- Binance’s delisting of WRX reflects unresolved disputes and regulatory risks, causing a 56% price crash.

- Market metrics confirm WRX’s bearish trend, with oversold RSI and critical support nearing $0.0869.

In a dramatic turn of events, Binance’s decision to delist WazirX [WRX], Kaon [AKRO], and Bluzelle [BLZ] has led to a sharp decline in their values, with WRX plunging 56% at press time to $0.1006.

The fallout from this announcement extends beyond price action, shining a spotlight on the unresolved Binance-WazirX dispute and raising questions about regulatory risks tied to these tokens.

What happened between Binance and WazirX?

The Binance-WazirX relationship has been controversial since Binance claimed to acquire WazirX in 2019, only to deny full ownership in 2022.

The conflict escalated after regulatory scrutiny of WazirX in India, leading to allegations of money laundering and $235 million in hacking incidents. Recently, the Delhi High Court ordered a fresh investigation into WazirX’s breach, adding to the exchange’s woes.

This delisting by Binance signals a further breakdown in the relationship. For WRX, the native token of WazirX, the delisting removes one of its critical trading platforms, diminishing its liquidity and investor appeal.

WRX’s freefall: What do the charts say?

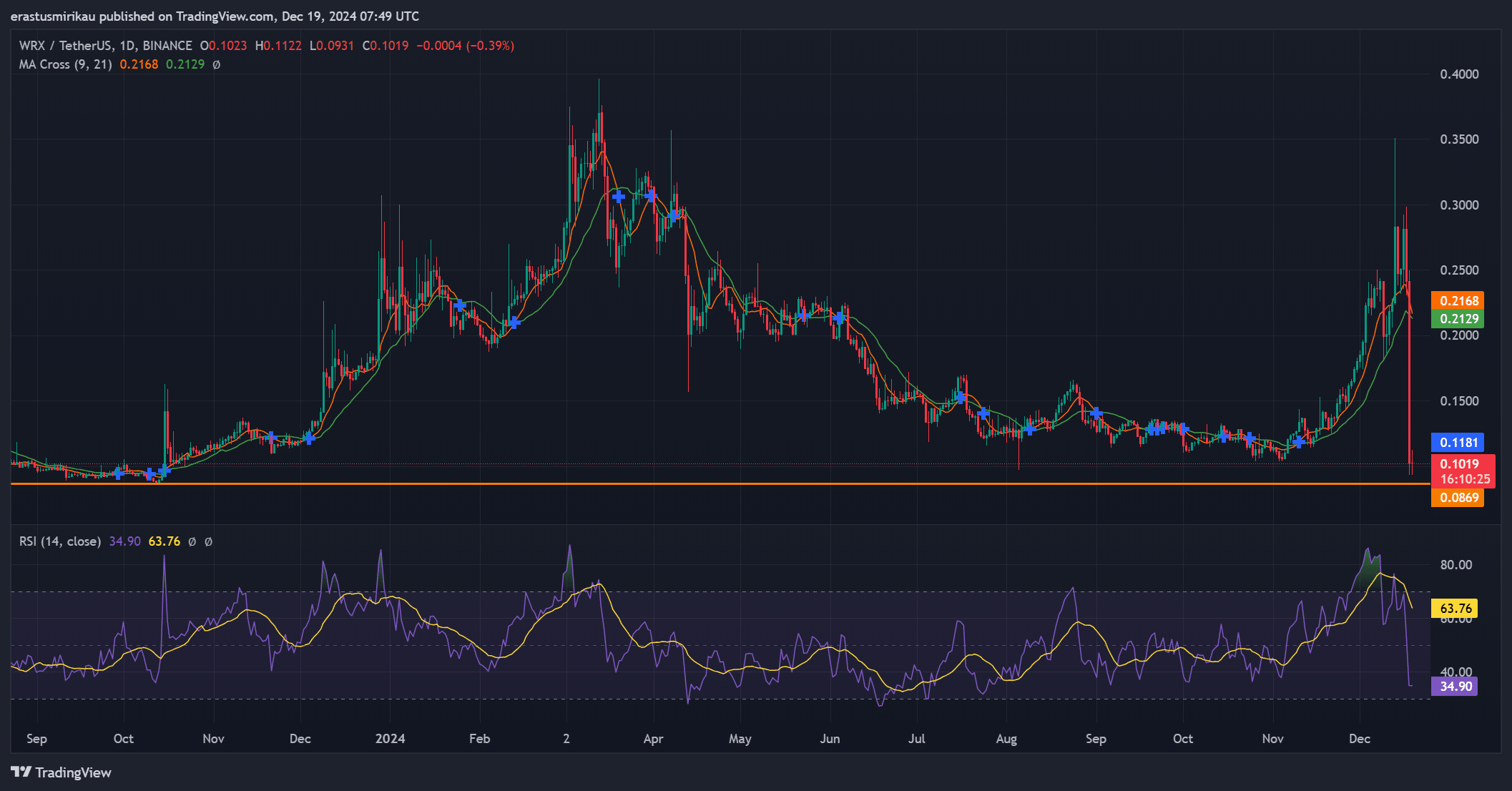

WRX’s 56% dip within 24 hours highlights the token’s vulnerability. At press time, the token was trading at $0.1006, with a market cap of $38.42 million, down by 56.27%. Trading volume spiked by 550%, suggesting significant panic selling.

From a technical perspective, WRX has broken key support levels, with immediate support at $0.0869 and resistance at $0.1181. The RSI (Relative Strength Index) dropped to 34.9, reflecting oversold conditions.

The Moving Average (MA) cross (9, 21) shows a sustained bearish trend at $0.2168 and $0.2129.

The delisting, combined with regulatory uncertainties, paints a bleak picture for WRX’s recovery. Investor confidence is at an all-time low.

Source: TradingView

Why did Binance take this step?

Binance’s decision reflects its broader compliance-driven strategy amid increasing regulatory scrutiny. WRX has been entangled in legal challenges and ownership disputes, making it a liability for Binance.

This move follows heightened global scrutiny on crypto platforms, with regulators demanding tighter controls to combat fraud and illicit activities. Delisting contentious tokens like WRX demonstrates Binance’s attempt to mitigate risks and maintain regulatory goodwill.

What about AKRO and BLZ?

While WRX bore the brunt of the delisting, AKRO and BLZ also saw sharp declines. AKRO dropped 38% to $0.00238, and BLZ fell 42% to $0.07099 at press time.

Unlike WRX, these tokens lack regulatory disputes. Their decline appears market-driven as investors reacted to Binance’s announcement. However, their future remains uncertain, with reduced liquidity and exposure posing significant challenges.

The Binance-WazirX fallout serves as a cautionary tale for the crypto market, highlighting the importance of governance, transparency, and regulatory compliance. For WRX, recovery seems challenging in the face of legal and reputational hurdles.

Investors must tread carefully, understanding the risks tied to platform disputes and regulatory pressures.

Source: https://ambcrypto.com/here-are-wrxs-recovery-odds-from-0-10-after-binance-delisting/