- Shiba Inu’s recent price movements affirmed a bullish edge as the bulls now eye the next resistance level.

- Derivates data reaffirmed this edge, but it’s crucial to monitor Bitcoin’s movement to assess the sentiment.

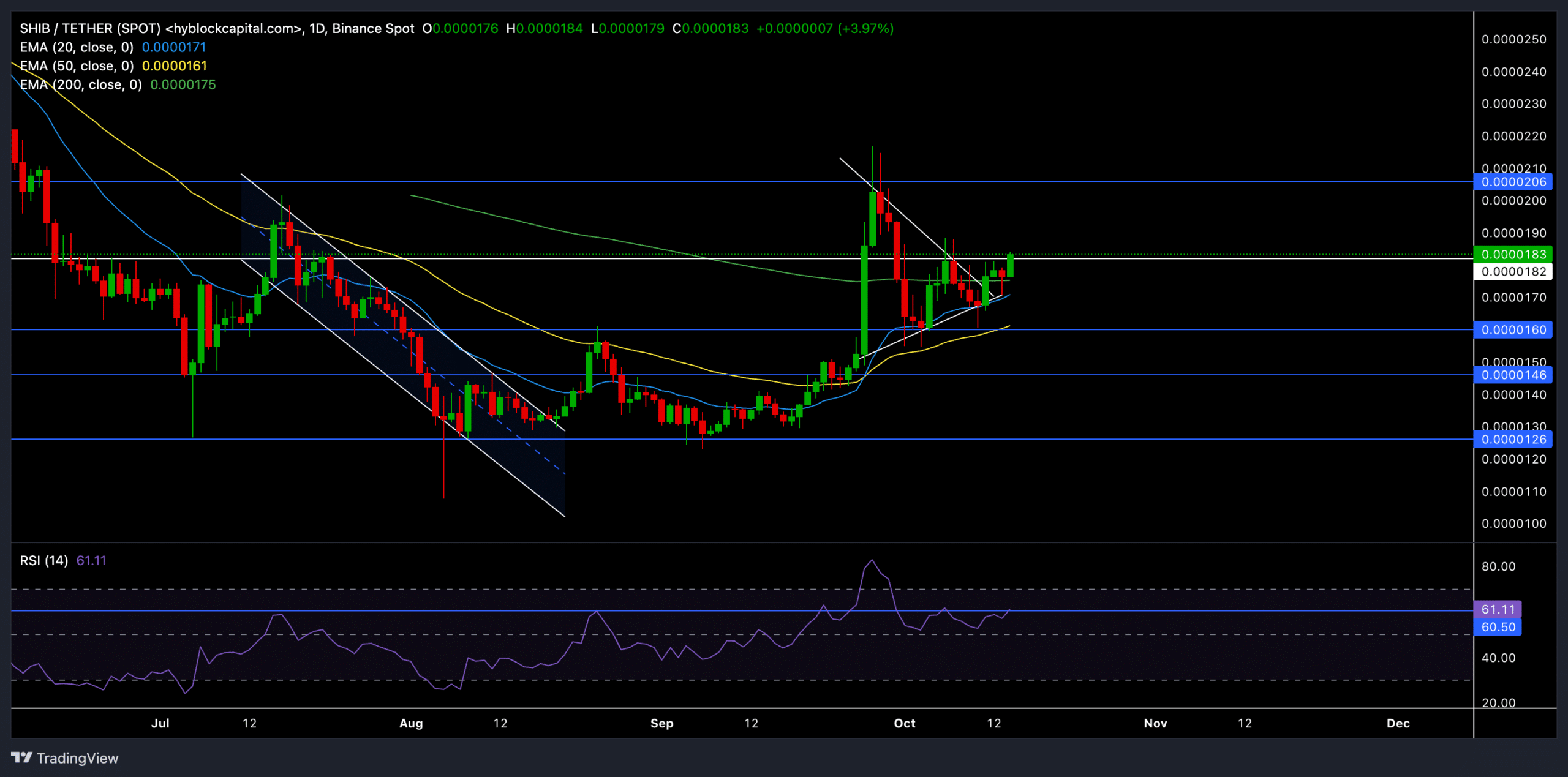

Shiba Inu [SHIB] has recently shown a strong bullish edge as the price climbed above the 20-day, 50-day, and 200-day EMAs. The recent symmetrical triangle breakout gave the bulls an upper hand, pushing SHIB to test crucial resistance levels.

At press time, SHIB was trading at approximately $0.0000184, up by 4.14% over the past 24 hours.

Can SHIB continue its rally?

Source: TradingView, SHIB/USDT

SHIB’s recent recovery above the 20-day, 50-day, and 200-day EMAs highlighted a strong resurgence in bullish momentum.

The recent symmetrical triangle breakout set the stage for buyers to push toward the $0.0000182 resistance level, which has now become a critical hurdle for further price gains.

A decisive close above this level could propel SHIB toward the $0.0000206 resistance in the coming sessions, where bears would likely step in to initiate a consolidation phase.

In this case, buyers can expect a sideways trajectory between the $0.0000206 and $0.0000182 range.

On the downside, immediate support was around the EMAs, which could provide a solid base for SHIB to regain its footing if it experiences a pullback.

The RSI stood well above the midline to indicate a bullish edge. A close above the 60-61 zone could pave the way for additional gains before a potential reversal from the overbought territory. Traders should also watch Bitcoin’s price action, as market-wide sentiment will likely influence SHIB’s trajectory.

Derivatives data revealed THIS

Source: Coinglass

It’s worth mentioning that the 24-hour long/short ratio for the meme coin stood at 1.0462, indicating a slight bullish bias. The long/short ratios on Binance and OKX stood at 1.0462 and 2.43, respectively.

This reaffirmed a bullish edge and showed confidence among traders in the ongoing rally.

Similarly, the trading volume for SHIB rose by over 54.32% to reach $145.10 million, which is largely a positive sign given the daily gains. Open interest also surged by 13.15%, indicating that traders are increasingly taking new positions, likely anticipating further gains in the short term.

Read Shiba Inu’s [SHIB] Price Prediction 2024–2025

The liquidation data indicated higher short liquidations, suggesting that bears have been forced to exit their positions. This highlights a shift towards bullish sentiment, which could further fuel SHIB’s near-term momentum.

So, a close above the $0.0000182 resistance could open up additional upside potential for SHIB, targeting $0.0000206 as the next key level. Conversely, failure to sustain momentum above the EMAs could lead to a retest of the support at $0.0000171.

Source: https://ambcrypto.com/heres-what-shiba-inu-buyers-can-expect-from-this-breakout/