- Helium has gained 12% in seven days and has outperformed most DePIN tokens.

- The RSI rose above 50 earlier this week for the first time in more than two weeks as buying pressure increased.

Helium [HNT] has defied the bearish sentiment across the broader cryptocurrency market after a 3% gain to trade at $6.88 at press time. Following these gains, HNT is now up by nearly 12% in one week.

HNT has not only outperformed Bitcoin [BTC] in the last 24 hours, but it is also among the top performers among decentralized physical infrastructure (DePIN) tokens.

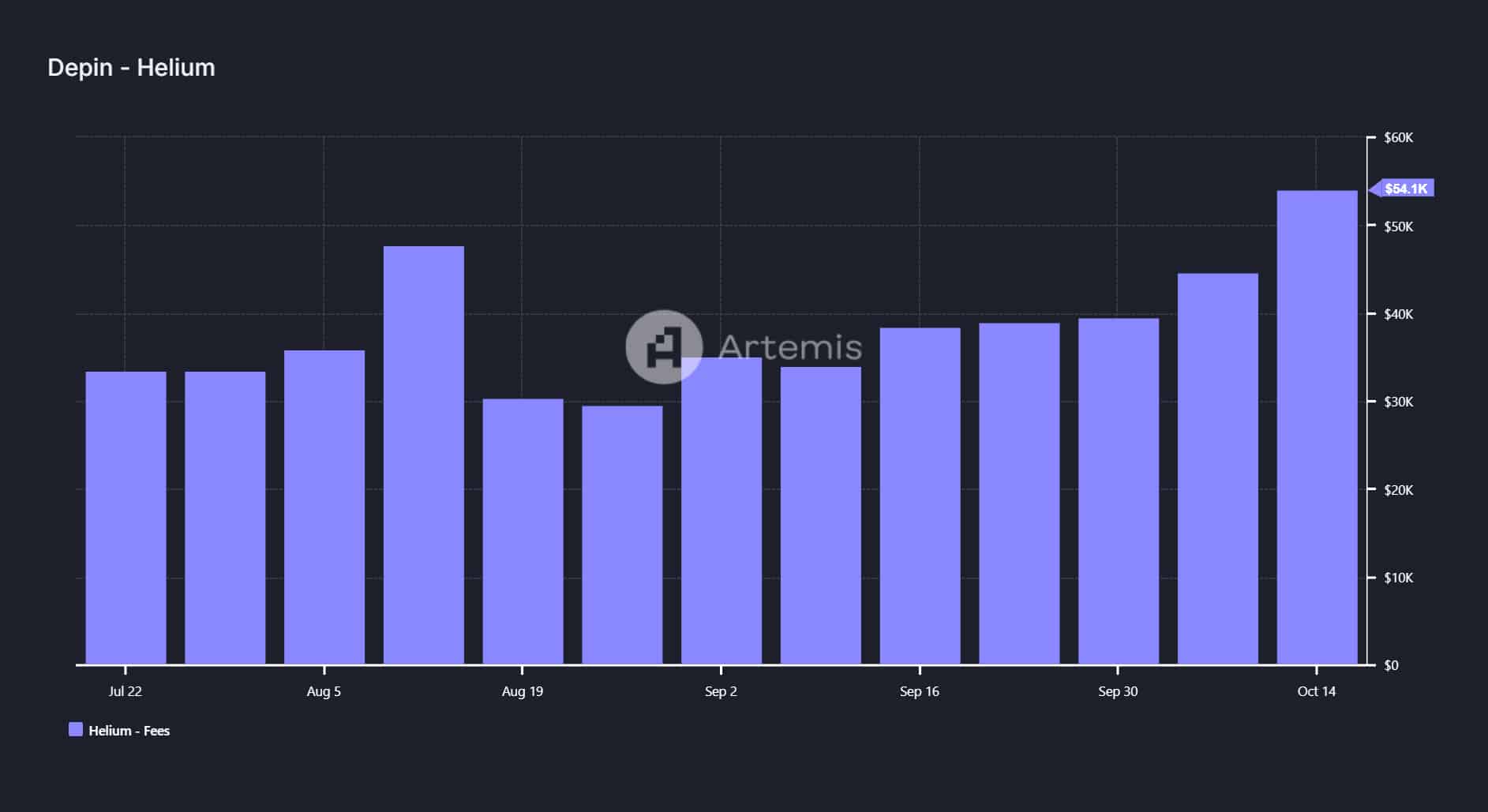

The recent uptrend coincided with rising network activity, as data from Artemis showed that weekly fees on Helium reached a three-month high.

Source: Artemis

This spike in fees and the price increase have renewed bullish sentiment that could precede a 12% price rally.

Bullish signs for HNT

The recent gains have formed bullish signs around HNT, which has made a V-shaped recovery on the daily chart. This shows that Helium is making a strong rebound after a sharp price decline.

Source: TradingView

The Moving Average Convergence Divergence (MACD) also shows a bullish shift after crossing above the signal line.

However, the MACD line remains negative, showing that while bulls are gaining strength, the overall trend remains bearish.

The MACD histogram bars have flipped to green amid rising buying pressure.

The Relative Strength Index (RSI) also crossed above 50 earlier this week for the first time since early October, showing bullish momentum. This indicator is tipping north, suggesting that HNT’s uptrend is because of buyers.

If this buying activity continues, HNT could gain by 12% from its current price to the 1.618 Fibonacci level ($7.81).

At this price, HNT will have completed its V-shaped recovery and could continue to rise if the market sentiment remains positive.

Rising activity in the derivatives market

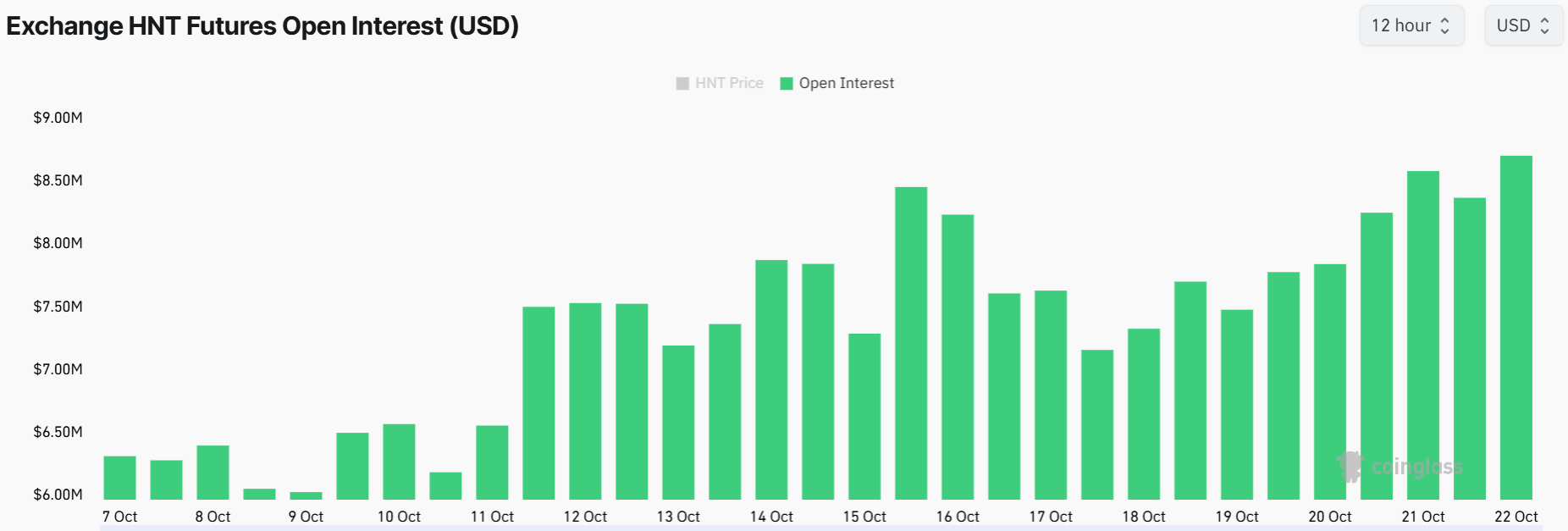

Data from Coinglass shows that HNT is attracting interest from derivative traders. Futures trading volumes had increased by 60% at press time, while Open Interest spiked by 3% to its highest level in nearly three weeks.

Source: Coinglass

The rising Open Interest shows that speculative activity around Helium is increasing, which could cause volatility.

The Long/Short Ratioat 1.04 also indicates a balance between long positions and short positions. This shows that despite the recent gains, short sellers are not opening new positions, suggesting conviction in the uptrend.

Read Helium’s [HNT] Price Prediction 2024–2025

Besides rising speculative activity in the derivatives market, positive market sentiment could also support Helium’s uptrend.

Data from Market Prophit shows that the crowd sentiment around Helium is positive. However, smart money remains bearish.

Source: https://ambcrypto.com/helium-rises-12-in-7-days-will-hnts-rally-continue/