- Hong Kong’s appointments to Stablecoin Review Tribunal announced.

- Regulation aims for fairness in stablecoin oversight.

- Impact limited to fiat-referenced stablecoins initially.

Hong Kong’s government has appointed Senior Counsel Kennedy Lai as Chairperson of its newly formed Stablecoin Review Tribunal, which will oversee regulation reviews starting November 1, 2025.

This Tribunal aims to bolster the fairness of regulatory decisions, potentially impacting stablecoin market dynamics and investor confidence in Hong Kong’s crypto framework.

Hong Kong Forms Tribunal to Oversee Stablecoin Regulations

The Hong Kong SAR government appointed Kennedy Lai as Chairperson of the Stablecoin Review Tribunal as part of its regulatory framework. This tribunal is tasked with reviewing HKMA’s decisions regarding stablecoin activities, as detailed in the Hong Kong Official Gazette Volume 29, Number 22.

Effective November 1, 2025, the tribunal will operate for three years to assure fairness in regulatory practices. The regulation specifically impacts fiat-referenced stablecoins, limiting retail offerings to licensed entities, as outlined in the Hong Kong Government Press Release on New Initiatives.

No official statements from the appointed members or SAR officials have been released, although speculation surrounds the tribunal’s impact. A government spokesperson cited the ordinance as a solid foundation for digital asset industry growth.

“The Ordinance has further strengthened the regulatory framework for digital asset activities in Hong Kong, providing a solid foundation for the steady and sustainable development of the industry. The Tribunal helps provide safeguards to ensure that the relevant regulatory decisions are reasonable and fair.”

Tether’s Market Cap Hits $183 Billion Amid Regulatory Shifts

Did you know? Historically, similar tribunals in Hong Kong have monitored banking and securities, ensuring industry compliance.

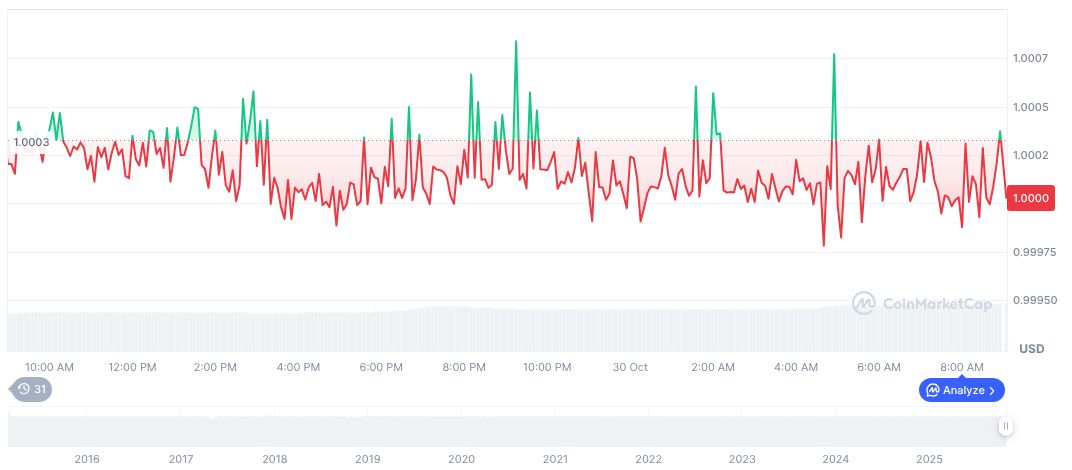

As of October 31, 2025, Tether USDt (USDT) holds a market cap of 183.38 billion. Its market dominance is at 4.97% with a 24-hour trading volume of 149.39 billion. Over the past 90 days, USDT’s price saw an increase of 2.06% according to CoinMarketCap.

Insights from the Coincu research team highlight a potential shift towards reinforced AML/CFT compliance and prudent risk controls for stablecoins, as discussed in the Consultation Paper on AML/CFT for Regulated Stablecoins. This regulation is anticipated to influence stablecoin offerings and their resilience in Hong Kong’s market.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/hong-kong-stablecoin-review-tribunal/