As the Cardano downward spiral persists, data shows crucial demand zones the asset needs to hold to avoid steeper price declines.

Cardano (ADA) continues its trend below the psychological $1 price mark. The ninth-largest cryptocurrency by market cap dropped beneath the valuation in mid-December, capitulating further to an intra-month low of $0.7620.

Meanwhile, bears continue to dominate proceedings in the crypto market, with Cardano recording its third consecutive weekly downtrend last week. Amidst the correction, data has shown Cardano’s crucial support levels.

Critical Levels for Cardano

IntoTheBlock’s analytical insight has indicated a strong demand wall that could prevent further downtrend for Cardano. Data shows that 223,070 wallets acquired 1.97 billion ADA between the prices of $0.8366 and $0.6683, creating the first major support for Cardano should the bearish pressure persist. The bulls can leverage this region to hedge against steeper drops to $0.65.

Furthermore, another support wall exists between $0.5353 and $0.6683, where 405,660 addresses bought 5.39 billion ADA at an average price of $0.5973. This second demand wall could provide additional support should the initial wall break.

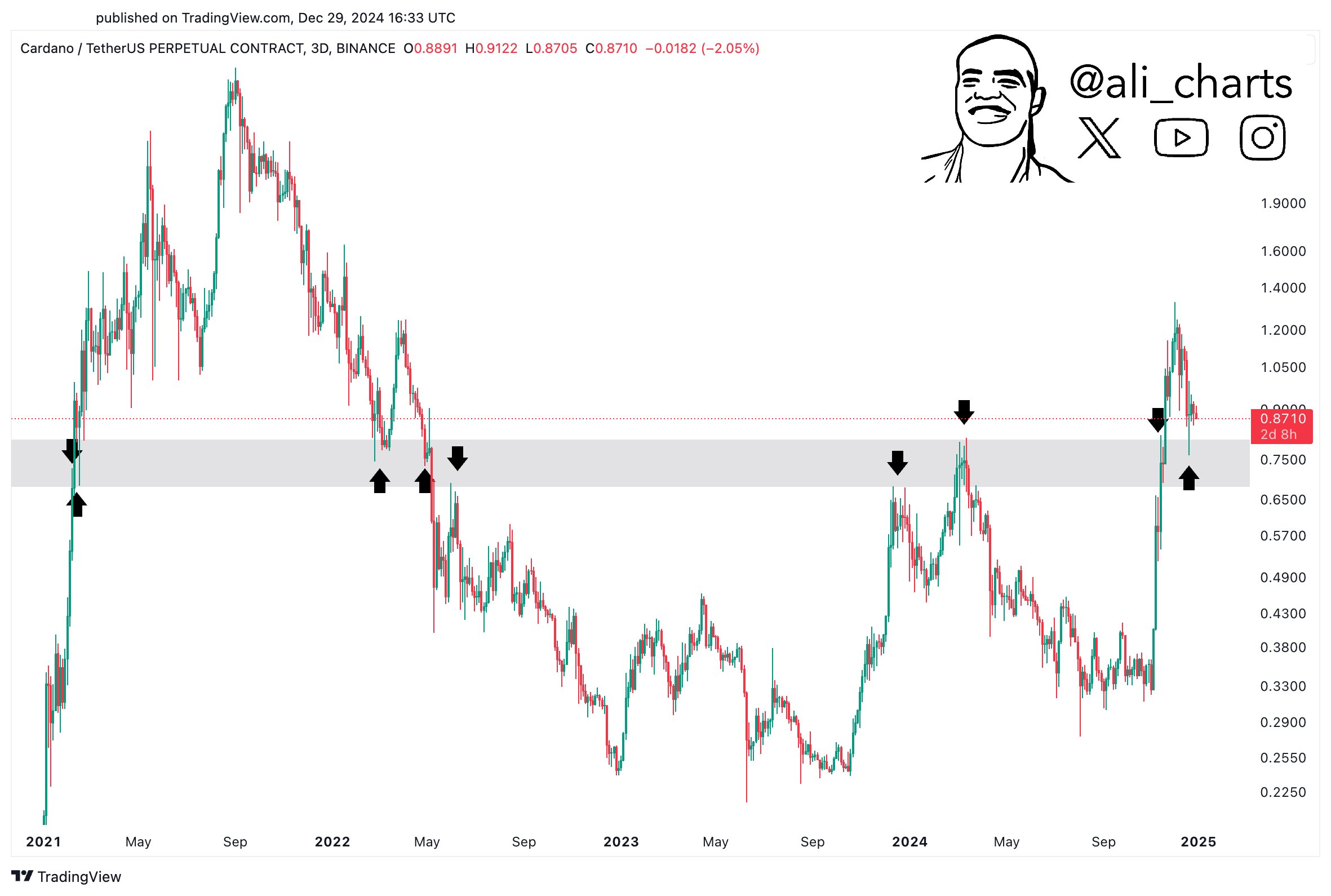

In addition, market data shows that Cardano boasts another support level between $0.68 and $0.77. According to trend analysis, the demand zone has detected Cardano’s historical price action on several occasions.

Price Action Confirms Level’s Importance

Meanwhile, Cardano’s price action between the $0.5973 and $0.7556 demand zone further confirms the level’s importance for a price rebound. For context, the upper demand wall cushioned a further downtrend for ADA on December 20, when the asset capitulated to an intra-day low of $0.7620.

However, the area’s detection of Cardano’s next price action dates back to 2022. The demand zone served as support for ADA during the 2022 price correction, providing a short-lived rebound before the downtrend persisted.

Furthermore, when the marked flipped this area to resistance, the region impeded Cardano’s upward drive in December 2023 and March, spurring a considerable correction with each rejection. Finally, ADA broke through the zone with a bullish upsurge in November, turning it into a significant support zone.

If Cardano loses the support between $0.5973 and $0.7556, it could correct a staggering 46% to the next support around $0.4600, which served as support during the January price correction. Notably, 432,150 addresses bought 3.5 billion ADA at the level, at an average price of $0.4852.

In the meantime, ADA trades at $0.8715, up 1.37% in the past 24 hours.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2024/12/30/here-are-key-demand-walls-cardano-needs-to-hold-to-hedge-against-drop-below-0-65/?utm_source=rss&utm_medium=rss&utm_campaign=here-are-key-demand-walls-cardano-needs-to-hold-to-hedge-against-drop-below-0-65