- The U.S. government shutdown causes a potential absence of CPI data.

- Economic and market strategists face heightened uncertainty.

- Impacts expected on Federal Reserve decisions and financial markets.

The White House announced that anticipated U.S. inflation data will not be released in October due to the ongoing government shutdown, a potential first in economic history.

This delay complicates market forecasts and monetary policy decisions, potentially heightening financial market volatility, affecting cryptocurrencies like Bitcoin and Ethereum reliant on economic indicators for forecasting.

Government Shutdown Halts CPI Data Release, Spurs Economic Anxiety

The White House has confirmed a likely halt in releasing the October CPI data, a decision stemming directly from operational limitations due to the ongoing government shutdown. The Bureau of Labor Statistics (BLS), charged with generating the CPI data, has its activities suspended as part of the federal operational pause.

The unavailability of CPI data reduces clarity in monetary policy-making, with markets particularly at risk. The CME FedWatch Tool shows a spike in projections for a Federal Reserve rate cut, reflecting market anticipation of potentially accommodative policy absent new economic data inputs. Cryptocurrencies like BTC and ETH, known for volatility in reaction to policy decisions, are experiencing heightened trading activity.

The lack of data release has ignited concerns across financial markets, prompting discussions among economists and traders. Karoline Leavitt’s statements emphasize the gravity, noting potential economic disruptions without this key report. Yet, leading crypto figures from firms like Binance and Ethereum have yet to vocalize reactions, with major industry platforms remaining silent on direct impacts.

CPI Data Absence and Its Ripple Effects on Crypto and Markets

Did you know? The unavailability of the CPI report during this shutdown is a first, with potential ramifications reminiscent of past financial uncertainties when critical macroeconomic indicators were unavailable, leading to spikes in asset volatility.

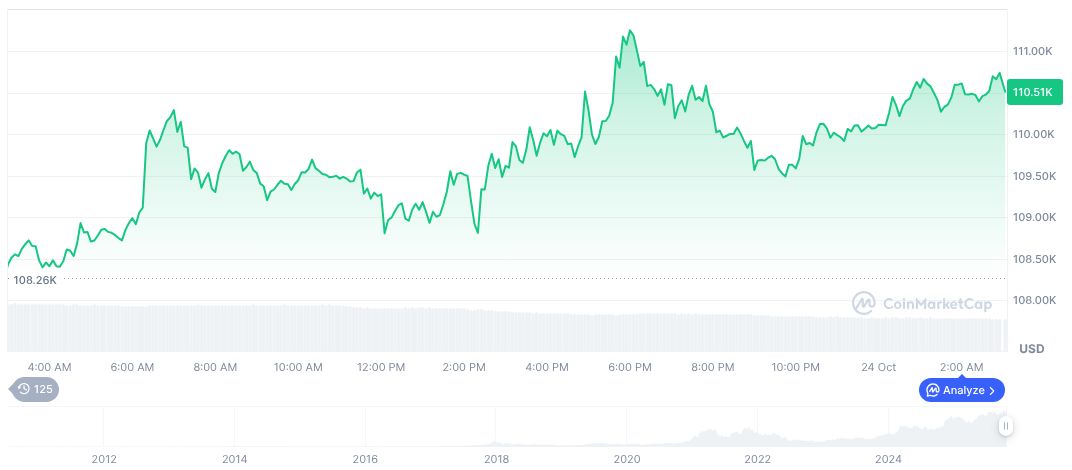

As of October 24, 2025, Bitcoin (BTC) was valued at $110,999.76 with a market cap of $2.21 trillion as per CoinMarketCap data. The cryptocurrency showed price changes of 1.20% over 24 hours, 3.32% over seven days, and -2.29% over 30 days. BTC has exhibited a moderate decrease in 24-hour trading volume by 13.09%.

Analysts from Coincu warn that absent CPI data, financial markets could remain volatile, with potential for delayed Federal Reserve decisions on interest rates. Study of historical trends suggests significant asset price swings could ensue without the grounding effect of key economic indicators, influencing both mainstream and crypto markets alike.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/us-cpi-data-delay-shutdown/