- Hong Kong passes Stablecoins Bill, impacting cross-border payments and digital assets.

- Regulation boosts RMB internationalization.

- New framework fosters stablecoin and asset tokenization growth.

Hong Kong’s Legislative Council has enacted the Stablecoins Bill as of May 2025. The legislation, designed to enhance the digital asset landscape, sets comprehensive regulatory standards.

This regulatory move is central to urbanizing the RMB and expanding cross-border payments, setting a precedent for stablecoin use and tokenization in the region.

Hong Kong’s Stablecoins Bill Spurs Financial Innovation

Hong Kong’s Stablecoins Bill emerged amidst a drive to forge a regulatory environment conducive to digital asset innovation. Major financial players like HSBC and JD.com have publicly supported the initiative. The legislation targets boosting financial operations through cross-border payment systems and RMB’s global integration.

The enactment of the bill marks a turning point, fostering institutional investment and expanding digital trading platforms. Enhanced regulation is projected to solidify market stability and aid Hong Kong’s global financial positioning.

“The new law goes beyond stablecoins and will anchor the multi-trillion-dollar tokenization of real-world assets (RWAs) in the city. Stablecoins would eliminate volatility from the tokenization sector, increasing market liquidity in the nascent industry.” – Yang Zeyuan, Analyst, CITIC Securities

Stablecoins Bill Projected to Boost Hong Kong’s Global Role

Did you know? In previous financial centers with clear regulations, such as Singapore, clear protocols have historically boosted digital asset innovation, mirroring the impact anticipated in Hong Kong.

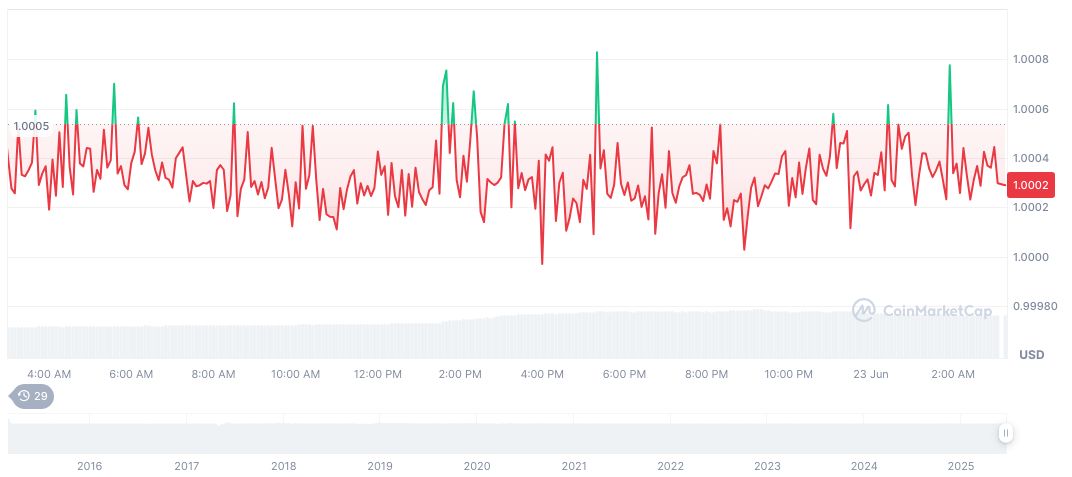

According to CoinMarketCap, Tether USDt (USDT) maintains a steady value at $1.00, with a market cap of approximately $formatNumber(155992042144, 2). Its 24-hour trading volume reaches around $formatNumber(93981388100, 2), despite a slight 0.03% daily price reduction. This data highlights USDT’s role in stabilizing crypto markets.

Coincu provides insight into Hong Kong’s legislative shift, anticipating robust cross-border payment networks and stablecoin adoption. Tokenization of real-world assets and enhanced compliance standards are expected to strengthen the city’s financial architecture, fostering innovation and economic resilience.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/344644-hong-kong-stablecoins-bill-growth/