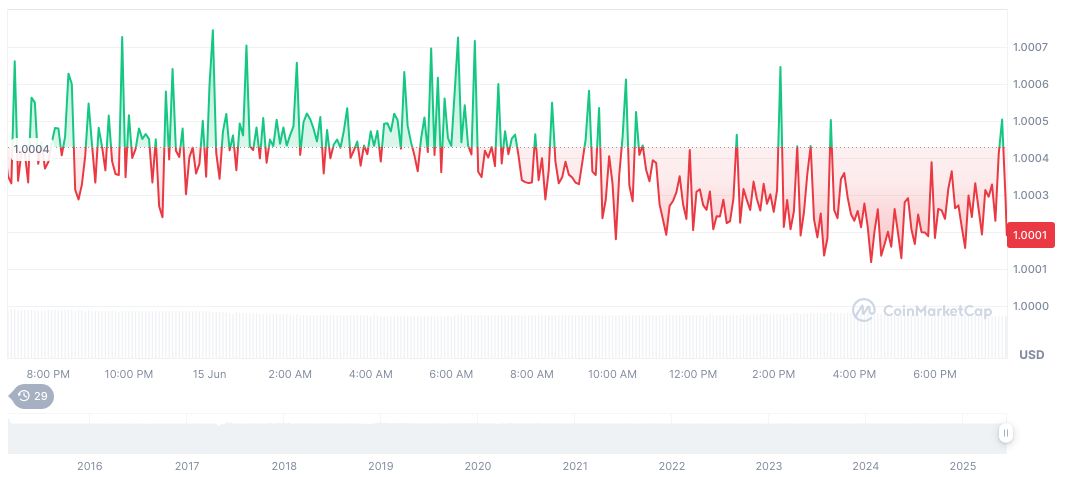

On June 16, 2025, Tether USDt’s market cap stood at 155,508,906,514.00, comprising 4.71% market dominance, according to CoinMarketCap. Despite a slight 0.04% drop over 24 hours, USDT showed resilience, reflecting stablecoin enthusiasm in anticipation of Hong Kong’s regulatory changes.

Insights from the Coincu research team suggest beneficial financial outcomes from these regulations. Hong Kong’s stablecoin framework could serve as a model globally, integrating digital assets with traditional finance for a more innovative financial sector. Collectively, such advancements are expected to increase Hong Kong’s competitive edge, positioning it as a future leader in digital finance.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/343518-hong-kong-stablecoin-licensing/