- Stablecoin law ignites digital stock surge, Hong Kong sees major gains.

- Investor optimism triggers 80% Lianlian Digital increase.

- Future growth expected as regulation fuels market confidence.

Stocks linked to digital currency experienced significant gains in Hong Kong on June 2, following the implementation of a new stablecoin law.

The stablecoin law is key to Hong Kong’s strategy to become a digital asset hub, boosting investor confidence. Hong Kong’s Ambitious Journey to Become a Crypto Regulation Hub highlights how these developments align with the region’s long-term digital asset plans.

Hong Kong Stocks Surge 80% After New Stablecoin Law

Hong Kong’s market saw notable gains in digital currency stocks with the introduction of the new stablecoin law. Lianlian Digital surged by 80% intraday, while other stocks like Moxian and Chain Cloud Link also posted rapid increases.

The enactment of the “Stablecoin Order” aligns with global regulatory trends, indicating accelerated integration of digital currencies into mainstream finance. This move is expected to expand the industry’s regulatory framework.

Both regional and global observers responded positively to developments. As an unnamed government official stated, “The recent introduction of the ‘Stablecoin Order’ marks a pivotal step for Hong Kong as it aims to become a global digital asset hub, possibly outpacing global peers in compliant stablecoin issuance.”

Stablecoin Regulation Expected to Spur Global Market Growth

Did you know? The implementation of Hong Kong’s stablecoin law mirrors historical regulatory shifts that often lead to significant market boons, similar to the effects seen with Japan’s early blockchain regulations.

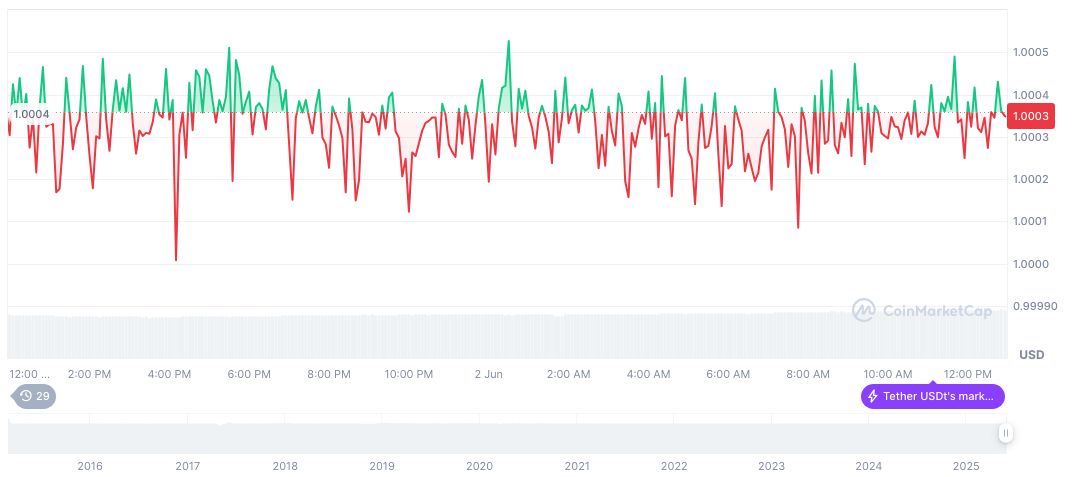

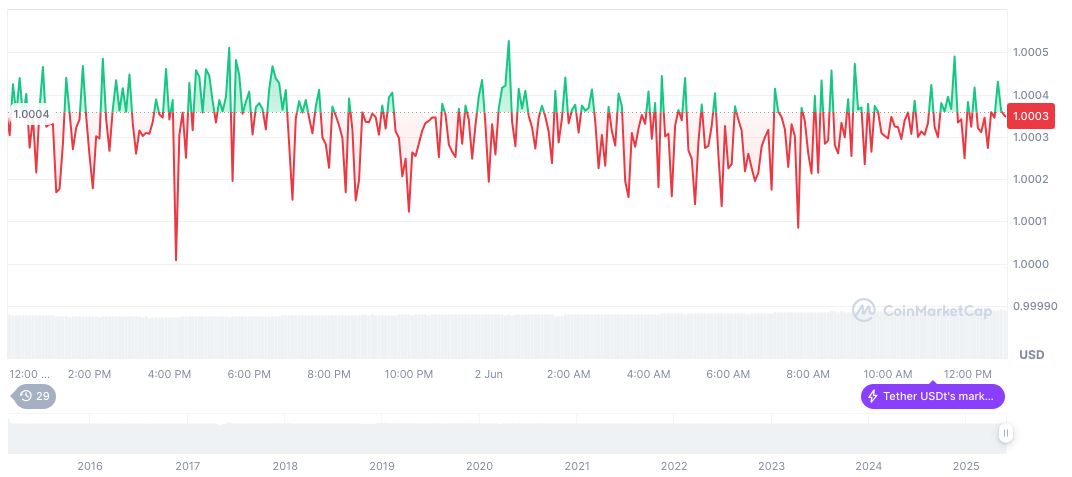

Tether USDt (USDT) maintains a price of $1.00, per CoinMarketCap, supported by a market cap of formatNumber(153205079782, 2) and a dominant 4.70% of the market. Its trading volume reached formatNumber(59517595046, 2), noting a change of 12.51% in 24 hours.

Coincu’s research underscores the potential ripple effects of this regulatory development on stablecoins. Such frameworks signal robust financial markets, with stablecoins poised as crucial instruments for future digital asset proliferation.

Source: https://coincu.com/341193-hong-kong-stablecoin-law-stocks/